Abercrombie & Fitch 1998 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1998 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Abercrombie &Fitch Co.

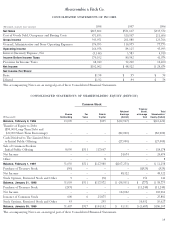

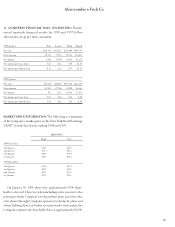

A reconciliation between the statutory Federal income tax rate

and the effective income tax rate follows:

1998 1997 1996

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 4.7% 4.7% 4.7%

Other items, net 0.3% 0.3% 0.2%

Total 40.0% 40.0% 39.9%

Income taxes payable included net current deferred tax assets

of $9.0 million and $4.1 million at January 30, 1999 and

January 31, 1998.

Subsequent to the Exchange Offer, the Company began filing

its tax returns on a separate basis. Prior to the Exchange Offer,

income tax obligations were treated as having been settled

through the intercompany accounts as if the Company was

filing its income tax returns on a separate company basis.

Amounts paid to The Limited totaled $27.4 million, $27.6

million and $10.6 million in 1998, 1997 and 1996. Subsequent to

the Exchange Offer, the Company made tax payments directly to

taxing authorities. Such amounts totaled $31.7 million in 1998.

The effect of temporary differences which gives rise to

net deferred income tax assets was as follows (thousands):

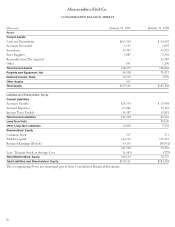

1998 1997

Deferred Compensation $8,711 $1,198

Property and Equipment 1,446 1,496

Rent 2,341 1,507

Accrued expenses 4,008 2,667

Inventory 2,093 972

Other, net 1,168 54

Total deferred income taxes $19,767 $7,894

No valuation allowance has been provided for deferred tax

assets because management believes that it is more likely than

not that the full amount of the net deferred tax assets will be

realized in the future.

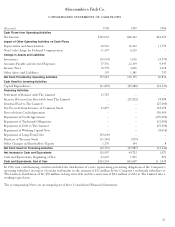

7. LONG-TERM DEBT The Company entered into a $150 mil-

lion syndicated unsecured credit agreement (the “Agreement”), on

April 30, 1998 (the “Effective Date”). Borrowings outstanding

under the Agreement are due April 30, 2003. The Agreement has

several borrowing options, including interest rates that are based

on the bank agent’s “Alternate Base Rate”, a LIBO Rate or a rate

submitted under a bidding process. Facility fees payable under the

Agreement are based on the Company’s ratio (the “leverage

ratio”) of the sum of total debt plus 800% of forward minimum

rent commitments to trailing four-quarters EBITDAR and

currently accrues at .275% of the committed amount per annum.

The Agreement contains limitations on debt, liens, restricted

payments (including dividends), mergers and acquisitions, sale-

leaseback transactions, investments, acquisitions, hedging

transactions and transactions with affiliates and financial covenants

requiring a minimum ratio of EBITDAR to interest expense and

minimum rent and a maximum leverage ratio. No amounts were

outstanding under the Agreement at January 30, 1999.

Long-term debt at January 31, 1998 consisted of a 7.80%

unsecured note in the amount of $50 million that represented the

Company’s proportionate share of certain long-term debt of

The Limited. The interest rate and maturity of the note paralleled

that of corresponding debt of The Limited.

During the first quarter of 1998, the Company repaid the $50

million long-term note owed to The Limited with $24,125,000 in

cash and by issuing 600,000 shares of Class A common stock at a

price of $43.125 per share.

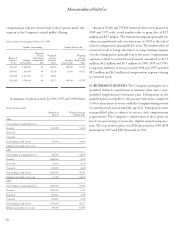

8. RELATED PARTY TRANSACTIONS Prior to the Exchange

Offer, transactions between the Company and The Limited and

its subsidiaries and affiliates principally consisted of the following:

Merchandise purchases

Real estate management and leasing

Capital expenditures

Inbound and outbound transportation

Corporate services

Information with regard to these transactions through the

completion of the Exchange Offer is as follows: Significant

purchases were made from Mast, a wholly-owned subsidiary

of The Limited. Purchases were also made from Gryphon, an