Abercrombie & Fitch 1998 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

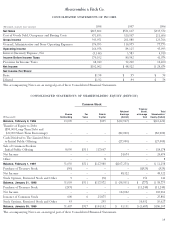

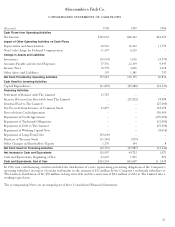

21

(Thousands)1998 1997 1996

Cash Flows from Operating Activities

Net Income $102,062 $48,322 $24,674

Impact of Other Operating Activities on Cash Flows

Depreciation and Amortization 20,946 16,342 11,759

Non Cash Charge for Deferred Compensation 11,497 6,219 –

Change in Assets and Liabilities

Inventories (10,065) 1,016 (4,555)

Accounts Payable and Accrued Expenses 37,530 22,309 9,943

Income Taxes 10,758 4,606 4,218

Other Assets and Liabilities 355 1,381 797

Net Cash Provided by Operating Activities 173,083 100,195 46,836

Cash Used for Investing Activities

Capital Expenditures (41,876) (29,486) (24,323)

Financing Activities

Settlement of Balance with The Limited 23,785 ––

Increase (Decrease) in Receivable from The Limited –(29,202) 18,988

Dividend Paid to The Limited –– (27,000)

Net Proceeds from Issuance of Common Stock 25,875 – 118,178

Proceeds from Credit Agreement –– 150,000

Repayment of Credit Agreement –– (150,000)

Repayment of Trademark Obligations –– (32,000)

Repayment of Debt to The Limited –– (91,000)

Repayment of Working Capital Note –– (8,616)

Repayment of Long-Term Debt (50,000) ––

Purchase of Treasury Stock (11,240) (929) –

Other Changes in Shareholders’ Equity 1,270 144 8

Net Cash Used for Financing Activities (10,310) (29,987) (21,442)

Net Increase in Cash and Equivalents 120,897 40,722 1,071

Cash and Equivalents, Beginning of Year 42,667 1,945 874

Cash and Equivalents, End of Year $163,564 $42,667 $ 1,945

Abercrombie &Fitch Co.

CONSOLIDATED STATEMENTS OF CASH FLOWS

In 1996, non cash financing activities included the distribution of a note representing preexisting obligations of the Company’s

operating subsidiary in respect of certain trademarks in the amount of $32 million by the Company’s trademark subsidiary to

The Limited, distribution of the $50 million in long-term debt and the conversion of $8.6 million of debt to The Limited into a

working capital note.

The accompanying Notes are an integral part of these Consolidated Financial Statements.