Westjet 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S

DISCUSSION & ANALYSIS

OF FINANCIAL RESULTS

Page18

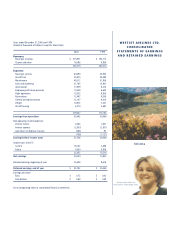

plans. The profit share amounted to $13.5 million in 2000, a 104.3% increase over the

$6.6 million in the previous year which was directly attributable to our increased pretax

margin. The second component of WestJet’s compensation philosophy is the Employee

Share Purchase Program (ESP). At the end of 1999, 69.4% of WestJetters were

contributing an average of 11.6% of their base wage to the plan, which is matched dollar

for dollar by the company. At the end of 2000, the number had increased to an 81.4%

participation level and an average of 12.5% of their pay. This lead to our people

purchasing, in total, $8.0 million in WJA shares, $4.0 million of which came from our

people. The corporation’s matching contribution under the share purchase plan is

recorded as an operating cost, one that has increased in 2000 over previous years, but is a

vital way to reward our people and an area of cost increase that WestJet is proud to

acknowledge.

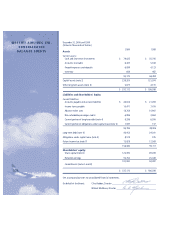

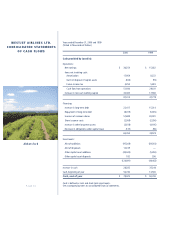

Financial Condition

WestJet ended the year with $79.0 million cash, $239.3 million in capital assets, $49.5

million in long-term debt and capital lease obligations, and only four aircraft of our 22

financed under operating leases. The Corporation has ample working capital, enjoys a net

debt free status and has $181.1 million in shareholders’equity. Clearly, the company has

one of the most favourable balance sheets in the industry.

Our plan for fleet renewal by the introduction of new generation aircraft is necessary to

continue to place the airline in a position to grow and benefit from a changing industry

in Canada. We have firm orders for 36 aircraft over five years and over the next eight years

we have flexibility in both the retirement schedule of the existing fleet as well as options

and purchase rights with Boeing and General Electric for an additional 58 aircraft.

WestJet’s capital philosophy has always been towards a conservatively leveraged balance

sheet. It is our intention to have one-third of our fleet on operating lease and two-thirds

of our fleet financed, 50.0% with debt and 50.0% with equity. We now have the luxury of

a two-year window before the first purchased aircraft is delivered to WestJet to generate

sufficient revenue and to raise the appropriate amounts of financing. The obligation of

buying 26 aircraft represents a $1.2 billion ($744 million US) commitment to Boeing

between 2003 and 2006 but is supported by a $1.1 billion commitment from the US

Government’s Export-Import Bank on a 12-year term loan, should we need it. In current

market terms the interest rate that would be applicable to this financing would be

approximately 5.8%.

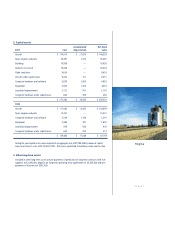

Prince George