Abercrombie & Fitch 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

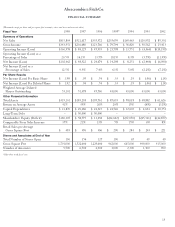

merchandise categories and a lower markdown rate. In addition,

buying and occupancy costs, expressed as a percentage of net

sales, declined due to leverage achieved from comparable store

sales increases.

In 1997, the gross income rate increased to 38.5% from 36.9%

in 1996. The improvement was the result of higher merchandise

margins, expressed as a percentage of net sales. Improved IMU,

in both the men’s and women’s businesses, drove the increase in

merchandise margins. In addition, buying and occupancy costs,

expressed as a percentage of net sales, declined slightly due to lever-

age achieved from comparable store sales increases.

GENERAL, ADMINISTRATIVE AND STORE OPERATING

EXPENSES General, administrative and store operating

expenses, expressed as a percentage of net sales, were 16.9%

in the fourth quarter of 1998 and 17.5% in the comparable

period in 1997. The improvement resulted primarily from

favorable leveraging of expenses due to higher sales volume.

Included in these expenses was approximately $2.6 million in

the fourth quarter of 1998 and 1997 of compensation expense

associated with restricted stock grants awarded to key execu-

tives of the Company.

General, administrative and store operating expenses for

the year, expressed as a percentage of net sales, were 21.7%,

22.4% and 23.2% in 1998, 1997 and 1996. The improvement

during the three-year period resulted from management’s

continued emphasis on expense control and favorable leverag-

ing of expenses, primarily store expenses, due to higher sales

volume. The 1998 improvement was offset by compensation

expense associated with restricted stock grants of approxi-

mately $11.5 million.

OPERATING INCOME Operating income, expressed as a per-

centage of net sales, was 32.4%, 27.9% and 25.4% for the fourth

quarter of 1998, 1997 and 1996 and 20.5%, 16.1% and 13.7% for

fiscal years 1998, 1997 and 1996. The improvement was the

result of higher gross income coupled with lower general, admin-

istrative and store operating expenses, expressed as a percentage

of net sales. Sales volume and gross income have increased at a

faster rate than general, administrative and store operating

expenses as the Company continues to emphasize cost controls.

15

Abercrombie &Fitch Co.

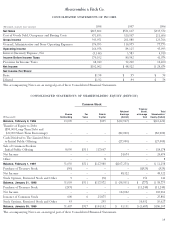

INTEREST INCOME/EXPENSE Net interest income was $1.6

million in the fourth quarter of 1998 and $3.1 million for all of

1998 compared with net interest expense of $305 thousand and

$3.6 million for the corresponding periods last year. Net interest

income in 1998 was primarily from short-term investments.

Net interest expense in 1997 included $975 thousand per quarter

associated with $50 million of long-term debt that was repaid

during the first quarter of 1998, offset by interest income on

short-term investments.

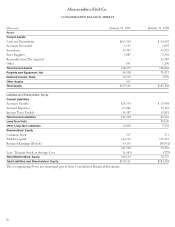

FINANCIAL CONDITION The Company’s continuing growth

in operating income provides evidence of financial strength and

flexibility. A more detailed discussion of liquidity, capital

resources and capital requirements follows.

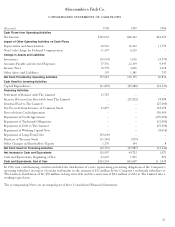

LIQUIDITY AND CAPITAL RESOURCES Cash provided by

operating activities and the Company’s $150 million credit agree-

ment provide the resources to support operations, including

seasonal requirements and capital expenditures. A summary of

the Company’s working capital position and capitalization

follows (thousands):

1998 1997 1996

Working capital $096,007 $042,000 $1,288

Capitalization:

Long-term debt – $050,000 $50,000

Shareholders’ equity $186,105 58,775 11,238

Total capitalization $186,105 $108,775 $61,238

The Company considers the following to be measures of

liquidity and capital resources:

1998 1997 1996

Current ratio (current assets divided

by current liabilities) 1.79 1.63 1.03

Debt-to-capitalization ratio (long-term debt

divided by total capitalization) n/a 46% 82%

Cash flow to capital investment

(net cash provided by operating

activities divided by capital expenditures) 413% 340% 193%

n/a=not applicable