Air New Zealand 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

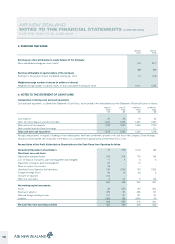

1. SEGMENTAL INFORMATION

Air New Zealand operates predominantly in one segment, its primary business being the transportation of passengers and cargo on scheduled airline

services to, from and within New Zealand.

Geographical

An analysis of operating revenue by geographical region of original sale is provided below.

GROUP

2009

$M

GROUP

2008

$M

Analysis of revenue by geographical region of original sale

New Zealand 2,373 2,448

Australia and Pacific Islands 647 625

United Kingdom and Europe 533 551

Asia 498 480

North America 558 563

Total operating revenue 4,609 4,667

The principal non-current assets of the Group are the aircraft fleet which is registered in New Zealand and employed across the worldwide network.

Accordingly, there is no reasonable basis for allocating these assets to geographical segments.

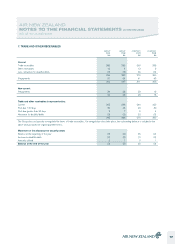

2. PROFIT BEFORE TAXATION

GROUP

2009

$M

GROUP

2008

$M

COMPANY

2009

$M

COMPANY

2008

$M

Profit before taxation has been determined by (debiting)/crediting the

following:

Total operating revenue, including finance income 4,707 4,784 4,101 4,365

Audit of financial statements* (1) (1) (1) (1)

Termination costs (6) (4) (6) (4)

Net foreign exchange gain on working capital balances 27 6 18 11

Loss on disposal of property, plant and equipment (11) (4) (8) (6)

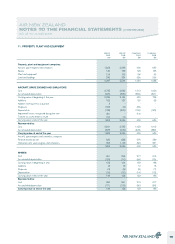

Impairment losses on property, plant and equipment** (81) - (14) -

Discount on acquisition (refer Note 13) 10 - - -

Amortisation of deferred credits - - - 1

Donations*** (1) - (1) -

Rental and lease expenses

Aircraft (286) (226) (417) (387)

Buildings (48) (44) (42) (39)

Total rental and lease expenses (334) (270) (459) (426)

* Excluded from the fees above are fees for other audit related services of $196k for the year ended 30 June 2009 (30 June 2008: $218k) paid in

respect of the half-year review. Other fees of $45k (30 June 2008: $31k) were paid for tax compliance work and other assurance services.

** Impairment losses on property, plant and equipment (recognised within “Other expenses”) relate to an Airbus A320 ($45 million) which was lost in

the Mediterranean sea, and one Boeing 747-400 aircraft ($36 million). The Airbus A320 aircraft was being leased to and operated by XL Airways

Germany GmbH and was insured by the lessor. Impairment of the Group’s last remaining owned Boeing 747-400 Rolls Royce powered aircraft arose

upon transfer of the airframe and two engines to an assets held for resale category.

*** Donations predominately comprise payments to the Air New Zealand Environmental Charitable Trust, Kids Restore New Zealand and Make-A-Wish

Foundation.

“Foreign exchange gains/(losses)” as disclosed in the Statement of Financial Performance comprise realised gains/(losses) from operating hedge

derivatives, the translation of monetary assets and liabilities denominated in foreign currencies and ineffective and non-hedge accounted foreign

currency derivatives.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR TO 30 JUNE 2009

13