3M 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

Forprepaidservicecontracts,salesrevenueisrecognizedonastraight-linebasisoverthetermofthecontract,unlesshistorical

evidenceindicatesthecostsareincurredonotherthanastraight-linebasis.Licensefeerevenueisrecognizedasearned,andno

revenueisrecognizeduntiltheinceptionofthelicenseterm.

Onoccasion,agreementswillcontainmilestones,or3Mwillrecognizerevenuebasedonproportionalperformance.Forthese

agreements,anddependingonthespecifics,3Mmayrecognizerevenueuponcompletionofasubstantivemilestone,orinproportion

tocostsincurredtodatecomparedwiththeestimateoftotalcoststobeincurred.

Accountsreceivableandallowances:Tradeaccountsreceivablearerecordedattheinvoicedamountanddonotbearinterest.The

Companymaintainsallowancesforbaddebts,cashdiscounts,productreturnsandvariousotheritems.Theallowancefordoubtful

accountsandproductreturnsisbasedonthebestestimateoftheamountofprobablecreditlossesinexistingaccountsreceivableand

anticipatedsalesreturns.TheCompanydeterminestheallowancesbasedonhistoricalwrite-offexperiencebyindustryandregional

economicdataandhistoricalsalesreturns.TheCompanyreviewstheallowancefordoubtfulaccountsmonthly.TheCompanydoes

nothaveanysignificantoff-balance-sheetcreditexposurerelatedtoitscustomers.

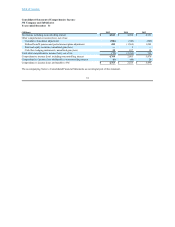

Advertisingandmerchandising:Thesecostsarechargedtooperationsintheperiodincurred,andtotaled$368millionin2015,$407

millionin2014and$423millionin2013.

Research,developmentandrelatedexpenses:Thesecostsarechargedtooperationsintheperiodincurredandareshownona

separatelineoftheConsolidatedStatementofIncome.Research,developmentandrelatedexpensestotaled$1.763billionin2015,

$1.770billionin2014and$1.715billionin2013.Researchanddevelopmentexpenses,coveringbasicscientificresearchandthe

applicationofscientificadvancesinthedevelopmentofnewandimprovedproductsandtheiruses,totaled$1.223billionin2015,

$1.193billionin2014and$1.150billionin2013.Relatedexpensesprimarilyincludetechnicalsupport;internallydevelopedpatent

costs,whichincludecostsandfeesincurredtoprepare,file,secureandmaintainpatents;amortizationofexternallyacquiredpatents

andexternallyacquiredin-processresearchanddevelopment;andgains/lossesassociatedwithcertaincorporateapproved

investmentsinR&D-relatedventures,suchasequitymethodeffectsandimpairments.

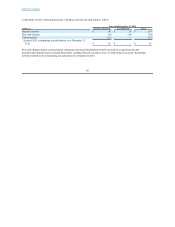

Internal-usesoftware:TheCompanycapitalizesdirectcostsofservicesusedinthedevelopmentofinternal-usesoftware.Amounts

capitalizedareamortizedoveraperiodofthreetosevenyears,generallyonastraight-linebasis,unlessanothersystematicand

rationalbasisismorerepresentativeofthesoftware’suse.Amountsarereportedasacomponentofeithermachineryandequipment

orcapitalleaseswithinproperty,plantandequipment.

Environmental:Environmentalexpendituresrelatingtoexistingconditionscausedbypastoperationsthatdonotcontributetocurrent

orfuturerevenuesareexpensed.Reservesforliabilitiesrelatedtoanticipatedremediationcostsarerecordedonanundiscounted

basiswhentheyareprobableandreasonablyestimable,generallynolaterthanthecompletionoffeasibilitystudies,theCompany’s

commitmenttoaplanofaction,orapprovalbyregulatoryagencies.Environmentalexpendituresforcapitalprojectsthatcontribute

tocurrentorfutureoperationsgenerallyarecapitalizedanddepreciatedovertheirestimatedusefullives.

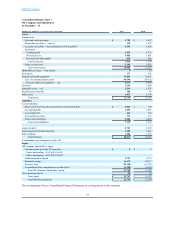

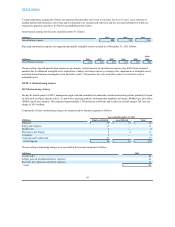

Incometaxes:Theprovisionforincometaxesisdeterminedusingtheassetandliabilityapproach.Underthisapproach,deferred

incometaxesrepresenttheexpectedfuturetaxconsequencesoftemporarydifferencesbetweenthecarryingamountsandtaxbasisof

assetsandliabilities.TheCompanyrecordsavaluationallowancetoreduceitsdeferredtaxassetswhenuncertaintyregardingtheir

realizabilityexists.AsofDecember31,2015and2014,theCompanyhadvaluationallowancesof$31millionand$22millionon

itsdeferredtaxassets,respectively.TheincreaseinvaluationallowanceatDecember31,2015relatestocurrentacquisitionsin

certaininternationaljurisdictions.TheCompanyrecognizesandmeasuresitsuncertaintaxpositionsbasedontherulesunderASC

740,IncomeTaxes.

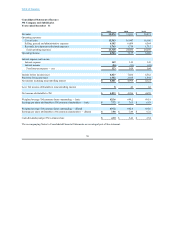

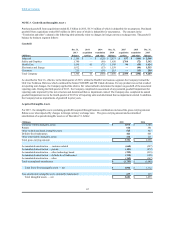

Earningspershare:Thedifferenceintheweightedaverage3Msharesoutstandingforcalculatingbasicanddilutedearningsper

shareattributableto3McommonshareholdersistheresultofthedilutionassociatedwiththeCompany’sstock-basedcompensation

plans.Certainoptionsoutstandingunderthesestock-basedcompensationplansduringtheyears2015,2014and2013werenot

includedinthecomputationofdilutedearningspershareattributableto3Mcommonshareholdersbecausetheywouldnothavehad

adilutiveeffect(5.0millionaverageoptionsfor2015,1.4

59