Abercrombie & Fitch 1998 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

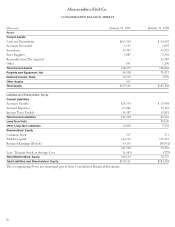

the addition of approximately 36 new Abercrombie & Fitch

stores, 15-20 “abercrombie” kids’ stores and the remodeling

and/or expansion of ten stores.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Abercrombie &

Fitch stores opened in 1999 will approximate $710,000 per

store, after giving effect to landlord allowances. In addition,

inventory purchases are expected to average approximately

$300,000 per store.

The planned size of the “abercrombie” kids’ stores is approx-

imately 4,000 gross square feet and the average cost for

leasehold improvements and furniture and fixtures will be

approximately $450,000.

The Company expects that substantially all future capital

expenditures will be funded with cash from operations. In addi-

tion, the Company has available a $150 million credit agreement

to support operations.

INFORMATION SYSTEMS AND “YEAR 2000” COMPLIANCE :

YEAR 2000 READINESS DISCLOSURES Potential Year 2000

issues will arise primarily from computer programs which

only have a two-digit date field, rather than four, to define the

applicable year of business transactions. Because such com-

puter programs will be unable to properly interpret dates beyond

the year 1999, a systems failure or other computer errors may

ensue. The Company relies on computer-based technology and

utilizes a variety of proprietary and third party hardware and

software. The Company’s critical information technology (IT)

functions include point-of-sale equipment, merchandise and

non-merchandise procurement and business and accounting

management.

In order to address the Year 2000 issue the Company has

developed a Year 2000 plan that focuses on three areas: IT sys-

tems, facilities and distribution equipment and vendor relations.

The plan includes five stages, including (i) awareness, (ii)

assessment, (iii) renovation, (iv) validation and (v) implemen-

tation. In addition to renovation of legacy systems, new financial

software packages are being implemented. The Company is

using both internal and external resources to complete its Year

2000 initiatives.

Year 2000 remediation of existing systems and implementation

of new systems, including validation and implementation, is

16

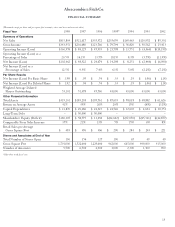

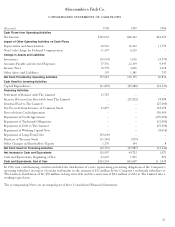

Net cash provided by operating activities totaled $173.1 million,

$100.2 million and $46.8 million for 1998, 1997 and 1996.

In 1998, the improvement in net cash provided by operating

activities was largely due to increased net income. Cash require-

ments for inventory increased $11.1 million during 1998,

supporting both the 56% sales growth and inventory levels that are

10% higher per gross square foot than last year. Correspondingly,

accounts payable and accrued expenses increased, supporting

the growth in inventories and sales.

The Company’s operations are seasonal in nature and typically

peak during the back-to-school and Christmas holiday selling

seasons. Accordingly, cash requirements for inventory expenditures

are highest during these periods.

Investing activities were all for capital expenditures, which

are primarily for new stores.

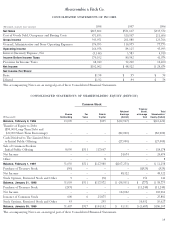

In 1998, financing activities consisted primarily of the repay-

ment of $50 million long-term debt to The Limited. This occurred

through the issuance of 600,000 shares of Class A common stock

to The Limited with the remaining balance paid with cash from

operations. Additionally, settlement of the intercompany

balance between the Company and The Limited occurred con-

currently with the Exchange offer as described in Note 1 to the

Consolidated Financial Statements.

On July 16, 1998, the Board of Directors authorized the repur-

chase of up to 1.0 million shares of the Company’s common

stock for general corporate purposes. During 1998, the Company

repurchased 245 thousand shares of common stock.

CAPITAL EXPENDITURES Capital expenditures, primarily for

new and remodeled stores, amounted to $41.9 million, $29.5

million and $24.3 million for 1998, 1997 and 1996.

During the year, the Company opened 28 Abercrombie &

Fitch stores and 13 “abercrombie” kids’ stores.

The Company anticipates spending $85 to $95 million in

1999 for capital expenditures, of which $45 to $50 million will

be for new stores, remodeling and/or expansion of existing

stores and related improvements. The balance of capital expen-

ditures will chiefly be related to the construction of a new office

and distribution center which is expected to be completed by

mid-2001. The Company intends to add approximately 400,000

gross square feet in 1999, which will represent a 22% increase

over year-end 1998. It is anticipated the increase will result from

Abercrombie &Fitch Co.