Westjet 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S

DISCUSSION & ANALYSIS

OF FINANCIAL RESULTS

Page14

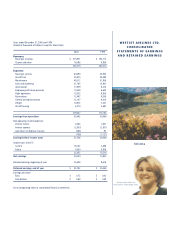

With WestJet’s maturing and increasing fleet, large dollar expenditure items such as

engine overhauls and heavy airframe maintenance checks do not vary significantly from

year to year.They can, however,create large peaks and valleys in expenditures from quarter

to quarter, and historically WestJet’s accounting policy for interim and quarterly reporting

purposes has been to budget these expenditures with a maintenance reserve or accrual on

the balance sheet. By fiscal year end the result is the same; no reserve is accrued and the

costs reflect the actual expenditures for all maintenance expenses incurred during the year.

WestJet had recorded these expenses in this way because a quarter may have no large

dollar engine or airframe work, simply due to timing. This could create an unusually low

cost picture and higher earnings number. Conversely, a reporting period could have higher

than normal quarterly activity for these large expenditures and potentially mislead the

reader of financial statements with lower earnings performance.

For interim reporting periods in 2001 and forward, WestJet will move to a consistent

maintenance policy for quarters and year-end by booking actual expenses on a quarterly

basis. Fortunately, due to our increased size and current scheduling for maintenance work,

we anticipate that these expenditures for maintenance should track our revenue patterns

quarter to quarter during 2001. The longer the reporting period and the larger the fleet,

the less vulnerable the reporting is to these fluctuations.

In 1998, WestJet entered into fixed price and fixed volume fuel supply agreements with

jet fuel suppliers.The contracts were not derivative instruments; rather, they committed a

certain supply in cents per litre for jet fuel. As a better-understood and indicative number,

we locked up the majority of our fuel requirement in the comparable range of a crude oil

price of US $16 per barrel. This arrangement originally extended through 1998, 1999 and

to June of 2000 and meant that we did not benefit when the price of oil dropped to US

$11 in early 1999. In July of 1999 we negotiated an extension to the contract to June 2003

and moved to one supplier who provided us with a Canadian cent per litre price supply

contract on enhanced volumes. To protect us from falling energy prices, this contract

provided us with a ceiling price of US $18.61.These fuel management arrangements have

effectively hedged WestJet’s exposure to the price of oil. As our airline grows, the fixed

volume nature of the contracts has been diluted with 90.0% of our jet fuel purchases

covered in 1998, 70.0% in 1999, and 67.0% in 2000. With our estimated growth we

anticipate 50.0% of our fuel requirements in 2001 will still be covered by this agreement.

Grande Prairie