3M 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

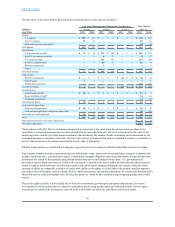

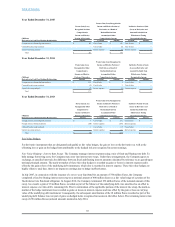

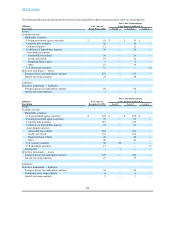

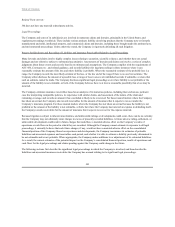

YearEndedDecember31,2015

PretaxGain(Loss)Recognizedin

PretaxGain(Loss) IncomeonEffectivePortionof IneffectivePortionofGain

RecognizedinOther DerivativeasaResultof (Loss)onDerivativeand

Comprehensive Reclassificationfrom AmountExcludedfrom

IncomeonEffective AccumulatedOther EffectivenessTesting

(Millions) PortionofDerivative ComprehensiveIncome RecognizedinIncome

DerivativesinCashFlowHedgingRelationships Amount Location Amount Location Amount

Foreigncurrencyforward/optioncontracts $ 212 Costofsales $ 178 Costofsales $ —

Commoditypriceswapcontracts — Costofsales (2) Costofsales —

Interestrateswapcontracts — Interestexpense (2) Interestexpense —

Total $ 212 $ 174 $ —

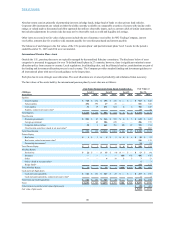

YearEndedDecember31,2014

PretaxGain(Loss)Recognizedin

PretaxGain(Loss) IncomeonEffectivePortionof IneffectivePortionofGain

RecognizedinOther DerivativeasaResultof (Loss)onDerivativeand

Comprehensive Reclassificationfrom AmountExcludedfrom

IncomeonEffective AccumulatedOther EffectivenessTesting

(Millions) PortionofDerivative ComprehensiveIncome RecognizedinIncome

DerivativesinCashFlowHedgingRelationships Amount Location Amount Location Amount

Foreigncurrencyforward/optioncontracts $ 183 Costofsales $ 3 Costofsales $ —

Commoditypriceswapcontracts (4) Costofsales 2 Costofsales —

Interestrateswapcontracts (8) Interestexpense (1) Interestexpense —

Total $ 171 $ 4 $ —

YearEndedDecember31,2013

PretaxGain(Loss)Recognizedin

PretaxGain(Loss) IncomeonEffectivePortionof IneffectivePortionofGain

RecognizedinOther DerivativeasaResultof (Loss)onDerivativeand

Comprehensive Reclassificationfrom AmountExcludedfrom

IncomeonEffective AccumulatedOther EffectivenessTesting

(Millions) PortionofDerivative ComprehensiveIncome RecognizedinIncome

DerivativesinCashFlowHedgingRelationships Amount Location Amount Location Amount

Foreigncurrencyforward/optioncontracts $ 9 Costofsales $ (11) Costofsales $ —

Foreigncurrencyforwardcontracts (108) Interestexpense (108) Interestexpense —

Commoditypriceswapcontracts 1 Costofsales (2) Costofsales —

Interestrateswapcontracts — Interestexpense (1) Interestexpense —

Total $ (98) $ (122) $ —

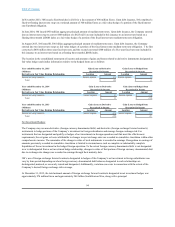

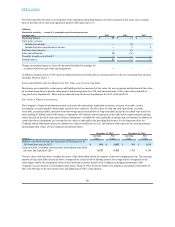

FairValueHedges:

Forderivativeinstrumentsthataredesignatedandqualifyasfairvaluehedges,thegainorlossonthederivativesaswellasthe

offsettinglossorgainonthehedgeditemattributabletothehedgedriskarerecognizedincurrentearnings.

FairValueHedging-InterestRateSwaps:TheCompanymanagesinterestexpenseusingamixoffixedandfloatingratedebt.To

helpmanageborrowingcosts,theCompanymayenterintointerestrateswaps.Underthesearrangements,theCompanyagreesto

exchange,atspecifiedintervals,thedifferencebetweenfixedandfloatinginterestamountscalculatedbyreferencetoanagreed-upon

notionalprincipalamount.Themark-to-marketofthesefairvaluehedgesisrecordedasgainsorlossesininterestexpenseandis

offsetbythegainorlossoftheunderlyingdebtinstrument,whichalsoisrecordedininterestexpense.Thesefairvaluehedgesare

highlyeffectiveand,thus,thereisnoimpactonearningsduetohedgeineffectiveness.

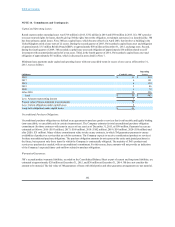

InJuly2007,inconnectionwiththeissuanceofaseven-yearEurobondforanamountof750millionEuros,theCompany

completedafixed-to-floatinginterestrateswaponanotionalamountof400millionEurosasafairvaluehedgeofaportionofthe

fixedinterestrateEurobondobligation.InAugust2010,theCompanyterminated150millionEurosofthenotionalamountofthis

swap.Asaresult,againof18millionEuros,recordedaspartofthebalanceoftheunderlyingdebt,wasamortizedasanoffsetto

interestexpenseoverthisdebt’sremaininglife.Priortoterminationoftheapplicableportionoftheinterestrateswap,themark-to-

marketofthehedgeinstrumentwasrecordedasgainsorlossesininterestexpenseandwasoffsetbythegainorlossoncarrying

valueoftheunderlyingdebtinstrument.Consequently,thesubsequentamortizationofthe18millionEurosrecordedaspartofthe

underlyingdebtbalancewasnotpartofgainsonhedgeditemsrecognizedinincomeinthetablesbelow.Theremaininginterestrate

swapof250millionEuros(notionalamount)maturedinJuly2014.

93