Xcel Energy 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58 XCEL ENERGY 2003 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

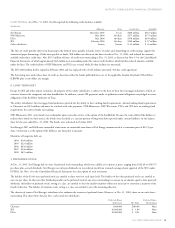

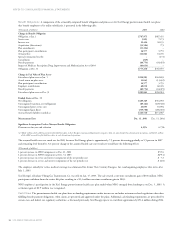

4. NRG RESTRUCTURING, BANKRUPTCY AND REORGANIZATION

In December 2001, Moody’s placed NRG’s long-term senior unsecured debt rating on review for possible downgrade. In February 2002, in response to

this threat to NRG’s investment grade rating, Xcel Energy announced a financial improvement plan for NRG, which included an initial step of acquiring

100 percent of NRG through a tender offer and merger involving a tax-free exchange of 0.50 shares of Xcel Energy common stock for each outstanding

share of NRG common stock. The exchange transaction was completed on June 3, 2002. In addition, the initial plan included: financial support to NRG

from Xcel Energy; marketing certain NRG generating assets for possible sale; canceling and deferring capital spending for NRG projects; and combining

certain of NRG’s functions with Xcel Energy’s systems and organization. During 2002, Xcel Energy provided NRG with $500 million of cash infusions.

Xcel Energy’s reacquisition of all of the 26 percent of NRG shares not then owned by Xcel Energy was accounted for as a purchase. The 25,764,852

shares of Xcel Energy stock issued were valued at $25.14 per share, based on the average market price of Xcel Energy shares for three days before and

after April 4, 2002, when the revised terms of the exchange were announced and recommended by the independent members of the NRG board of

directors. Including other costs of acquisition, this resulted in a total purchase price to acquire NRG’s shares of approximately $656 million. The process

to allocate the purchase price to underlying interests in NRG assets, and to determine fair values for the interests in assets acquired, resulted in approximately

$62 million of amounts being allocated to fixed assets related to projects where the fair values were in excess of carrying values, to prepaid pension assets and

to other assets.

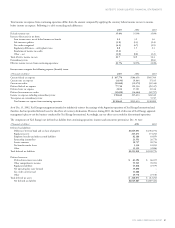

The continued financial difficulties at NRG, resulting primarily from lower prices for power and declining credit ratings, culminated in NRG and certain

of its affiliates filing, on May 14, 2003, voluntary petitions in the U.S. Bankruptcy Court for the Southern District of New York for reorganization under

Chapter 11 of the U.S. Bankruptcy Code to restructure their debt. NRG’s filing included its plan of reorganization and the terms of the overall settlement

among NRG, Xcel Energy and members of NRG’s major creditor constituencies that provided for payments by Xcel Energy to NRG and its creditors of

$752 million. NRG’s creditors and the bankruptcy court approved the plan of reorganization, and on Dec. 5, 2003, NRG completed reorganization and

emerged from bankruptcy. As part of the reorganization, Xcel Energy completely divested its ownership interest in NRG, which in turn issued new

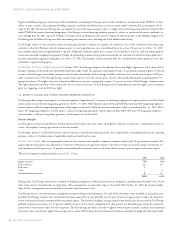

common equity to its creditors. The other principal terms of the overall settlement include the following:

–Xcel Energy will pay $752 million to NRG to settle all claims of NRG against Xcel Energy and claims of NRG creditors against Xcel Energy under

the NRG plan of reorganization:

–$400 million paid on Feb. 20, 2004, including $112 million to NRG’s bank lenders.

–$352 million will be paid on April 30, 2004, unless at such time Xcel Energy has not received tax refunds equal to at least $352 million associated

with the loss on its investment in NRG. To the extent such refunds are less than the required payments, the difference between the required payments

and those refunds would be due on May 30, 2004.

–In return for such payments, Xcel Energy received, or was granted, voluntary and involuntary releases from NRG and its creditors.

–Xcel Energy’s exposure on any guarantees, indemnities or other credit-support obligations incurred by Xcel Energy for the benefit of NRG or any

NRG subsidiary was terminated, or other arrangements satisfactory to Xcel Energy and NRG were made, such that Xcel Energy has no further

exposure, and any cash collateral posted by Xcel Energy has been returned.

–As part of the settlement, any intercompany claims of Xcel Energy against NRG or any subsidiary arising from the provision of goods or services or

the honoring of any guarantee were paid in full and in cash in the ordinary course, except that the agreed amount of certain intercompany claims

arising or accrued as of Jan. 31, 2003 (approximately $50 million), were reduced to $10 million. The $10 million agreed amount has been satisfied

with an unsecured promissory note of NRG in the principal amount of $10 million with a maturity of 30 months and an annual interest rate of

3 percent.

–NRG and its subsidiaries will not be reconsolidated with Xcel Energy or any of its other affiliates for tax purposes at any time after their March 2001

federal tax de-consolidation (except to the extent required by state or local tax law) or treated as a party to or otherwise entitled to the benefits of any

existing tax-sharing agreement with Xcel Energy. However, NRG and certain subsidiaries would continue to be treated substantially as they were

under the December 2000 tax allocation agreement to the extent they remain part of a consolidated or combined state tax group that includes Xcel

Energy, and with respect to any adjustments to pre-March 2001 federal tax periods. Under the settlement agreement, NRG will not be entitled to

any tax benefits associated with the tax loss Xcel Energy expects to recognize as a result of the cancellation of its stock in NRG on the effective date

of the NRG plan of reorganization.

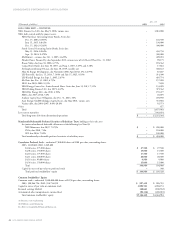

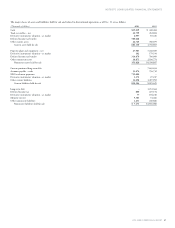

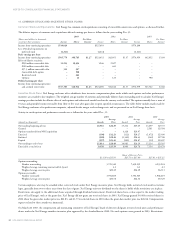

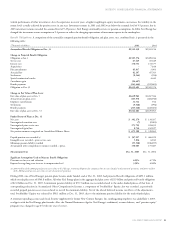

5. SHORT-TERM BORROWINGS

Notes Payable At Dec. 31, 2003 and 2002, Xcel Energy and its continuing subsidiaries had approximately $59 million and $504 million, respectively,

in notes payable to banks. The weighted average interest rate at Dec. 31, 2003, was 3.97 percent.