Yamaha 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Please give us an overview of Yamaha Motor’s business results for fiscal

2013, the first year under the Medium-Term Management Plan.

We achieved sales growth in all businesses.

Looking at the global economy in 2013, the United States posted a significant recovery and there were major

expectations for a recovery in Japan as well. However, European economies remained sluggish and growth appeared to

stall in emerging markets in Asia and Central and South America. Against this backdrop, the Yamaha Motor Group made

a comprehensive effort to achieve sustainable growth in terms of business scale, financial strength, and corporate

strength as outlined in the Medium-Term Management Plan (MTP), which sets fiscal 2015 Group targets of ¥1,600.0

billion in net sales and ¥80.0 billion in operating income (for an operating income margin of 5%).

In fiscal 2013, the Group recorded a 16.8% increase in net sales, to ¥1,410.5 billion. Net sales rose in all business

segments, on increased unit sales of motorcycles in Indonesia and India and outboard motors in North America, coupled

with the impact of yen depreciation.

Operating income totaled ¥55.1 billion, a ¥36.5 billion increase from fiscal 2012. This reflected improved earnings

in the marine products business and cost reductions in the motorcycle business in emerging markets, as well as yen

depreciation. Ordinary income and net income rose significantly, with a ¥32.8 billion increase in ordinary income, to

¥60.1 billion, and a ¥36.6 billion increase in net income, to ¥44.1 billion, which included the additional recording of

deferred tax assets at overseas subsidiaries.

Our financial position remained stable, with a net debt-equity (D/E) ratio of 0.7 times, unchanged from the end of

the previous year, and a 1.5 percentage point improvement in the shareholders’ equity ratio, to 33.5%.

What initiatives are the motorcycle business pursuing in developed

markets?

We are working to further enhance our product lineup.

Yamaha’s motorcycle shipments in developed markets had been declining

since the global financial crisis, but turned around in 2013 to a 6% increase

from the previous year, to 370 thousand units. New product launches included

the new 950cc BOLT cruiser in North America, the new 850cc, three-cylinder

MT-09 sports bike in Europe, and the Majesty S, our first 155cc sports

commuter in Japan, and all three of these models recorded solid sales.

In addition to this solid progress under the MTP, which emphasizes new

product development and enhanced product strength, there was a positive

effect from yen depreciation, and I am pleased with our improved earnings.

Looking ahead to 2014, we expect the size of the market to be flat with

2013 in Europe, and to grow in Japan and North America, and are forecasting

an 11% increase in Yamaha Motor’s shipments, to 410 thousand units.

We will strengthen our product lineup in 2014 by continuing to

proactively release new models like the MT-07 from 2013, highlighting their

high performance, light weight, low fuel consumption, and superior design.

INTERVIEW WITH THE PRESIDENT

Q1 Q2

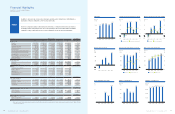

Net Sales

2012

($80/€103) ($98/€130) ($100/€135)

2014

Forecast

2013

(Billion ¥) (Billion ¥)

Operating Income

Motorcycles

Marine products

Power products

Other

2013: Operating income: motorcycles bottoming out, large improvements in marine products

2014: Increases in sales and income for all business segments

798.7

196.3

103.6

109.1

1,207.7

928.2

243.4

126.7

112.2

1,410.5

995.0

250.0

140.0

115.0

1,500.0

18.6

55.1

75.0

2012

($80/€103) ($98/€130) ($100/€135)

2014

Forecast

2013

10.8

7.4

0.5

-0.2

8.4

31.8

5.3

9.7

20.0

36.0

8.0

11.0

Unit Sales

2012 2014

Forecast

2013

(Thousand units)

Japan

North

America

Europe

Oceania

2013: Yamaha sales at 370,000 units/106%. Decline bottoms out, recovery in progress

Japan: 115%; North America: 99% (first half); 118% (second half)

Europe: 89% (first half); 113% (second half)

2014: Overall demand increases in Japan and North America. In Europe, figures are similar

to last year. Yamaha forecasts sales of 410,000 units/111%

Main Initiatives (2014)

High-performance, lightweight, fuel-efficient

+ design concept

Expansion of MT and other categories

94

71

165

17

347

109

76

162

19

366

108

82

198

20

20

408

Sales and Operating Income by Business Segment Motorcycle Business: Developed Markets

MT-07 MT-09

Yamaha Motor Co., Ltd. ⎢ Annual Report 2013 Yamaha Motor Co., Ltd. ⎢ Annual Report 2013

14 15