Xcel Energy 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

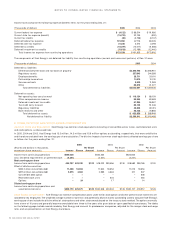

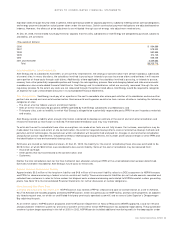

In addition, NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy, the

holder of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $854 million in additional cash dividends

on common stock at Dec. 31, 2005.

Registered holding companies and certain of their subsidiaries, including Xcel Energy and its utility subsidiaries, were limited, under the PUHCA,

in their ability to issue securities. Such registered holding companies and their subsidiaries could not issue securities unless authorized by an

exemptive rule or order of the SEC. Because Xcel Energy did not qualify for any of the main exemptive rules, it sought and received financing

authority from the SEC under the PUHCA for various financing arrangements. Xcel Energy’s current financing authority permits it, subject to

certain conditions, to issue through June 30, 2008, up to $1.8 billion of new long-term debt, common equity and equity-linked securities

and $1.0 billion of short-term debt securities during the new authorization period, provided that the aggregate amount of long-term debt,

common equity, and equity-linked and short-term debt securities issued during the new authorization period does not exceed $2.0 billion.

Xcel Energy’s ability to issue securities under the financing authority was subject to a number of conditions. One of the conditions of the

financing authority was that Xcel Energy’s ratio of common equity to total capitalization, on a consolidated basis, be at least 30 percent.

As of Dec. 31, 2005, such common equity ratio was approximately 42 percent. Additional conditions require that a security to be issued that

is rated, must be at least rated investment grade by at least one nationally recognized rating agency. Finally, all outstanding securities

that are rated must be rated investment grade by at least one nationally recognized rating agency. On Feb. 10, 2006, Xcel Energy’s senior

unsecured debt was considered investment grade by Standard & Poor’s, Moody’s and Fitch.

Upon the repeal of the PUHCA, these limitations on Xcel Energy’s financings generally will no longer apply, nor will the PUHCA restrictions

generally apply to the financings by the utility subsidiaries. However, utility financings and intra-system financings will become subject to

the jurisdiction of the FERC under the Federal Power Act. The FERC by rule has granted a blanket authorization under certain intra-system

financings involving holding companies. Requests to the FERC to clarify its rules or grant similar blanket authorizations filed by other entities

are presently pending before the FERC. Xcel Energy and the utility subsidiaries are presently evaluating the specific applications that they

will need to file with the FERC due to the repeal of the PUHCA. It is possible that in lieu of requesting authority from the FERC for intra-company

financings, Xcel Energy and the utility subsidiaries may rely in the interim on a transitional savings clause that would permit such financing

transactions to the extent authorized by the SEC financing order and so long as the conditions in the SEC financing order continue to be satisfied.

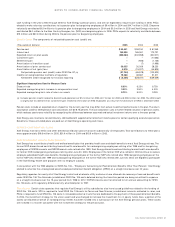

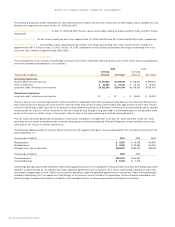

Stockholder Protection Rights Agreement

In June 2001, Xcel Energy adopted a Stockholder Protection Rights Agreement. Each share of

Xcel Energy’s common stock includes one shareholder protection right. Under the agreement’s principal provision, if any person or group

acquires 15 percent or more of Xcel Energy’s outstanding common stock, all other shareholders of Xcel Energy would be entitled to buy, for

the exercise price of $95 per right, common stock of Xcel Energy having a market value equal to twice the exercise price, thereby substantially

diluting the acquiring person’s or group’s investment. The rights may cause substantial dilution to a person or group that acquires 15 percent

or more of Xcel Energy’s common stock. The rights should not interfere with a transaction that is in the best interests of Xcel Energy and its

shareholders because the rights can be redeemed prior to a triggering event for $0.01 per right.

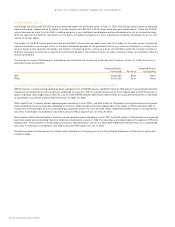

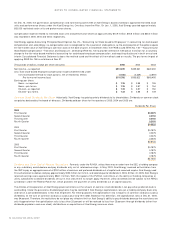

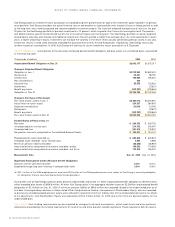

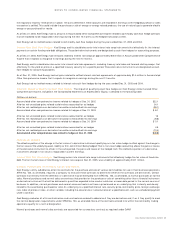

10. BENEFIT PLANS AND OTHER POSTRETIREMENT BENEFITS

Xcel Energy offers various benefit plans to its benefit employees. Approximately 56 percent of benefiting employees are represented by several

local labor unions under several collective-bargaining agreements. At Dec. 31, 2005, NSP-Minnesota had 2,144 and NSP-Wisconsin had

417 bargaining employees covered under a collective-bargaining agreement, which expires at the end of 2007. PSCo had 2,165 bargaining

employees covered under a collective-bargaining agreement, which expires in May 2006. SPS had 733 bargaining employees covered under

a collective-bargaining agreement, which expires in October 2008.

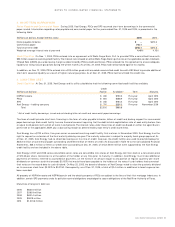

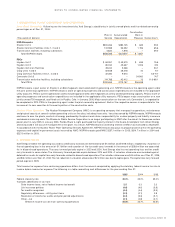

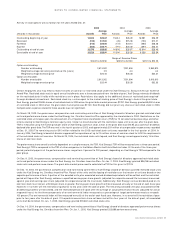

PENSION BENEFITS

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all employees. Benefits are based on a combination

of years of service, the employee’s average pay and Social Security benefits.

Xcel Energy’s policy is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial

reporting purposes, subject to the limitations of applicable employee benefit and tax laws.

Pension Plan Assets

Plan assets principally consist of the common stock of public companies, corporate bonds and U.S. government

securities. In 2004, Xcel Energy completed a review of its pension plan asset allocation and adopted revised asset allocation targets. The

target range for our pension asset allocation is 60 percent in equity investments, 20 percent in fixed income investments and 20 percent in

nontraditional investments, such as real estate, timber ventures, private equity and a diversified commodities index.

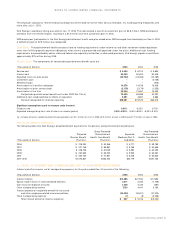

The actual composition of pension plan assets at Dec. 31 was:

2005 2004

Equity securities 65% 69%

Debt securities 20 19

Real estate 44

Cash 11

Nontraditional investments 10 7

100% 100%

XCEL ENERGY 2005 ANNUAL REPORT 59

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS