Abercrombie & Fitch 1998 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch Co.

24

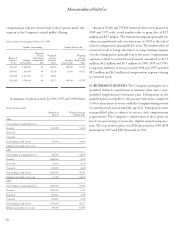

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL

STATEMENTS The preparation of financial statements in con-

formity with generally accepted accounting principles requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities as of the date of the finan-

cial statements and the reported amounts of revenues and expenses

during the reporting period. Since actual results may differ from

those estimates, the Company revises its estimates and assump-

tions as new information becomes available.

RECLASSIFICATIONS Certain amounts have been reclassified

to conform with current year presentation.

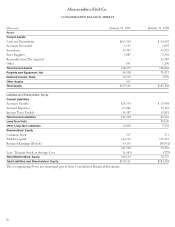

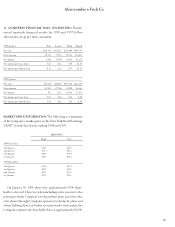

3. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

1998 1997

Furniture, fixtures and equipment $126,091 $104,671

Beneficial leaseholds 7,349 7,349

Leasehold improvements 16,450 11,615

Construction in progress 2,728 365

Total $152,618 $124,000

Less: accumulated depreciation and amortization 63,060 53,483

Property and equipment, net $89,558 $070,517

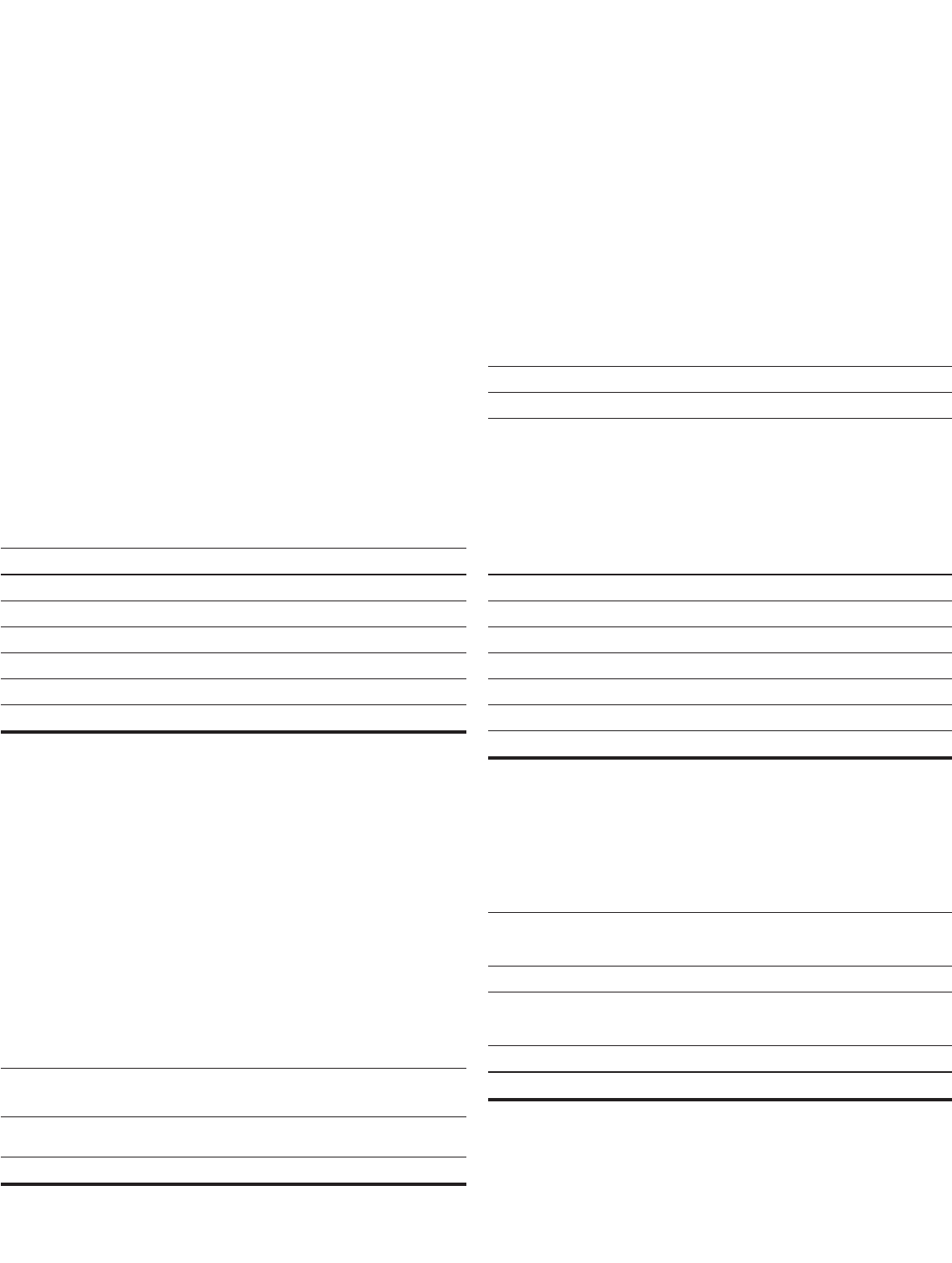

4. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent

rent based on a percentage of sales exceeding a stipulated amount.

Store lease terms generally require additional payments covering

taxes, common area costs and certain other expenses. Rent expense

for 1998, 1997 and 1996 included charges from The Limited and

its subsidiaries for space under formal agreements that approxi-

mate market rates.

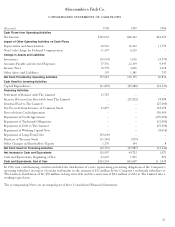

A summary of rent expense follows (thousands):

1998 1997 1996

Store rent:

Fixed minimum $42,774 $34,402 $24,599

Contingent 6,382 2,138 1,620

Total store rent $49,156 $36,540 $26,219

Buildings, equipment and other 1,814 1,400 1,229

Total rent expense $50,970 $37,940 $27,448

At January 30, 1999, the Company was committed to non-

cancelable leases with remaining terms of one to fifteen years.

These commitments include store leases with initial terms

ranging primarily from ten to fifteen years and offices and a

distribution center leased from an affiliate of The Limited with

a term of three years from the date of the Exchange Offer. A

summary of minimum rent commitments under noncance-

lable leases follows (thousands):

1999 $48,924 2002 $49,488

2000 $50,243 2003 $48,284

2001 $49,824 Thereafter 181,661

5. ACCRUED EXPENSES Accrued expenses consisted of the

following (thousands):

1998 1997

Rent and landlord charges $13,368 $08,105

Compensation and benefits 9,800 8,357

Catalogue and advertising costs 8,701 4,012

Interest – 986

Taxes, other than income 3,634 1,827

Other 28,379 11,856

Total $63,882 $35,143

6. INCOME TAXES The provision for income taxes consisted of

(thousands):

1998 1997 1996

Currently payable:

Federal $65,270 $29,040 $16,001

State 14,682 6,450 3,646

$79,952 $35,490 $19,647

Deferred:

Federal (9,530) (2,620) (2,601)

State (2,382) (650) (646)

$(11,912) $(3,270) $(3,247)

Total provision $68,040 $32,220 $16,400