3M 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

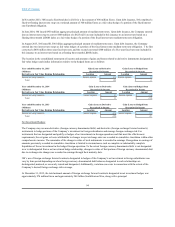

CreditRiskandOffsettingofAssetsandLiabilitiesofDerivativeInstruments:

TheCompanyisexposedtocreditlossintheeventofnonperformancebycounterpartiesininterestrateswaps,currencyswaps,

commoditypriceswaps,andforwardandoptioncontracts.However,theCompany’sriskislimitedtothefairvalueofthe

instruments.TheCompanyactivelymonitorsitsexposuretocreditriskthroughtheuseofcreditapprovalsandcreditlimits,andby

selectingmajorinternationalbanksandfinancialinstitutionsascounterparties.3Mentersintomasternettingarrangementswith

counterpartieswhenpossibletomitigatecreditriskinderivativetransactions.Amasternettingarrangementmayalloweach

counterpartytonetsettleamountsowedbetweena3Mentityandthecounterpartyasaresultofmultiple,separatederivative

transactions.AsofDecember31,2015,3MhasInternationalSwapsandDerivativesAssociation(ISDA)agreementswith16

applicablebanksandfinancialinstitutionswhichcontainnettingprovisions.Inadditiontoamasteragreementwith3Msupportedby

aprimarycounterparty’sparentguarantee,3Malsohasassociatedcreditsupportagreementsinplacewith15ofitsprimary

derivativecounterpartieswhich,amongotherthings,providethecircumstancesunderwhicheitherpartyisrequiredtoposteligible

collateral(whenthemarketvalueoftransactionscoveredbytheseagreementsexceedsspecifiedthresholdsorifacounterparty’s

creditratinghasbeendowngradedtoapredeterminedrating).TheCompanydoesnotanticipatenonperformancebyanyofthese

counterparties.

3MhaselectedtopresentthefairvalueofderivativeassetsandliabilitieswithintheCompany’sconsolidatedbalancesheetona

grossbasisevenwhenderivativetransactionsaresubjecttomasternettingarrangementsandmayotherwisequalifyfornet

presentation.However,thefollowingtablesprovideinformationasiftheCompanyhadelectedtooffsettheassetandliability

balancesofderivativeinstruments,nettedinaccordancewithvariouscriteriaintheeventofdefaultorterminationasstipulatedby

thetermsofnettingarrangementswitheachofthecounterparties.Foreachcounterparty,ifnetted,theCompanywouldoffsetthe

assetandliabilitybalancesofallderivativesattheendofthereportingperiodbasedonthe3Mentitythatisapartytothe

transactions.Derivativesnotsubjecttomasternettingagreementsarenoteligiblefornetpresentation.Asoftheapplicabledates

presentedbelow,nocashcollateralhadbeenreceivedorpledgedrelatedtothesederivativeinstruments.

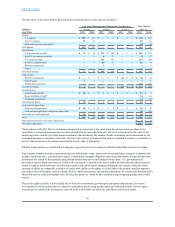

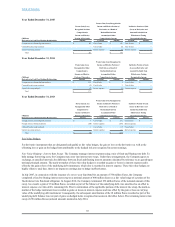

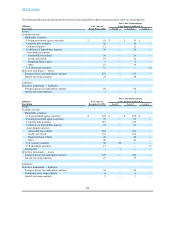

OffsettingofFinancialAssetsunderMasterNettingAgreementswithDerivativeCounterparties

December31,2015 GrossAmountsnotOffsetinthe

ConsolidatedBalanceSheetthatareSubject

GrossAmountof toMasterNettingAgreements

DerivativeAssets GrossAmountof

Presentedinthe EligibleOffsetting

Consolidated Recognized CashCollateral NetAmountof

(Millions) BalanceSheet DerivativeLiabilities Received DerivativeAssets

Derivativessubjecttomasternetting

agreements $ 296 $ 37 $ — $ 259

Derivativesnotsubjecttomasternetting

agreements — —

Total $ 296 $ 259

December31,2014 GrossAmountsnotOffsetinthe

ConsolidatedBalanceSheetthatareSubject

GrossAmountof toMasterNettingAgreements

DerivativeAssets GrossAmountof

Presentedinthe EligibleOffsetting

Consolidated Recognized CashCollateral NetAmountof

(Millions) BalanceSheet DerivativeLiabilities Received DerivativeAssets

Derivativessubjecttomasternetting

agreements $ 256 $ 20 $ — $ 236

Derivativesnotsubjecttomasternetting

agreements — —

Total $ 256 $ 236

97