3M 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

CommodityPricesRisk:

TheCompanymanagescommoditypricerisksthroughnegotiatedsupplycontracts,priceprotectionagreementsandforward

contracts.3Musedcommoditypriceswapsascashflowhedgesofforecastedcommoditytransactionstomanagepricevolatility,but

discontinuedthispracticeinthefirstquarterof2015.Therelatedmark-to-marketgainorlossonqualifyinghedgeswasincludedin

othercomprehensiveincometotheextenteffective,andreclassifiedintocostofsalesintheperiodduringwhichthehedged

transactionaffectedearnings.

ValueAtRisk:

ThevalueatriskanalysisisperformedannuallytoassesstheCompany’ssensitivitytochangesincurrencyrates,interestrates,and

commodityprices.AMonteCarlosimulationtechniquewasusedtotesttheimpactonafter-taxearningsrelatedtofinancial

instruments(primarilydebt),derivativesandunderlyingexposuresoutstandingatDecember31,2015.Themodel(third-partybank

dataset)useda95percentconfidencelevelovera12-monthtimehorizon.Theexposuretochangesincurrencyratesmodelused18

currencies,interestratesrelatedtothreecurrencies,andcommoditypricesrelatedtofivecommodities.Thismodeldoesnotpurport

torepresentwhatactuallywillbeexperiencedbytheCompany.Thismodeldoesnotincludecertainhedgetransactions,becausethe

Companybelievestheirinclusionwouldnotmateriallyimpacttheresults.Theriskoflossorbenefitassociatedwithexchangerates

washigherin2015duetoagreatermixoffloatingratedebtandarisinginterestrateenvironmentintheU.S.Interestratevolatility

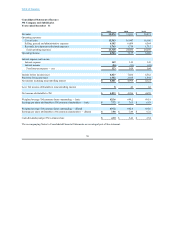

increasedin2015,basedonahighermixoffloatingratedebtandtheuseofforwardrates.Thefollowingtablesummarizesthe

possibleadverseandpositiveimpactstoafter-taxearningsrelatedtotheseexposures.

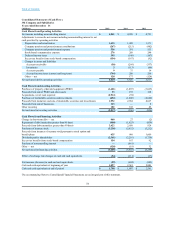

Adverseimpactonafter-tax Positiveimpactonafter-tax

earnings earnings

(Millions) 2015 2014 2015 2014

Foreignexchangerates $ (254) $ (164) $ 273 $ 173

Interestrates (13) (4) 9 3

Commodityprices (1) (1) 1 1

Inadditiontothepossibleadverseandpositiveimpactsdiscussedintheprecedingtablerelatedtoforeignexchangerates,recent

historicalinformationisasfollows.3Mestimatesthatyear-on-yearcurrencyeffects,includinghedgingimpacts,hadthefollowing

effectsonpre-taxincome:2015($390milliondecrease)and2014($100milliondecrease).Thisestimateincludestheeffectof

translatingprofitsfromlocalcurrenciesintoU.S.dollars;theimpactofcurrencyfluctuationsonthetransferofgoodsbetween3M

operationsintheUnitedStatesandabroad;andtransactiongainsandlosses,includingderivativeinstrumentsdesignedtoreduce

foreigncurrencyexchangeraterisksandthenegativeimpactofswappingVenezuelanbolivarsintoU.S.dollars.3Mestimatesthat

year-on-yearderivativeandothertransactiongainsandlosseshadthefollowingeffectsonpre-taxincome:2015($180million

increase)and2014($10millionincrease).

Ananalysisoftheglobalexposuresrelatedtopurchasedcomponentsandmaterialsisperformedateachyear-end.Aonepercent

pricechangewouldresultinapre-taxcostorsavingsofapproximately$70millionperyear.Theglobalenergyexposureissuchthat

atenpercentpricechangewouldresultinapre-taxcostorsavingsofapproximately$40millionperyear.Globalenergyexposure

includesenergycostsusedin3Mproductionandotherfacilities,primarilyelectricityandnaturalgas.

46