Xcel Energy 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Environmental Matters

Environmental costs include payments for nuclear plant decommissioning, storage and ultimate disposal of spent nuclear fuel, disposal of

hazardous materials and waste, remediation of contaminated sites and monitoring of discharges to the environment. A trend of greater

environmental awareness and increasingly stringent regulation has caused, and may continue to cause, higher operating expenses and capital

expenditures for environmental compliance.

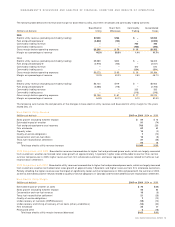

In addition to nuclear decommissioning and spent nuclear fuel disposal expenses, costs charged to operating expenses for environmental

monitoring and disposal of hazardous materials and waste were approximately:

– $147 million in 2005;

– $133 million in 2004; and

– $133 million in 2003.

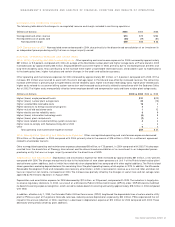

Xcel Energy expects to expense an average of approximately $176 million per year from 2006 through 2010 for similar costs. However, the

precise timing and amount of environmental costs, including those for site remediation and disposal of hazardous materials, are currently

unknown. Additionally, the extent to which environmental costs will be included in and recovered through rates is not certain.

Capital expenditures placed in service on environmental improvements at regulated facilities were approximately:

– $37.1 million in 2005;

– $20.9 million in 2004; and

– $58.5 million in 2003.

The regulated utilities expect to incur approximately $438 million in capital expenditures for compliance with environmental regulations and

environmental improvements in 2006, and approximately $714 million of related expenditures during the period from 2007 through 2010.

Included in these amounts are expenditures to reduce emissions of generating plants in Minnesota and Colorado. Approximately $347 million

and $392 million of these expenditures, respectively, are related to modifications to reduce the emissions of NSP-Minnesota’s generating

plants located in the Minneapolis-St. Paul metropolitan area pursuant to MERP, which are recoverable from customers through cost-recovery

mechanisms. Expected expenditures related to environmental modifications on Comanche Units 1 and 2 are approximately $26 million in 2006

and $62 million during the period from 2007 through 2010. The remaining expected capital expenditures relate to various other environmental

projects. See Note 14 to the Consolidated Financial Statements for further discussion of Xcel Energy’s environmental contingencies.

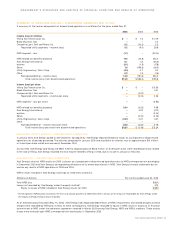

The issue of global climate change is receiving increased attention. Debate continues concerning the extent to which the earth’s climate is

warming, the causes of climate variations that have been observed and the ultimate impact that might result from a changing climate.

There also is considerable debate regarding public policy for the approach that the United States should follow to address the issue. The

United Nations-sponsored Kyoto Protocol, which establishes greenhouse gas reduction targets for developed nations, entered into force on

Feb. 16, 2005. President Bush has declared that the United States will not ratify the protocol and is opposed to legislative mandates, preferring

a program based on voluntary efforts and research on new technologies. Xcel Energy is closely monitoring the issue from both scientific

and policy perspectives. While it is not possible to know the eventual outcome, Xcel Energy believes the issue merits close attention and is

taking actions it believes are prudent to be best positioned for a variety of possible outcomes. Xcel Energy is participating in a voluntary carbon

management program and has established goals to reduce its volume of carbon dioxide emissions by 12 million tons by 2009, and to reduce

carbon intensity by 7 percent by 2012. In certain regulatory jurisdictions, the evaluation process for future generating resources incorporates

the risk of future carbon limits through the use of a carbon cost adder or externality costs. Xcel Energy also is involved in other projects to

improve available methods for managing carbon.

Impact of Nonregulated Investments

In the past, Xcel Energy’s investments in nonregulated operations have had a significant impact on its results of operations. As a result of the

divestiture of NRG and other nonregulated operations, Xcel Energy does not expect that its investments in nonregulated operations will continue

to have such a significant impact on its results. Xcel Energy does not expect to make any material investments in nonregulated projects.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders.

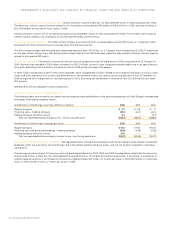

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of the Consolidated Financial Statements and related disclosures in compliance with GAAP requires the application of appropriate

technical accounting rules and guidance, as well as the use of estimates. The application of these policies necessarily involves judgments

regarding future events, including the likelihood of success of particular projects, legal and regulatory challenges and anticipated recovery of

costs. These judgments, in and of themselves, could materially impact the Consolidated Financial Statements and disclosures based on varying

assumptions, which may be appropriate to use. In addition, the financial and operating environment also may have a significant effect, not

only on the operation of the business, but on the results reported through the application of accounting measures used in preparing the

Consolidated Financial Statements and related disclosures, even if the nature of the accounting policies applied have not changed. The

following is a list of accounting policies that are most significant to the portrayal of Xcel Energy’s financial condition and results, and that

require management’s most difficult, subjective or complex judgments. Each of these has a higher potential likelihood of resulting in

materially different reported amounts under different conditions or using different assumptions. Each critical accounting policy has been

discussed with the audit committee of the Xcel Energy board of directors.

XCEL ENERGY 2005 ANNUAL REPORT 29

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS