Yamaha 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

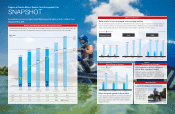

By reinforcing its business strategies, Yamaha Motor reached the targets set under its Medium-Term

Management Plan (MTP).

Sales and profit grew in all segments, on sales growth from an expanded product lineup and increased sales of higher-priced products. We

are forecasting continued growth in consolidated sales and profit in all segments again in 2015, the final year of the current MTP.

Medium-Term Management Plan: Management Targets

Unit sales in developed markets rose in 2014, as total demand bottomed out and new products were launched. In emerging markets, unit

sales rose in India on an increase in total demand and new product introductions. ASEAN markets saw a decline in unit sales, however,

owing to a drop in total demand ahead of new product launches. This resulted in a slight decline in overall unit sales.

Solid results in both developed and emerging markets

Progress was made in expanding the customer base and shifting the

business model toward higher profitability by leveraging Yamaha’s

brand strength, including its comprehensive business capabilities,

reliability and network.

Sales and profi t growth in fi scal 2014

Marine Products Business

81

35

86 89

37

35

(Ten thousand units)

Total demand Yamaha Motor

2013 20152014

New Launches

Cost Reduction Strategies

Cost reductions of ¥14.4 billion in

fi scal 2014 surpassed target

Cost reductions during fiscal 2014 totaled ¥14.4 billion,

surpassing our target of ¥10.0 billion. We will continue to reduce

costs during fiscal 2015, to achieve the targets set in the MTP.

2017

Ultimate

target

2014

Target

Net sales

Operating income

margin

Operating income

(Billion ¥) 2,000.0

1,410.5

3.9%

7.1%

7.5%

2012

Result

$80/€103

2013

Result

$98/€130

2015

Target*

$115/€130

2017

Ultimate

target

1,207.7

18.6 55.1

1,521.2

2014

Result

$106/€140

87.2

ROE 2.5% 12.7% 11.2% 16.2% 15.5% 15%

ROA 0.8% 4.2% 3.8% 5.6% 5.8% 5%

EPS ¥21 ¥126 ¥129 ¥196 ¥218 ¥200 or more

5.7%

5.0%

1,700.0

2014

Target*

$100/€135

*As of Feb. 12, 2014 *As of Feb. 12, 2015

1,500.0

1.5%

Progress of Yamaha Motor’s Medium-Term Management Plan

SNAPSHOT

Motorcycle Business

India ASEANDeveloped markets

(Ten thousand units)

Total demand Yamaha Motor

2013 20152014

1,254 1,209 1,211

342

324

361

2013 20152014

1,434

1,600 1,700

72

57

46

2013 20152014

274 261 266

44

41

37

Of the 250 new products

scheduled for release

by 2015, 63% were

launched during 2013–

2014, and we expect to

reach 100% in 2015.

Launched unique, new products

15

Yamaha Motor Co., Ltd. Annual Report 2014

14 Yamaha Motor Co., Ltd. Annual Report 2014