Westjet 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

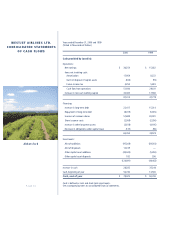

Years ended December 31, 2000 and 1999

(Tabular Amounts are Stated in Thousands of Dollars)

1. Significant accounting policies:

(a) Principles of consolidation:

These consolidated financial statements include the accounts of the Corporation and its

wholly-owned subsidiaries.

(b) Revenue recognition:

Passenger revenue is recognized when air transportation is provided. The value of unused

tickets is included in the balance sheet as advance ticket sales under current liabilities.

(c) Non-refundable passenger credits:

The Corporation, under certain circumstances, may issue future travel credits which are non-

refundable and which expire one year from the date of issue. The utilization of passenger

credits are recorded as revenue when the passenger has flown.

(d) Foreign currency:

Monetary assets and liabilities, denominated in foreign currencies, are translated into

Canadian dollars at rates of exchange in effect at the balance sheet date. Other assets and

revenue and expense items are translated at rates prevailing when they were acquired or

incurred.

Exchange gains and losses arising on the translation of long-term monetary items that are

denominated in foreign currencies are deferred and amortized on a straight-line basis over the

remaining term of the related monetary item.

(e) Inventory:

Materials and supplies are valued at the lower of cost and replacement value. Aircraft

expendables and consumables are expensed as incurred.

(f) Deferred costs:

Sales and marketing and reservation expenses attributed to the advance ticket sales are

deferred and expensed in the period the related revenue is recognized. Included in prepaid

expenses are $2,435,000 (1999 - $1,169,000) of deferred costs.

(g) Capital assets:

Capital assets are depreciated over their estimated useful lives at the following rates and

methods.

Asset Basis Rate

Aircraft net of estimated residual value Flight hours Hours flown

Spare engines and parts Flight hours Hours flown

Aircraft under capital lease Straight-line Over the term of the lease

Flight simulators Straight-line 10 and 25 years

Computer hardware and software Straight-line 5 years

Equipment Straight-line 5 years

Leasehold improvements Straight-line Over the term of the lease

Buildings Straight-line 40 years

Darrin works with

our maintenance team

in Hamilton.

WESTJET AIRLINES LTD.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

Victoria