Yamaha 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Can you give us an overview of business results in 2014, the second year of

your Medium-Term Management Plan (MTP)?

What factors led to increases in net sales and operating income in each of your

business segments?

We achieved our operating income target a year ahead of schedule.

In 2014, global economic conditions remained uncertain, although signs of a rally were visible in developed markets, as stagnation

endured in emerging markets.

In the United States, improvements in the employment situation and personal income levels continued to support a gradual

revival. In contrast, Europe’s recovery stumbled, as Greece’s debt crisis reignited and currency instability persisted in Russia. In

Japan, consumer spending fell, despite further yen depreciation and persistently high share prices, as a consequence of a hike in

the country’s consumption tax. Overall conditions in emerging markets reflected a lull in growth in the Association of Southeast

Asian Nations (ASEAN) region, China and South America, although India’s economy remained on the road to recovery.

In this environment, we promoted a variety of efforts in line with our MTP, formulated to guide our efforts from 2013 through

2015, with a focus on such considerations as greater product competitiveness, changes to Monozukuri *, structural reforms and

growth strategies. All business segments reported increases in net sales and operating income in fiscal 2014, the second year of

the plan, as we achieved our operating income target for 2015—¥80.0 billion—a year ahead of schedule.

Net sales in 2014 rose 7.9%, or ¥110.7 billion, to ¥1,521.2 billion, bolstered by the expansion of our product lineup, increased

sales of high-priced products and the declining value of the yen against the currencies of other developed markets. In addition to

higher sales, the positive impact of yen depreciation surpassed the negative impact of elevated research and development (R&D)

expenses, among others, in developed markets. In emerging markets, the favorable influence of cost reductions exceeded the

detrimental influence of increases in procurement costs, among others, attributable to weak local currencies. Operating income

climbed 58.2%, or ¥32.1 billion, to ¥87.2 billion, and ordinary income soared 61.9%, or ¥37.2 billion, to ¥97.3 billion. Net income,

at ¥68.5 billion, was up 55.4%, or ¥24.4 billion.

As of December 31, 2014, our net debt-to-equity (D/E) ratio improved to 0.6 times, from 0.7 times at the same point a year

earlier. The shareholders’ equity ratio was also stable, slipping 1.6 percentage points to 35.1% from the end of 2013.

* An approach to engineering, manufacturing and marketing products that emphasizes craftsmanship and excellence

Initiatives implemented in line with four key priorities began to yield solid results.

1. Launch unique new products

One target of our current MTP is to launch 250 new products incorporating creativity, technologies and design excellence that

embody the unique style of Yamaha in markets around the world. Our progress rate as of the end of 2014 was 63.0%, and we are

confident that we will meet this target in 2015.

Customer reception of these new products has been favorable, enabling us to enhance our presence in crucial markets.

2. Change our approach to Monozukuri

With efforts to develop products using a new approach that centers on engine, frame, functional component and exterior component

platforms progressing, we began to bring new platform products to market. We also began to launch products planned and

developed with the goal of expanding our focus beyond the ASEAN region to the global market.

Concurrently, we took steps to create a business foundation that will balance product appeal and cost considerations, as

well as to trim purchasing costs through platform development and production and logistics costs through theoretical-value-

based production.

3. Press ahead with structural reforms

We entered the final stage of an ongoing initiative intended to realign our domestic production configuration from 12 factories and

25 units at the end of 2009 to six factories and 13 units at the end of 2015. We also proceeded with efforts to restructure our

operations in Europe from the current “One Company” format, under which organizational and operational functions are integrated

into independent companies, to a “One Entity” format, wherein all functions are combined into a single entity.

4. Implement strategies for future growth

We continued to implement strategies directed at securing future growth. These included establishing new companies and

preparing for the construction of plants with the aim of expanding our motorcycle business into Pakistan and Nigeria, augmenting

our financing business in North America and developing new businesses.

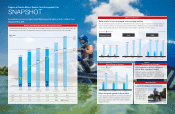

Net Sales

2013

($98/€130) ($106/€140)

2014

(Billion ¥) Operating Income (Billion ¥)

Motorcycles

Marine

Power Products

Others

928.2

243.4

126.7

112.2

1,410.5

977.6

276.4

142.2

125.1

1,521.2

2013

($98/€130) ($106/€140)

2014

Motorcycles

Marine

Power Products

Others

8.4

31.8

5.3

9.7

55.1

22.9

45.8

6.5

12.0

87.2

Details of Net Sales and Operating Income by Business (FY2014)

Achieve increases in sales and income in all business segments.

Motorcycles: The effect of sales increases, cost reductions, and yen depreciation outweighed the effects of currency

depreciation in emerging countries, resulting in income increase.

Marine: Income increased thanks to sales increases (introduction of larger engines, etc.), cost reductions, and the

effect of yen depreciation.

INTERVIEW

WITH THE PRESIDENT

Q1 Q2

Yamaha Motor Co., Ltd. Annual Report 2014 Yamaha Motor Co., Ltd. Annual Report 2014

22 23