Xcel Energy 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

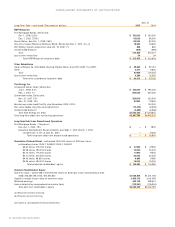

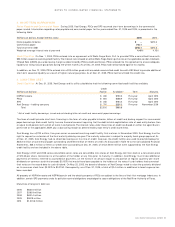

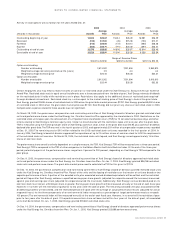

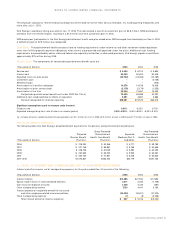

5. PREFERRED STOCK

Xcel Energy has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31, 2005, Xcel Energy had six series of preferred

stock outstanding, redeemable at its option at prices ranging from $102.00 to $103.75 per share plus accrued dividends. Under the PUHCA,

unless there was an order from the SEC, a holding company or any subsidiary could declare and pay dividends only out of retained earnings.

With the repeal of the PUHCA, restrictions on the ability of holding companies or utility subsidiaries to declare dividends set out in that

statute no longer apply.

The holders of the $3.60 series preferred stock are entitled to three votes per each share held. The holders of the other series of preferred

stock are entitled to one vote per share. In the event dividends payable on the preferred stock of any series outstanding is in arrears in an

amount equal to four quarterly dividends, the holders of preferred stocks, voting as a class, are entitled to elect the smallest number of

directors necessary to constitute a majority of the board of directors. The holders of common stock, voting as a class, are entitled to elect the

remaining directors.

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31, 2005, there are no

preferred shares outstanding.

Preferred Shares Preferred Shares

Authorized Par Value Outstanding

SPS 10,000,000 $1.00 None

PSCo 10,000,000 $0.01 None

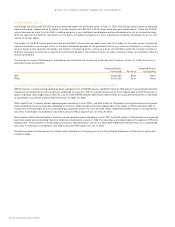

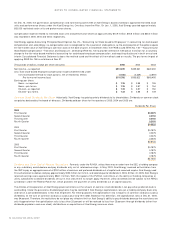

6. MANDATORILY REDEEMABLE PREFERRED SECURITIES OF SUBSIDIARY TRUSTS

NSP Financing I, a wholly owned, special-purpose subsidiary trust of NSP-Minnesota, had $200 million of 7.875-percent trust preferred securities

issued and outstanding that were originally scheduled to mature in 2037. The preferred securities were redeemable at NSP Financing I’s

option at $25 per share, beginning in 2002. On July 31, 2003, NSP-Minnesota redeemed the $200 million of trust preferred securities. A certificate

of cancellation was filed to dissolve NSP Financing I on Sept. 15, 2003.

PSCo Capital Trust I, a wholly owned, special-purpose subsidiary trust of PSCo, had $194 million of 7.60-percent trust preferred securities issued

and outstanding that were originally scheduled to mature in 2038. The securities were redeemable at the option of PSCo after May 2003, at

100 percent of the principal amount outstanding plus accrued interest. On June 30, 2003, PSCo redeemed the $194 million of trust preferred

securities. A certificate of cancellation was filed to dissolve PSCo Capital Trust I on Dec. 29, 2003.

Southwestern Public Service Capital I, a wholly owned, special-purpose subsidiary trust of SPS, had $100 million of 7.85-percent trust preferred

securities issued and outstanding that were originally scheduled to mature in 2036. The securities were redeemable at the option of SPS after

October 2001, at 100 percent of the principal amount plus accrued interest. On Oct. 15, 2003, SPS redeemed the $100 million of trust preferred

securities. A certificate of cancellation was filed to dissolve SPS Capital I on Jan. 5, 2004.

Distributions paid to preferred security holders were reflected as a financing cost in the Consolidated Statements of Operations, along with

interest charges.

54 XCEL ENERGY 2005 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS