3M 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

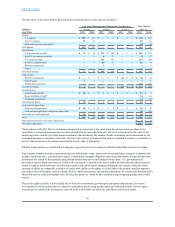

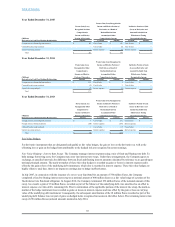

U.S. Pension Plans and Postretirement Benefit Plan Assets

InordertoachievetheinvestmentobjectivesintheU.S.pensionplansandU.S.postretirementbenefitplans,theinvestmentpolicies

includeatargetstrategicassetallocation.Theinvestmentpoliciesallowsometolerancearoundthetargetinrecognitionthatmarket

fluctuationsandilliquidityofsomeinvestmentsmaycausetheallocationtoaspecificassetclasstovaryfromthetargetallocation,

potentiallyforlongperiodsoftime.Acceptablerangeshavebeendesignedtoallowfordeviationfromstrategictargetsandtoallow

fortheopportunityfortacticalover-andunder-weights.Theportfolioswillnormallyberebalancedwhenthequarter-endasset

allocationdeviatesfromacceptableranges.Theallocationisreviewedregularlybythenamedfiduciaryoftheplans.Approximately

39%ofthepostretirementbenefitplanassetsareina401(h)account.The401(h)accountassetsareinthesametrustastheprimary

U.S.pensionplanandinvestedwiththesameinvestmentobjectivesastheprimaryU.S.pensionplan.

ThefairvaluesoftheassetsheldbytheU.S.pensionplansbyassetclassareasfollows:

FairValueMeasurementsUsingInputsConsideredas FairValueat

(Millions) Level1 Level2 Level3 Dec.31,

AssetClass 2015 2014 2015 2014 2015 2014 2015 2014

Equities

U.S.equities $ 1,897 $ 1,766 $ — $ — $ — $ — $ 1,897 $ 1,766

Non-U.S.equities 1,149 1,214 — — — — 1,149 1,214

Indexandlong/shortequityfunds* 578 607

TotalEquities $ 3,046 $ 2,980 $ — $ — $ — $— $ 3,624 $ 3,587

FixedIncome

U.S.governmentsecurities $ 1,095 $ 1,032 $ 456 $ 590 $ — $ — $ 1,551 $ 1,622

Non-U.S.governmentsecurities — 7 126 381 — — 126 388

Preferredandconvertiblesecurities 4 6 8 9 — — 12 15

U.S.corporatebonds 9 8 2,820 2,889 — — 2,829 2,897

Non-U.S.corporatebonds — — 616 566 — — 616 566

Derivativeinstruments (1) 6 40 126 — — 39 132

Other* 11 32

TotalFixedIncome $ 1,107 $ 1,059 $ 4,066 $ 4,561 $ — $— $ 5,184 $ 5,652

PrivateEquity

Derivativeinstruments $ — $ — $ — $ — $(106)$(74)$(106)$(74)

Growthequity 24 15 — — — — 24 15

Partnershipinvestments* 2,450 2,561

TotalPrivateEquity $ 24 $ 15 $ — $ — $(106)$(74)$ 2,368 $ 2,502

AbsoluteReturn

Derivativeinstruments $ — $ — $(5)$ — $ — $ — $(5)$ —

Fixedincomeandother 253 26 46 52 — — 299 78

Hedgefund/fundoffunds* 1,409 1,807

Partnershipinvestments* 355 288

TotalAbsoluteReturn $ 253 $ 26 $ 41 $ 52 $ — $— $ 2,058 $ 2,173

CashandCashEquivalents

Cashandcashequivalents $ 102 $ 287 $ 6 $ 86 $ — $ — $ 108 $ 373

Cashandcashequivalents,valuedatnetassetvalue* 783 531

TotalCashandCashEquivalents $ 102 $ 287 $ 6 $ 86 $ — $ — $ 891 $ 904

Total $ 4,532 $ 4,367 $ 4,113 $ 4,699 $(106)$(74)$ 14,125 $ 14,818

Otheritemstoreconciletofairvalueofplanassets $(159)$(175)

Fairvalueofplanassets $ 13,966 $ 14,643

*InaccordancewithASC820-10,certaininvestmentsthataremeasuredatfairvalueusingthenetassetvalue(NAV)pershare(or

itsequivalent)asapracticalexpedienthavenotbeenclassifiedinthefairvaluehierarchy.TheNAVisbasedonthefairvalueofthe

underlyingassetsownedbythefund,minusitsliabilitiesthendividedbythenumberofunitsoutstandingandisdeterminedbythe

investmentmanagerorcustodianofthefund.Thefairvalueamountspresentedinthistableareintendedtopermitreconciliationof

thefairvaluehierarchytotheamountspresentedinthefairvalueofplanassets.

88