Westjet 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interests with the airline and subscribed to the philosophy of shared success, as 81.4% of

our people participated in our Employee Share Purchase Plan.

Results of Operations

Earnings per share on a fully diluted basis increased to 69 cents in 2000, a 76.9% gain

from 39 cents in 1999. Despite an era of high-energy prices and their impact on WestJet’s

un-hedged fuel, the overall cost of operating WestJet increased only nominally.

Improvements in revenues and savings in a number of other cost categories have helped

offset the impact of fuel on WestJet’s bottom line.

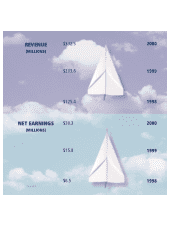

During 2000, net earnings nearly doubled and cash generated through operations

provided $87.4 million to treasury, compared with $47.8 million in the previous year. Net

earnings amounted to 9.1% of revenues in 2000 compared with 7.8% in 1999. Our

operating margin was among the highest in the North American airline industry at 16.1%

of revenues, an improvement of more than one full percentage point over 1999’s result.

WestJet’s capacity grew by 52.6% over 1999 and revenue passenger miles outpaced

capacity growth increasing 60.9%. Costs increased by 61.2%, less than in 1999, con-

tributing to the improved operating margin.

Earnings before interest, income taxes, depreciation, and aircraft rent (EBITDAR) also

showed solid improvement, growing 86.1% from 1999’s $43.2 million to $80.4 million in

2000. WestJet’s EBITDAR margin improved to 24.2% in 2000 from 21.2% in 1999. It

should be noted that in 2000 we revised our estimates for depreciation to take into account

the potential for an earlier retirement of the 737-200 fleet.

Profit sharing is an integral and very important component of WestJet’s total

compensation philosophy for our people. The plan provides that a minimum of 10.0% up

to a maximum of 20.0% of the airline’s pre-tax and pre-profit share income is distributed

in cash to all employees based on a formula that matches margin to profit share. This

formula means that in an instance where the Corporation may have a doubling of margin

from 10.0% to 20.0%, WestJet’s people could see a quadrupling of their profit share. All

of WestJet’s cost and margin statistics previously mentioned include a provision for profit

share. The margin for purposes of this calculation achieved a record high in 2000 at

19.5%, compared with 17.5% in 1999. These financial results are a due to a number of

Page10

MANAGEMENT’S

DISCUSSION & ANALYSIS

OF FINANCIAL RESULTS