Yamaha 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

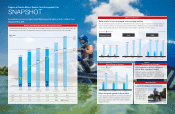

2012 2013 2014

Forecast

2015

ATV

ROV

SMB

40.0

14.9

54.9

46.4

23.3

69.7

55.8

22.4

78.2

79.0

21.0

100.0

2012 2013 2014

Forecast

2015

30.8 32.3

38.9 44.0

2012 2013 2014

Forecast

2015

Domestic

Exports

186

190

229

232

253

53

43

306

269

80

349

Net Sales (Billion ¥) Net Sales (Billion ¥) PAS D/U Unit Sales (Thousand units)

RV Business

2014: Expansion of ROV/SMB Product

Lineup Progressed.

2015: Return to growth and profitability

with net sales of 100 billion yen.

IM Business

2014: Recovery in equipment investment

demand, incorporating businesses of

other companies.

2015: Building share in the full-scale

high-speed mounter market, development

of a new market category.

SPV Business

2014: Domestic sales increased (110%)

through introduction of new technologies,

full-scale export to Europe began.

2015: Expanding the smart power business

through ongoing introduction of new

technologies and products.

2014 2015

TargetForecast

2016

Japan

Europe

ASEAN

6

5

6

17

8

11

8

27

10

14

15

39

Unit Sales (Thousand units)

Introduction of “LMW—the Third-Vehicle Category” to the Market

2014: Introduced the new category to the market, and achieved sales targets in developed markets (121%).

2015: Creating a new brand image to develop the customer base.

01GEN

SMB: Snowmobile

INTERVIEW

WITH THE PRESIDENT

How are efforts in other businesses progressing? What are you doing to foster new businesses?

Our emphasis is on promoting Yamaha’s unique versatility, which contributes to our

overall growth and profitability.

Recreational Vehicles (RVs)

We strengthened our lineup of recreational off-highway vehicles (ROVs) in fiscal 2014 with new launches including the six-person

VIKING VI and the SR Viper snowmobile.

In 2015, we will further expand our ROV lineup by introducing new products in the sports category, including an eagerly

awaited two-person edition of the Wolverine. In snowmobiles, we will promote a strategy aimed at building our share in North

American markets. We will also work to restore the ability of our recreational vehicles business to attain annual net sales in the

area of ¥100.0 billion and contribute to overall growth and profitability.

Industrial Machinery (IM)

A recovery in capital investment and the introduction of new medium- and high-speed surface units supported increased sales of

surface mounters in China and other Asian markets, as well as in Europe. We also formulated a strategy to steer our full-scale entry

into the market for high-speed mounters and concluded an agreement for the transfer of certain related assets previously owned by

the Hitachi High-Tech Group. Having established a new development, production and sales configuration, in 2015 we will promote

efforts to attract customers and cultivate new markets.

Smart Powered Vehicles (SPVs)

Sales rose in the domestic market in 2014, bolstered by the launch of new models of electrically power assisted bicycles (E-bikes)

equipped with the PAS triple sensor. Despite concerns regarding the impact of Japan’s April 2014 consumption tax hike, sales

remained favorable throughout the year. We also commenced full-scale exports of the E-kit E-bike system kit to Europe.

In 2015, we will introduce new PAS models mounted with our new GREEN CORE next-generation smart power drive unit.

We will also expand our smart power business in Japan by launching the new E-VINO electric scooter, which offers both superb

performance and low cost.

We want to create a “growing world of personal mobility” that embodies the unique

style of Yamaha.

We have identified the creation of a “growing world of personal mobility” as a key strategic focus that will direct our efforts to

expand the application of two-wheel vehicle technologies to three- and four-wheeled vehicles and to broaden our customer base.

One emphasis of this was the development of a “third-vehicle category” that incorporates our Leaning Multi-Wheel (LMW)

technology.

We launched our first such vehicle, the TRICITY, in Japan, Europe and the ASEAN region. Thanks to solid support from target

customers in developed markets, sales of the TRICITY for the year exceeded our original forecast by 21.0%.

Recently, we announced the 01GEN, a new multi-wheel crossover concept model that represents a new direction in multi-

wheeled vehicle design. Inspired by our “refined dynamism” design philosophy, the 01GEN is the first model that embodies our

GEN design concept and the new value it promises customers.

Q6 Q7

Yamaha Motor Co., Ltd. Annual Report 2014 Yamaha Motor Co., Ltd. Annual Report 2014

30 31