Westjet 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Thunder Bay

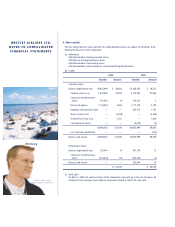

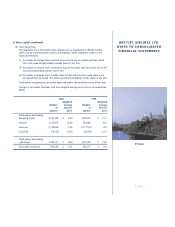

7. Income taxes:

During the year, the Corporation adopted the new method of accounting for income taxes. The liability

method is described in note 1.

Income taxes vary upon the amount that would be computed by applying the basic Federal and

Provincial tax rate of 45% to earnings before taxes as follows:

2000 1999

Expected income tax provision $ 23,718 $ 13,207

Add (deduct):

Non-deductible expenses 35 55

Other (124) (10)

Capital taxes 170 264

Large corporations tax 475 —

Future tax reductions (1,822) —

$ 22,452 $ 13,516

The components of the net future income tax liability at December 31, 2000 is as follows:

Future income tax assets:

Share issue costs $ 1,334

Future income tax liabilities:

Capital assets $ 17,162

Net future income tax liability $ 15,828

Ally works with our

Ottawa airport team.