Westjet 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

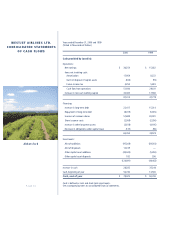

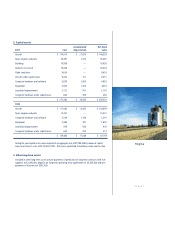

Cost per Available Seat Mile

Excluding Profit Share, Nav Canada

Fees and Impact of Fuel (Cents)

14

12

10

8

1996 1997 1998 1999 2000

10.8

12.0 11.9

12.3

page17

constant despite the increased size of the company, we were able to make unit cost

improvements in this area.

Notably, our insurance costs were favorably reduced in 2000. However, the aviation

insurance market is under strenuous pressure, as premiums are not keeping pace with

claims. WestJet renewed its policies early in 2000. Due to a number of factors – including

our excellent safety record, our history and our plan for growth, and fleet renewal – we

enjoyed a dramatic 25.5% reduction in our unit cost of insurance. We also opted to extend

the new policy term to avoid the volatile insurance market and take advantage of the low

in the market’s cycle.

Like all businesses in Canada, WestJet has benefited from the tax cuts legislated by the

federal and many provincial governments. In 2000, current taxes payable and the

allowance for future income taxes on timing differences amounted to 42.6% of pre-tax

earnings, a reduction from 46.1% in 1999. Our allowance for future corporate income

taxes to both levels of government, on current earnings but deferred and not currently

taxable, is based only on enacted legislation. While we consider the estimates to be

conservative at 40.7%, Management, the Audit Committee, and the Board of Directors

are comfortable with this approach and have developed a plan for adjusting the estimates

downward as further tax changes are passed into law.

Salaries and wages, before benefits and profit share, account for approximately 15.0% of

WestJet’s total operating costs, which is second only to fuel. Productivity can be measured

by the number of employees needed to operate an aircraft. WestJet had 61 employees per

aircraft in the fleet at the end of 1998, 55 at the end of 1999 and 56 by the end of 2000.

This includes two people per airplane dedicated to planning and executing our transition

to the new Boeing 737-700 jets. Another measure, employees per aircraft in revenue

service, indicated that there were 83 people per revenue aircraft at the end of 1998, 73 at

the end of 1999 and including the 737-700 team, was still down to 72 in December of

2000. This measure disregards the aircraft which are operational spares or are in

maintenance checks.

WestJet’s people are paid mid-market base salary or hourly wage but have the opportunity

to improve that compensation through our profit sharing and employee share purchase

12.0

Cost per Available Seat Mile

Excluding Profit Share

and Nav Canada Fees (Cents)

14

12

10

8

1996 1997 1998 1999 2000

10.6

11.6 11.7

12.1

12.8