Yamaha 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

What about the motorcycle business in emerging markets?

We are working to expand our business, focusing on India and Indonesia.

With slowing economies and fiscal tightening, the lull in emerging economies’ motorcycle markets continued in 2013.

Nevertheless, we enhanced our product competitiveness with new model launches, and sales grew in all markets with

the exceptions of Thailand and Vietnam, which were affected by economic slowdowns. The growth was led by solid

scooter sales in India, and sales in Indonesia, which is experiencing a recovery in demand. Cost reductions and yen

depreciation also contributed to improved earnings.

In terms of sales, we beefed up promotional events, including large-scale test-drive events in Indonesia and India.

We also strove to provide even greater value-added solutions, we added to our sales network, and we pursued

marketing activities that aim to create a “Yamaha world.” On the production side, we moved forward with preparations

for the start-up of a new factory in Chennai, India (scheduled for October 2014).

By market, initiatives for 2014 will include strengthening our position in the scooter category in India with

additional launches of new models, including the CYGNUS α, and creating demand by introducing new models in the

deluxe category. With the new factory in Chennai scheduled to commence operations in October 2014, we will work to

cultivate markets and customers and expand sales from cities to the countryside.

In Indonesia, where demand is recovering, we will strengthen our

position in the sports category by launching the R15 in addition to the

GT125, to offer new value.

For the entire ASEAN region, we will also release global models and

develop new platform models featuring next-generation engines. We plan

to release the R25 superbike that you can ride every day, and the TRICITY,

which offers both a lightweight, sporty drive as well as a feeling of stability.

These models will offer unique features in terms of being high performance

and lightweight with low fuel consumption, combined with a superior

design and cost performance, and we will strive to cultivate new customers

by promoting these models beyond Asia to the rest of the world.

INTERVIEW WITH THE PRESIDENT

Q3

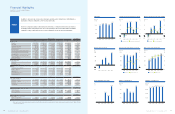

Unit Sales

2012 2014

Forecast

2013

(Thousand units) Main Initiatives (2014)

Domestic

Exports

2013: Overall demand recovers after 3Q, 14.34 million units/104%

Yamaha sales is set at 650,000 units; domestic: 133%; export: 136%

2014: Forecast of overall demand at 15 million units, with Yamaha sales forecast at

830,000 units/127%

Strengthen scooter and deluxe categories

Market/customer development:

from urban areas to regional areas

New factory launch (scheduled for October)

17

348

140

488

462

190

651

613

213

826

2013: Overall demand turns upward after down-payment restriction, with sales of 7.74 million

units/110%. Yamaha sales also increases, with sales of 2.49 million units/103%

2014: Forecast of overall demand at 7.8 million units, with Yamaha sales forecast of 2.6 million

units/104%

Unit Sales

2012 2014

Forecast

2013

(Thousand units) Main Initiatives (2014)

Strengthen sports category, etc.

New generation engine + Platform,

global model launch

2,423

2,492

2,600

Motorcycle Business: Indonesian MarketMotorcycle Business: Indian Market

CYGNUS RAY Z GT125 R15

CYGNUS α

Yamaha Motor Co., Ltd. ⎢ Annual Report 2013 Yamaha Motor Co., Ltd. ⎢ Annual Report 2013

16 17