Abercrombie & Fitch 1998 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Options exercisable at year-end 194,000 $17.97

Abercrombie &Fitch Co.

28

compensation expense related only to those grants made sub-

sequent to the Company’s initial public offering.

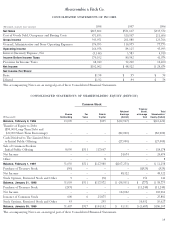

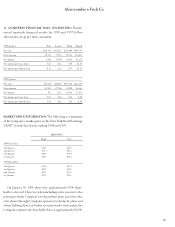

Stock Options Outstanding at January 30, 1999

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercisable

Prices Outstanding Life Price Exercisable Price

$13-$25 1,618,000 8.1 $16.05 169,000 $16.09

$26-$37 381,000 8.9 $31.09 25,000 $30.71

$38-$49 1,785,000 9.5 $46.08 – –

$13-$49 3,784,000 8.8 $31.73 194,000 $17.97

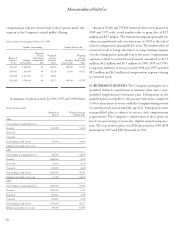

A summary of option activity for 1996, 1997 and 1998 follows:

Stock Option Activity

Number of Weighted Average

Shares Option Price

1996

Outstanding at beginning of year – –

Granted 240,000 $16.00

Exercised – –

Canceled – –

Outstanding at end of year 240,000 $16.00

Options exercisable at year-end – –

1997

Outstanding at beginning of year 240,000 $16.00

Granted 1,669,000 18.03

Exercised (4,000) 16.00

Canceled (21,000) 16.00

Outstanding at end of year 1,884,000 $17.81

Options exercisable at year-end 35,000 $16.00

1998

Outstanding at beginning of year 1,884,000 $17.81

Granted 1,985,000 44.93

Exercised (30,000) 17.98

Canceled (55,000) 38.79

Outstanding at end of year 3,784,000 $31.73

A total of 70,000 and 547,000 restricted shares were granted in

1998 and 1997, with a total market value at grant date of $2.7

million and $8.7 million. The restricted stock grants generally vest

either on a graduated scale over four years or 100% at the end of

a fixed vesting period, principally five years. The market value of

restricted stock is being amortized as compensation expense

over the vesting period, generally four to five years. Compensation

expenses related to restricted stock awards amounted to $11.5

million, $6.2 million and $0.5 million in 1998, 1997 and 1996.

Long-term liabilities at fiscal year-end 1998 and 1997 included

$8.7 million and $6.2 million of compensation expense relating

to restricted stock.

10. RETIREMENT BENEFITS The Company participates in a

qualified defined contribution retirement plan and a non-

qualified supplemental retirement plan. Participation in the

qualified plan is available to all associates who have completed

1,000 or more hours of service with the Company during certain

12-month periods and attained the age of 21. Participation in the

nonqualified plan is subject to service and compensation

requirements. The Company’s contributions to these plans are

based on a percentage of associates’ eligible annual compensa-

tion. The cost of these plans was $760 thousand in 1998, $558

thousand in 1997 and $472 thousand in 1996.