Abercrombie & Fitch 1998 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and remodeled stores. Comparable store sales increases were

strong in both the men’s and the women’s businesses as both were

driven by a very strong knit business. Additionally, fourth quarter

1997 net sales included results from the first Holiday issue of the

A&F Quarterly which accounted for 1.7% of total net sales.

Net sales for 1998 increased 56% to $815.8 million from $521.6

million a year ago. Sales growth resulted from a comparable

store sales increase of 35% and the net addition of 40 new stores.

Sales growth was strong across all major men’s and women’s

merchandise categories. Net retail sales per gross square foot for

the company increased 28%, principally from an increase in the

number of transactions per store. The A&F Quarterly repre-

sented 1.8% of 1998 sales.

Net sales for 1997 increased 56% to $521.6 million over the same

period in 1996. The sales increase was attributable to the net

addition of 29 stores and a 21% comparable store sales increase.

Comparable store sales increases were equally strong in both

men’s and women’s businesses and their performance strength was

broadly based across all major merchandise categories. Net sales

per gross square foot for the total Company increased 23%, driven

principally by an increase in the number of transactions per store.

GROSS INCOME Gross income, expressed as a percentage of

net sales, increased to 49.3% for the fourth quarter of 1998 from

45.4% for the same period in 1997. The increase was attributable

to significant leverage in buying and occupancy costs, expressed

as a percentage of net sales, associated with increased comparable

store sales. Merchandise margins (representing gross income

before the deduction of buying and occupancy costs) improved pri-

marily due to a lower markdown rate as the Company continued

to efficiently manage inventories.

Gross income, expressed as a percentage of net sales, increased

to 45.4% for the fourth quarter of 1997 from 43.0% for the same

period in 1996. The increase was attributable to improved mer-

chandise margins resulting from higher initial markups (IMU)

and a lower markdown rate. As a result of improved inventory

turnover, fewer markdowns, expressed as a percentage of net

sales, were needed in the fourth quarter of 1997 to clear season-

end merchandise as compared to the same period in 1996.

For the year, the gross income rate increased to 42.2% in 1998

from 38.5% in 1997. Merchandise margins, expressed as a

percentage of net sales, increased due to higher IMU across most

RESULTS OF OPERATIONS Net sales for the fourth quarter

were $304.6 million, an increase of 44% from $212.1 million

for the fourth quarter a year ago. Operating income was $98.7

million, up 67% compared to $59.1 million last year. Net income

per diluted share was $1.12, up 65% from $.68 last year.

Net sales for the fiscal year ended January 30, 1999, increased

56% to $815.8 million from $521.6 million last year. Operating

income for the year increased 99% to $167.0 million from $84.1

million in 1997. Net income per diluted share was $1.92 compared

to $.94 a year ago, an increase of 104%.

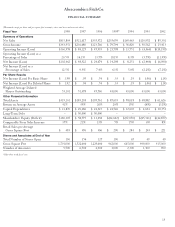

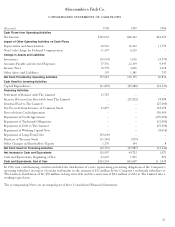

FINANCIAL SUMMARY The following summarized financial

data compares 1998 to the comparable periods for 1997 and 1996:

% Change

1998- 1997-

1998 1997 1996 1997 1996

Net sales (millions) $815.8 $521.6 $335.4 56% 56%

Increase in comparable store sales 35% 21% 13%

Retail sales increase attributable

to new and remodeled stores 21% 34% 29%

Retail sales per average

gross square foot $0,483 $0,376 $0,306 28% 23%

Retail sales per average store

(thousands) $4,551 $3,653 $2,955 25% 24%

Average store size at year-end

(gross square feet) 9,140 9,755 9,680 (6%) 1%

Gross square feet at year-end

(thousands) 1,791 1,522 1,229 18% 24%

Number of stores

Beginning of year 156 127 100

Opened 41 30 29

Closed (1) (1) (2)

End of year 196 156 127

NET SALES Net sales for the fourth quarter of 1998 increased

44% to $304.6 million from $212.1 million in 1997. The increase

was due to a comparable store sales increase of 26%, driven

primarily by significantly higher transactions per store as com-

pared to the fourth quarter of 1997. Comparable store sales

increases were strong across both the men’s and women’s busi-

nesses and across all geographical regions of the country. The A&F

Quarterly, a catalogue/magazine, accounted for 2.0% of net sales

in the fourth quarter of 1998 as compared to 1.7% last year.

Fourth quarter 1997 net sales as compared to net sales for the

fourth quarter 1996 increased 52% to $212.1 million, due to a 23%

increase in comparable store sales and sales attributable to new

14

MANAGEMENT’S DISCUSSION AND ANALYSIS

Abercrombie &Fitch Co.