Abercrombie & Fitch 1998 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Abercrombie &Fitch Co.

services and the Company was required to purchase these ser-

vices from outsiders or develop internal expertise. Management

believes the charges and allocations described above are fair

and reasonable.

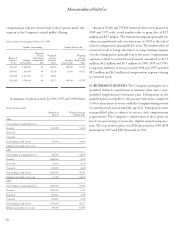

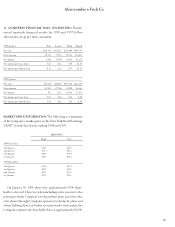

The following table summarizes the related party transac-

tions between the Company and The Limited and its subsidiaries,

for the years indicated. Fiscal year 1998 reflects activity through

the completion of the Exchange Offer.

(Thousands) 1998 1997 1996

Mast and Gryphon purchases $20,176 $089,892 $61,776

Capital expenditures 3,199 27,012 20,839

Inbound and outbound transportation 2,280 5,524 3,326

Corporate charges 2,671 6,857 3,989

Store leases and other occupancy, net 561 1,184 1,509

Distribution center, IT and home

office expenses 2,217 3,102 2,696

Centrally managed benefits 1,524 3,596 3,136

Interest charges, net 4 3,583 2,190

$32,632 $140,750 $99,461

The Company’s proprietary credit card processing is per-

formed by Alliance Data Systems which is approximately 31%

owned by The Limited.

Subsequent to the Exchange Offer, the Company and The

Limited entered into service agreements which include among

other things tax, information technology and store design and

construction. These agreements are generally for a term of one

year. Service agreements were also entered into for the contin-

ued use by the Company of its distribution and home office

space and transportation and logistic services. These agree-

ments are generally for a term of three years. Costs for these

services are generally the costs and expenses incurred by The

Limited plus five percent of such amounts. At the end of fiscal

year 1998, the Company had hired associates with the appropriate

expertise or contracted with outside parties to replace those ser-

vices provided by The Limited which expire in May 1999.

The Company does not anticipate that costs associated with

the remaining service agreements provided by The Limited

which expire in May 2001 or costs incurred to replace the services

currently provided by The Limited will have a material adverse

impact on its financial condition.

Shahid & Company, Inc. has provided advertising and design

services for the Company since 1995. Sam N. Shahid Jr., who

serves on the Board of Directors for the Company, has been

President and Creative Director of Shahid & Company, Inc.

since 1993. Fees paid to Shahid & Company, Inc. for services

provided during fiscal year 1998 were approximately $1.2 million.

9. STOCK OPTIONS AND RESTRICTED STOCK Under the

Company’s stock plan, associates may be granted up to a total of

5.5 million restricted shares and options to purchase the

Company’s common stock at the market price on the date of

grant. In 1998, associates of the Company were granted approx-

imately 2.0 million options, with vesting periods ranging from four

to six years. A total of 66,000 shares were issued to non-associate

directors in 1998, all of which vest over four years. All options have

a maximum term of ten years.

The Company adopted the disclosure requirements of SFAS

No. 123, “Accounting for Stock-Based Compensation,” effective

with the 1996 financial statements, but elected to continue to

measure compensation expense in accordance with APB

Opinion No. 25, “Accounting for Stock Issued to Employees.”

Accordingly, no compensation expense for stock options has been

recognized. If compensation expense had been determined

based on the estimated fair value of options granted in 1998,

1997 and 1996, consistent with the methodology in SFAS No.

123, the pro forma effect on net income and net income per

diluted share would have been a reduction of approximately $6.1

million or $.11 per share in 1998 and $1.7 million or $.03 per

share in 1997. In 1996, the pro forma effect would have had no

impact on net income and net income per diluted share. The

weighted-average fair value of all options granted during fiscal

1998, 1997 and 1996 was $19.59, $8.50 and $6.67. The fair

value of each option was estimated using the Black-Scholes

option-pricing model with the following weighted-average

assumptions for 1998, 1997 and 1996: no expected dividends,

price volatility of 40% in 1998 and 35% in 1997 and 1996, risk-

free interest rates of 5.5%, 6.0% and 6.25%, assumed forfeiture

rates of 10% and expected lives of 5 years in 1998 and 1996 and

6.5 years in 1997.

The pro forma effect on net income for 1998, 1997 and 1996

is not representative of the pro forma effect on net income

in future years because it takes into consideration pro forma