Xcel Energy 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 85

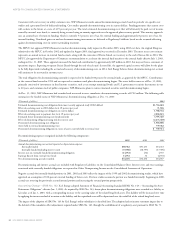

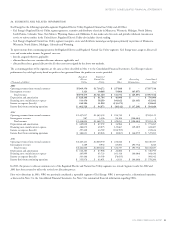

20. SEGMENTS AND RELATED INFORMATION

Xcel Energy has the following reportable segments: Regulated Electric Utility, Regulated Natural Gas Utility and All Other.

–Xcel Energy’s Regulated Electric Utility segment generates, transmits and distributes electricity in Minnesota, Wisconsin, Michigan, North Dakota,

South Dakota, Colorado, Texas, New Mexico, Wyoming, Kansas and Oklahoma. It also makes sales for resale and provides wholesale transmission

service to various entities in the United States. Regulated Electric Utility also includes electric trading.

–Xcel Energy’s Regulated Natural Gas Utility segment transports, stores and distributes natural gas and propane primarily in portions of Minnesota,

Wisconsin, North Dakota, Michigan, Colorado and Wyoming.

To r eport income from continuing operations for Regulated Electric and Regulated Natural Gas Utility segments, Xcel Energy must assign or allocate all

costs and certain other income. In general, costs are:

–directly assigned wherever applicable;

–allocated based on cost causation allocators wherever applicable; and

–allocated based on a general allocator for all other costs not assigned by the above two methods.

The accounting policies of the segments are the same as those described in Note 1 to the Consolidated Financial Statements. Xcel Energy evaluates

performance by each legal entity based on profit or loss generated from the product or service provided.

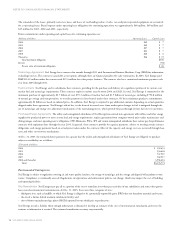

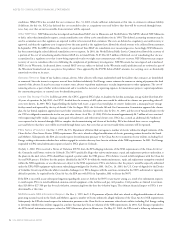

Regulated Regulated

Electric Natural Gas All Reconciling Consolidated

(Thousands of dollars) Utility Utility Other Eliminations Total

2003

Operating revenues from external customers $5,969,356 $1,710,272 $ 257,888 $ – $7,937,516

Intersegment revenues 1,123 10,868 53,866 (65,857) –

Total revenues $5,970,479 $1,721,140 $ 311,754 $ (65,857) $7,937,516

Depreciation and amortization $628,108 $ 81,794 $ 46,098 $ – $ 756,000

Financing costs, mainly interest expense 313,456 58,259 104,022 (23,435) 452,302

Income tax expense (benefit) 240,186 31,928 (113,472) – 158,642

Income (loss) from continuing operations $462,528 $ 94,873 $ (10,142) $ (37,239) $ 510,020

2002

Operating revenues from external customers $5,437,017 $1,363,359 $ 234,749 $ – $7,035,125

Intersegment revenues 987 5,396 94,304 (100,684) 3

Total revenues $5,438,004 $1,368,755 $ 329,053 $ (100,684) $7,035,128

Depreciation and amortization $ 649,020 $ 87,259 $ 34,986 $ – $ 771,265

Financing costs, mainly interest expense 286,872 49,075 125,667 (39,207) 422,407

Income tax expense (benefit) 297,420 44,789 (106,595) – 235,614

Income (loss) from continuing operations $ 486,811 $ 89,026 $ (2,067) $ (46,077) $ 527,693

2001

Operating revenues from external customers $6,463,411 $2,020,530 $ 236,846 $ – $8,720,787

Intersegment revenues 1,189 9,932 85,891 (93,772) 3,240

Total revenues $6,464,600 $2,030,462 $ 322,737 $ (93,772) $8,724,027

Depreciation and amortization $ 616,283 $ 87,906 $ 22,606 $ – $ 726,795

Financing costs, mainly interest expense 265,999 45,723 101,318 (46,604) 366,436

Income tax expense (benefit) 343,488 39,509 (78,655) – 304,342

Income (loss) from continuing operations $ 555,976 $ 63,051 $ 4,813 $ (44,640) $ 579,200

In 2003, the process to allocate common costs of the Regulated Electric and Natural Gas Utility segments was revised. Segment results for 2002 and

2001 have been restated to reflect the revised cost allocation process.

Prior to its divestiture in 2003, NRG was previously considered a reportable segment of Xcel Energy. NRG is now reported as a discontinued operation,

as discussed in Note 3 to the Consolidated Financial Statements. See Note 3 for summarized financial information regarding NRG.