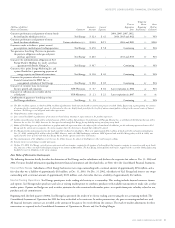

Xcel Energy 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

XCEL ENERGY 2003 ANNUAL REPORT 81

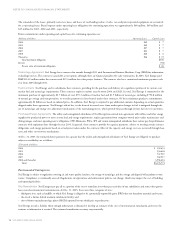

expense deductions taken in tax years 1993 through 1997 related to COLI policy loans. A request for technical advice from the IRS National Office with

respect to the proposed adjustment had been pending. Late in 2001, Xcel Energy received a technical advice memorandum from the IRS National Office,

which communicated a position adverse to PSRI. Consequently, the IRS examination division has disallowed interest expense deductions for the tax years

1993 through 1997.

After consultation with tax counsel, it is Xcel Energy’s position that the IRS determination is not supported by the tax law. Based upon this assessment,

management continues to believe that the tax deduction of interest expense on the COLI policy loans is in full compliance with the tax law. Therefore,

Xcel Energy intends to challenge the IRS determination, which could require several years to reach final resolution. Although the ultimate resolution of

this matter is uncertain, management continues to believe the resolution of this matter will not have a material adverse impact on Xcel Energy’s financial

position, results of operations or cash flows. For these reasons, PSRI has not recorded any provision for income tax or interest expense related to this matter,

and has continued to take deductions for interest expense related to policy loans on its income tax returns for subsequent years. However, defense of

Xcel Energy’s position may require significant cash outlays on a temporary basis, if refund litigation is pursued in U.S. District Court.

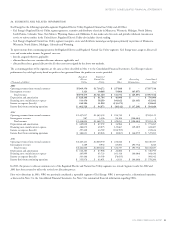

The total disallowance of interest expense deductions for the period of 1993 through 1997, as proposed by the IRS, is approximately $175 million.

Additional interest expense deductions for the period 1998 through 2003 are estimated to total approximately $404 million. Should the IRS ultimately

prevail on this issue, tax and interest payable through Dec. 31, 2003, would reduce earnings by an estimated $254 million after tax.

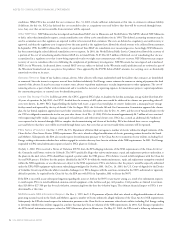

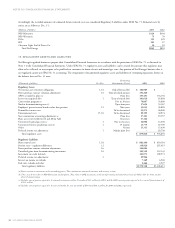

18. NUCLEAR OBLIGATIONS

Fuel Disposal NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is responsible for

permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear plants. NSP-Minnesota has funded its portion

of the DOE’s permanent disposal program since 1981. The fuel disposal fees are based on a charge of 0.1 cent per kilowatt-hour sold to customers from

nuclear generation. Fuel expense includes DOE fuel disposal assessments of approximately $13 million in 2003, $13 million in 2002 and $11 million

in 2001. In total, NSP-Minnesota had paid approximately $321 million to the DOE through Dec. 31, 2003. However, it is not determinable whether

the amount and method of the DOE’s assessments to all utilities will be sufficient to fully fund the DOE’s permanent storage or disposal facility.

The Nuclear Waste Policy Act required the DOE to begin accepting spent nuclear fuel no later than Jan. 31, 1998. In 1996, the DOE notified commercial

spent-fuel owners of an anticipated delay in accepting spent nuclear fuel by the required date and conceded that a permanent storage or disposal facility will

not be available until at least 2010. NSP-Minnesota and other utilities have commenced lawsuits against the DOE to recover damages caused by the DOE’s

failure to meet its statutory and contractual obligations.

NSP-Minnesota has its own temporary, on-site storage facilities for spent fuel at its Monticello and Prairie Island nuclear plants, which consist of storage

pools and a dry cask facility. With the dry cask storage facility licensed by the NRC approved in 1994 and again in 2003, management believes it has

adequate storage capacity to continue operation of its Prairie Island nuclear plant until at least the end of its license terms in 2013 and 2014. The

Monticello nuclear plant has storage capacity in the pool to continue operations until 2010. Storage availability to permit operation beyond these dates is

not known at this time. All of the alternatives for spent-fuel storage are being investigated until a DOE facility is available, including pursuing the estab-

lishment of a private facility for interim storage of spent nuclear fuel as part of a consortium of electric utilities.

Nuclear fuel expense includes payments to the DOE for the decommissioning and decontamination of the DOE’s uranium-enrichment facilities. In 1993,

NSP-Minnesota recorded the DOE’s initial assessment of $46 million, which is payable in annual installments from 1993 to 2008. NSP-Minnesota is

amortizing each installment to expense on a monthly basis. The most recent installment paid in 2003 was $4.5 million; future installments are subject to

inflation adjustments under DOE rules. NSP-Minnesota is obtaining rate recovery of these DOE assessments through the cost-of-energy adjustment

clause as the assessments are amortized. Accordingly, the unamortized assessment of $16.8 million at Dec. 31, 2003, is deferred as a regulatory asset.

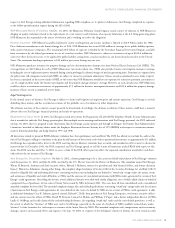

Plant Decommissioning Decommissioning of NSP-Minnesota’s nuclear facilities is planned for the years 2010 through 2048, using the prompt

dismantlement method. NSP-Minnesota is currently following industry practice by accruing the costs for decommissioning over the approved cost-

recovery period and including the accruals in Accumulated Depreciation. Upon implementation of SFAS No. 143, the decommissioning costs in

Accumulated Depreciation and ongoing accruals are reclassified to a regulatory liability account. The total decommissioning cost obligation is recorded

as an asset retirement obligation in accordance with SFAS No. 143. See Accounting Change – SFAS No. 143 for additional information.

Monticello began operation in 1971 and is licensed to operate until 2010. Prairie Island units 1 and 2 began operation in 1973 and 1974, respectively,

and are licensed to operate until 2013 and 2014, respectively. In 2003, the Minnesota Legislature changed a law that had limited expansion of on-site

storage. NSP-Minnesota will make a decision on whether to pursue license renewal for the Monticello and Prairie Island plants. Applications for license

renewal must be submitted to the NRC at least five years prior to license expiration. Preliminary scoping efforts for license renewal of the Monticello

plant have begun, including data collection and review. The Prairie Island license renewal process has not yet begun. NSP-Minnesota’s decision

whether to apply for license renewal approval could be contingent on incremental plant maintenance or capital expenditures, recovery of which

would be expected from customers through the respective rate-recovery mechanisms. Management cannot predict the specific impact of such future

requirements, if any, on its results of operations.