3M 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

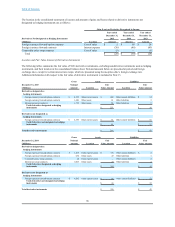

periodduringwhichthehedgedtransactionaffectsearnings.Gainsandlossesonthederivativerepresentingeitherhedge

ineffectivenessorhedgecomponentsexcludedfromtheassessmentofeffectivenessarerecognizedincurrentearnings.

CashFlowHedging-ForeignCurrencyForwardandOptionContracts:TheCompanyentersintoforeignexchangeforwardand

optioncontractstohedgeagainsttheeffectofexchangeratefluctuationsoncashflowsdenominatedinforeigncurrencies.These

transactionsaredesignatedascashflowhedges.Thesettlementorextensionofthesederivativeswillresultinreclassifications(from

accumulatedothercomprehensiveincome)toearningsintheperiodduringwhichthehedgedtransactionsaffectearnings.3Mmay

dedesignatethesecashflowhedgerelationshipsinadvanceoftheoccurrenceoftheforecastedtransaction.Theportionofgainsor

lossesonthederivativeinstrumentpreviouslyaccumulatedinothercomprehensiveincomefordedesignatedhedgesremainsin

accumulatedothercomprehensiveincomeuntiltheforecastedtransactionoccurs.Changesinthevalueofderivativeinstrumentsafter

dedesignationarerecordedinearningsandareincludedintheDerivativesNotDesignatedasHedgingInstrumentssectionbelow.

Beginninginthesecondquarterof2014,3Mbeganextendingthemaximumlengthoftimeoverwhichithedgesitsexposuretothe

variabilityinfuturecashflowsoftheforecastedtransactionsfromaprevioustermof12monthstoalongertermof24months,with

certaincurrenciesbeingextendedfurtherto36monthsstartinginthefirstquarterof2015.

CashFlowHedging-CommodityPriceManagement:TheCompanymanagescommoditypricerisksthroughnegotiatedsupply

contracts,priceprotectionagreementsandforwardcontracts.3Mdiscontinuedtheuseofcommoditypriceswapsascashflow

hedgesofforecastedcommoditytransactionsinthefirstquarterof2015.TheCompanyusedcommoditypriceswapsascashflow

hedgesofforecastedcommoditytransactionstomanagepricevolatility.Therelatedmark-to-marketgainorlossonqualifying

hedgeswasincludedinothercomprehensiveincometotheextenteffective,andreclassifiedintocostofsalesintheperiodduring

whichthehedgedtransactionaffectedearnings.

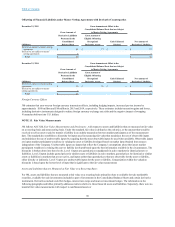

CashFlowHedging—InterestRateContracts:Inthethirdandfourthquartersof2014,theCompanyenteredintoforwardstarting

interestrateswapswithnotionalamountstotaling500millionEurosasahedgeagainstinterestratevolatilityassociatedwiththe

forecastedissuanceoffixedratedebt.3Mterminatedtheseinterestrateswapsuponissuanceof750millionEurosaggregate

principalamountoftwelve-yearfixedratenotesinconnectionwith3M’s1.250billionEurobondofferinginNovember2014.The

terminationresultedina$8millionpre-tax($5millionafter-tax)losswithinaccumulatedothercomprehensiveincomethatwillbe

amortizedoverthetwelve-yearlifeofthenotes.

Theamortizationofgainsandlossesonforwardstartinginterestrateswapsisincludedinthetablesbelowaspartofthegain/(loss)

recognizedinincomeontheeffectiveportionofderivativesasaresultofreclassificationfromaccumulatedothercomprehensive

income.

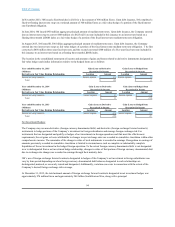

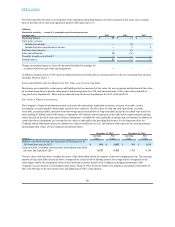

AsofDecember31,2015,theCompanyhadabalanceof$124millionassociatedwiththeaftertaxnetunrealizedgainassociated

withcashflowhedginginstrumentsrecordedinaccumulatedothercomprehensiveincome.Thisincludesaremainingbalanceof$5

million(aftertaxloss)relatedtoforwardstartinginterestrateswaps,whichwillbeamortizedovertherespectivelivesofthenotes.

BasedonexchangeratesasofDecember31,2015,3Mexpectstoreclassifyapproximately$98millionoftheafter-taxnetunrealized

foreignexchangecashflowhedginggainstoearningsin2016,approximately$23millionoftheafter-taxnetunrealizedforeign

exchangecashflowhedginggainstoearningsin2017,andapproximately$3millionoftheafter-taxnetunrealizedforeignexchange

cashflowhedginggainstoearningsafter2017(withtheimpactoffsetbyearnings/lossesfromunderlyinghedgeditems).

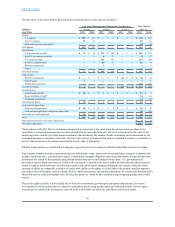

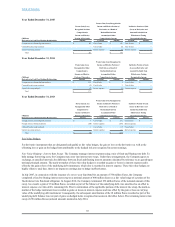

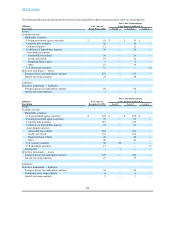

Thelocationintheconsolidatedstatementsofincomeandcomprehensiveincomeandamountsofgainsandlossesrelatedto

derivativeinstrumentsdesignatedascashflowhedgesareprovidedinthefollowingtable.Reclassificationsofamountsfrom

accumulatedothercomprehensiveincomeintoincomeincludeaccumulatedgains(losses)ondedesignatedhedgesatthetime

earningsareimpactedbytheforecastedtransaction.

92