Xcel Energy 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

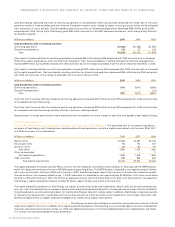

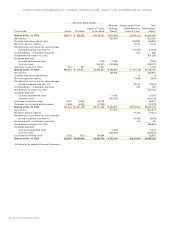

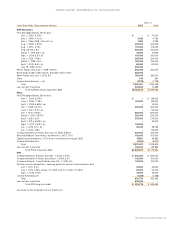

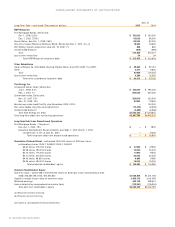

Common Stock Issued Retained Accumulated Other Total

Capital in Excess Earnings Comprehensive Stockholders’

(Thousands) Shares Par Value of Par Value (Deficit) Income (Loss) Equity

Balance at Dec. 31, 2002 398,714 $ 996,785 $4,038,151 $(100,942) $(269,010) $4,664,984

Net income 622,392 622,392

Currency translation adjustments 182,829 182,829

Minimum pension liability 9,710 9,710

Net derivative instrument fair value changes

during the period (see Note 12) (14,005) (14,005)

Unrealized gain – marketable securities 340 340

Comprehensive income for 2003 801,266

Dividends declared:

Cumulative preferred stock (720) (3,181) (3,901)

Common stock (149,521) (149,606) (299,127)

Issuances of common stock 251 627 2,591 3,218

Balance at Dec. 31, 2003 398,965 $ 997,412 $3,890,501 $ 368,663 $ (90,136) $5,166,440

Net income 355,961 355,961

Currency translation adjustments (3) (3)

Minimum pension liability (7,935) (7,935)

Net derivative instrument fair value changes

during the period (see Note 12) (8,024) (8,024)

Unrealized gain – marketable securities 164 164

Comprehensive income for 2004 340,163

Dividends declared:

Cumulative preferred stock (4,241) (4,241)

Common stock (323,742) (323,742)

Issuances of common stock 3,297 8,243 48,078 56,321

Purchases for restricted stock issuance (1,800) (4,500) (27,523) (32,023)

Balance at Dec. 31, 2004 400,462 $1,001,155 $3,911,056 $ 396,641 $(105,934) $5,202,918

Net income 512,972 512,972

Minimum pension liability (17,271) (17,271)

Net derivative instrument fair value changes

during the period (see Note 12) (8,919) (8,919)

Unrealized gain – marketable securities 63 63

Comprehensive income for 2005 486,845

Dividends declared:

Cumulative preferred stock (4,241) (4,241)

Common stock (343,234) (343,234)

Issuances of common stock 2,925 7,313 45,654 52,967

Balance at Dec. 31, 2005 403,387 $1,008,468 $3,956,710 $ 562,138 $(132,061) $5,395,255

See Notes to Consolidated Financial Statements.

44 XCEL ENERGY 2005 ANNUAL REPORT

CONSOLIDATED STATEM ENTS OF COMM ON STOCKHOLDERS’EQUITY AND COMPREHENSIVE INCOME