3M 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

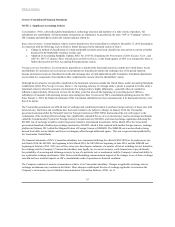

amended,iseffectiveJanuary1,2018.TheCompanyiscurrentlyassessingthisstandard’simpacton3M’sconsolidatedresultsof

operationsandfinancialcondition.

InFebruary2015,theFASBissuedASUNo.2015-02,AmendmentstotheConsolidationAnalysis,whichchangesguidancerelated

toboththevariableinterestentity(VIE)andvotinginterestentity(VOE)consolidationmodels.WithrespecttotheVIEmodel,the

standardchanges,amongotherthings,theidentificationofvariableinterestsassociatedwithfeespaidtoadecisionmakerorservice

provider,theVIEcharacteristicsforalimitedpartnerorsimilarentity,andtheprimarybeneficiarydetermination.Withrespecttothe

VOEmodel,theASUeliminatesthepresumptionthatageneralpartnercontrolsalimitedpartnershiporsimilarentityunlessthe

presumptioncanotherwisebeovercome.Underthenewguidance,ageneralpartnerwouldlargelynotconsolidateapartnershipor

similarentityundertheVOEmodel.For3M,thisASUiseffectiveJanuary1,2016,withearlyadoptionpermitted.3Mdoesnothave

significantinvolvementwithentitiessubjecttoconsolidationconsiderationsimpactedbytheVIEmodelchangesorwithlimited

partnershipspotentiallyimpactedbytheVOEmodelchanges.Asaresult,3MdoesnotexpectthisASUtohaveamaterialimpacton

theCompany’sconsolidatedresultsofoperationsandfinancialcondition.

InApril2015,theFASBissuedASUNo.2015-03,SimplifyingthePresentationofDebtIssuanceCosts,andinAugust2015issued

ASUNo.2015-15,PresentationandSubsequentMeasurementofDebtIssuanceCostsAssociatedwithLine-of-CreditArrangements

.UnderASU2015-03,debtissuancecostsreportedontheconsolidatedbalancesheetwouldbereflectedasadirectdeductionfrom

therelateddebtliabilityratherthanasanasset.WhileASU2015-03addressescostsrelatedtotermdebt,ASUNo.2015-15provides

clarificationregardingcoststosecurerevolvinglinesofcredit,whichare,attheoutset,notassociatedwithanoutstanding

borrowing.ASUNo.2015-15providescommentarythattheSECstaffwouldnotobjecttoanentitydeferringandpresentingcosts

associatedwithline-of-creditarrangementsasanassetandsubsequentlyamortizingthemratablyoverthetermoftherevolvingdebt

arrangement.For3M,ASUNo.2015-03iseffectiveJanuary1,2016,withearlyadoptionpermitted.TheCompanyadoptedthis

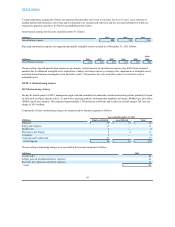

ASUinthefourthquarterof2015withretrospectiveapplicationtopriorperiods.Asaresult,debtissuecostsaggregating$26

millionpreviouslyincludedwithinOtherAssetshavebeenreflectedasreductionsinthebalancesofLong-TermDebtasof

December31,2014.

InApril2015,theFASBissuedASUNo.2015-05,Customer’sAccountingforFeesPaidinaCloudArrangement,whichrequiresa

customertodeterminewhetheracloudcomputingarrangementcontainsasoftwarelicense.Ifthearrangementcontainsasoftware

license,thecustomerwouldaccountforfeesrelatedtothesoftwarelicenseelementinamannerconsistentwithaccountingforthe

acquisitionofotheracquiredsoftwarelicenses.Ifthearrangementdoesnotcontainasoftwarelicense,thecustomerwouldaccount

forthearrangementasaservicecontract.Anarrangementwouldcontainasoftwarelicenseelementifboth(1)thecustomerhasthe

contractualrighttotakepossessionofthesoftwareatanytimeduringthehostingperiodwithoutsignificantpenaltyand(2)itis

feasibleforthecustomertoeitherrunthesoftwareonitsownhardwareorcontractwithanotherpartyunrelatedtothevendortohost

thesoftware.For3M,thisASUiseffectiveJanuary1,2016,withearlyadoptionpermitted.Thestandardprovidesforadoptioneither

fullyretrospectivelyorprospectivelytoarrangementsenteredinto,ormateriallymodified,aftertheeffectivedate.TheCompany

doesnotexpectthisASUtohaveamaterialimpacton3M’sconsolidatedresultsofoperationsandfinancialcondition.

InMay2015,theFASBissuedASUNo.2015-07,DisclosuresforInvestmentsinCertainEntitiesThatCalculateNetAssetValue

perShare(orItsEquivalent).Thisstandardmodifiesexistingdisclosurerequirementssuchthatinvestmentsforwhichthepractical

expedientisusedtomeasuretheirfairvalueatnetassetvalue(NAV)wouldberemovedfromthefairvaluehierarchydisclosures.

Instead,anentitywouldberequiredtoincludethoseinvestmentsasareconcilingitemsuchthatthetotalfairvalueamountof

investmentsinthefairvaluehierarchydisclosureisconsistentwiththeamountonthebalancesheet.Changeswerealsomadetothe

requirementsinasponsor’semployeebenefitplanassetdisclosures.For3M,thisstandardiseffectiveJanuary1,2016,withearly

adoptionpermitted.TheCompanyadoptedthisASUinthefourthquarterof2015withretrospectiveapplicationtopriorperiods.As

aresult,Note11,PensionandPostretirementBenefitPlans,reflectsthemodifieddisclosureswithrespecttoapplicableplanassets.

AsthisASUonlyrelatestocertaindisclosures,itdidnotimpacttheCompany’sconsolidatedresultsofoperationsandfinancial

condition.

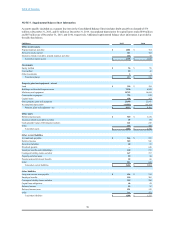

InJuly2015,theFASBissuedASUNo.2015-11,SimplifyingtheMeasurementofInventory,whichmodifiesexistingrequirements

regardingmeasuringinventoryatthelowerofcostormarket.Underexistingstandards,themarketamountrequiresconsiderationof

replacementcost,netrealizablevalue(NRV),andNRVlessanapproximatelynormalprofit

62