Westjet 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

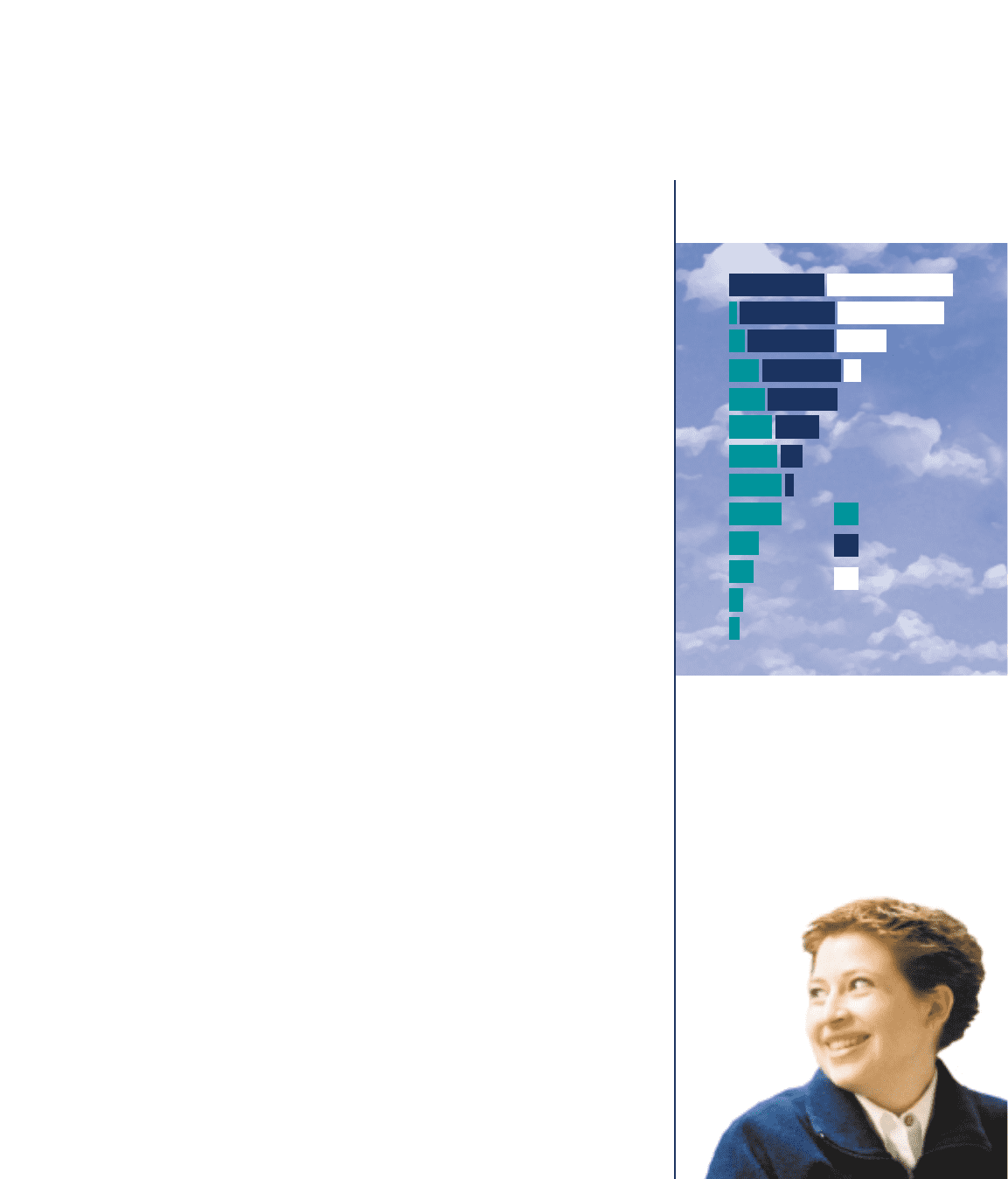

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

0 20 40 60 80 100

4

6

11

16

23

23 + 4

21 + 10

18 + 20

14 + 30

12 + 35 + 9

7 + 36 + 25

3+36+43

737-200 Series

NG Firm

New Generation Firm

NG OPTIONS

New Generation Options

Our financing activity in 2000 reflected our business philosophy of maintaining a flexible

and strong balance sheet while growing our fleet. We retired and sold one of our original

three aircraft early in the year, purchased six aircraft outright and added a seventh to the

fleet via operating lease. WestJet also completed a sale and capital leaseback transaction

for $10.0 million in the fourth quarter. WestJet has been very profitable, virtually since day

one, and long ago used its pre-startup loss carry forwards for income tax purposes. There

is a distinct tax advantage to owning rather than leasing aircraft and we purposely set out

to use that advantage and our cash to acquire the majority of our aircraft during the year.

WestJet is nearing completion of its $23.0 million hangar facility in Calgary and during

2000, moved into the new call centre and administrative headquarters building, which was

secured on a ten-year lease. As at December 31, 2000 capital outlay on the hangar and its

simulator bay amounted to $20.0 million and $10.3 million had been drawn on our $12.0

million mortgage facility.

The airline spent $9.6 million on its two simulators in 2000, about half of the total

commitment, and drew $8.8 million of $16.1 million in available term debt financing for

the 737-700 trainer. With cash, WestJet paid deposits and pre-delivery payments required

under the new aircraft leases and purchase contracts amounting to $18.4 million and also

acquired a total of $20.5 million in various spare engines and parts, leasehold

improvements, computer technology and sundry equipment.

Outlook

All WestJetters are excited about our new facilities and look forward to the arrival of our

new generation Boeing 737-700 aircraft. These planes fly faster, farther and quieter than

our existing airplanes and will provide us with improved utilization, fuel efficiencies, and

lower maintenance costs. We are confident of the improved economics they will provide,

notwithstanding their higher ownership cost. We have a strong balance sheet and a low

cost structure, which can well withstand any potential recessions and competitive

pressures in our industry and we feel very confident that we will be able to take full

advantage of this enviable position in the years to come. WestJet has been through

regional recessions, fare wars and vigorous competition for five years, all of which have

strengthened our culture and the determination of our people as our company further

expands its horizons.

Fleet Plan

36 + 58

Erin is a part of our

Moncton airport team.