Westjet 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EXPANDING

HORIZONS

WESTJET

AIRLINES LTD.

annual report 2000

Table of contents

-

Page 1

E H X O P R A I N Z D O I N N G S W E S T J E T A I R L I N E S a n n u a l r e p o r t L T D. 2 0 0 0 -

Page 2

TA B L E O F C O N T E N T S Highlights Message to Shareholders Management's Discussion and Analysis Auditor's Report to the Shareholders Financial Statements Notes to Financial Statements Corporate Information Page 01 Page 04 Page 09 Page 21 Page 22 Page 25 Page 36 -

Page 3

... George, Kelowna, Calgary, Edmonton, Grande Prairie, Saskatoon, Regina, W innipeg, Thunder Bay, H amilton, O ttawa and Moncton. As of December 31, 2000, WestJet operated 22 Boeing 737-200 aircraft and employed over 1500 people. WestJet is a publicly traded company on the Toronto Stock Exchange under... -

Page 4

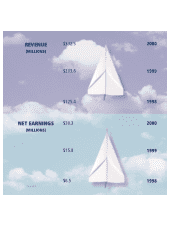

REVENUE (MILLIONS) $332.5 2000 $203.6 1999 $125.4 1998 NET EARNINGS (MILLIONS) $30.3 2000 $15.8 1999 $6.5 P a g e 0 2 1998 -

Page 5

... 1998 GLOSSARY Revenue Passenger Miles A measure of passenger traffic, calculated as the number of revenue passengers multiplied by the total distance flown. Available Seat Miles A measure of total passenger capacity, calculated by multiplying the total number of seats available for sale by the... -

Page 6

... Operations WestJet ended 2000 with 22 Boeing 737-200 aircraft, after adding six 737-200 series aircraft to our fleet during the year. These additional aircraft allowed us to further develop our route network across Canada, marking one of the most exciting growth phases of our five-year history... -

Page 7

... to purchasing a Boeing 737-700 flight simulator early in 2001. These simulators will significantly reduce our flight operation' s training costs, by allowing our pilots to train in Calgary rather than having to spend time traveling to other destinations. They will also provide us with a revenue... -

Page 8

... people' s goals with that of the company. The average full-time Most important of all, at the end of the day we know our people feel fulfilled, after having the opportunity to help others and impact the success of our airline. employee received two profit share cheques in 2000, totaling more than... -

Page 9

... affordable air travel to all Canadians. Your support, and that of our customers and more than 1500 WestJetters, will ensure that we can continue to expand our horizons - to build WestJet into Canada' s alternative airline. Clive Beddoe President, CEO and Executive Chairman WestJet Airlines Ltd... -

Page 10

Canada -

Page 11

... five years. We purchased two flight simulators, one for the existing fleet of 737-200 aircraft and another to ensure that our pilots can train, cost effectively, here at WestJet, for the 737-700s. We watched the construction of our new hangar and our new administrative headquarters and call centre... -

Page 12

...an earlier retirement of the 737-200 fleet. Profit sharing is an integral and very important component of WestJet's total compensation philosophy for our people. The plan provides that a minimum of 10.0% up to a maximum of 20.0% of the airline' s pre-tax and pre-profit share income is distributed in... -

Page 13

....9 million in 2000. In addition, 5.1% of WestJet' s total revenues were derived from charters, transportation of cargo, promotional golf and ski packages, group bookings, and the sundry fees levied for items such as itinerary changes, cancellations and excess baggage. These revenues represented $16... -

Page 14

...most important distribution channels. WestJet opted for a different approach, to reward our partners in the travel industry for their support, by paying a premium 7.0% commission when the booking is made through our call centre, and 9.0% if the agency books through our Internet site (www.westjet.com... -

Page 15

... 2000. In 2000, when the decision was made to renew the fleet with Boeing 737-700 aircraft, management revisited its estimates on the useful life of the 737-200 fleet and conservatively set out a retirement plan for these aircraft over the next eight years. This change reduced the estimated average... -

Page 16

... WestJet will move to a consistent maintenance policy for quarters and year-end by booking actual expenses on a quarterly basis. Fortunately, due to our increased size and current scheduling for maintenance work, we anticipate that these expenditures for maintenance should track our revenue patterns... -

Page 17

...the web site with the higher 9.0% commission. Through the last half of 2000, the growth in that portion of our revenues generated online has been exceptional, and by year-end amounted to more than 25.0% with consistently growing trends. WestJet' s cost of a booking through our Calgary call centre is... -

Page 18

... 1999 by 15.4% in 2000. WestJet' s general and administrative expenses are comprised mainly of salaries of senior management of the departments of finance, information technology and people (human resources), as well as our insurance premiums. W ith the size of these groups remaining P a g e 1 6 -

Page 19

... 737-700 team, was still down to 72 in December of 2000. This measure disregards the aircraft which are operational spares or are in maintenance checks. WestJet' s people are paid mid-market base salary or hourly wage but have the opportunity to improve that compensation through our profit sharing... -

Page 20

...component of WestJet' s compensation philosophy is the Employee Share Purchase Program (ESP). At the end of 1999, 69.4% of WestJetters were contributing an average of 11.6% of their base wage to the plan, which is matched dollar for dollar by the company. At the end of 2000, the number had increased... -

Page 21

...our original three aircraft early in the year, purchased six aircraft outright and added a seventh to the fleet via operating lease. WestJet also completed a sale and capital leaseback transaction for $10.0 million in the fourth quarter. WestJet has been very profitable, virtually since day one, and... -

Page 22

Calgary -

Page 23

... of WestJet Airlines Ltd. as at December 31, 2000 and 1999 and the consolidated statements of earnings and retained earnings and cash flows for the years then ended. These financial statements are the responsibility of the Corporation' s management. O ur responsibility is to express an opinion on... -

Page 24

...,172 $ 186,598 Liabilities and Shareholders' Equity Current liabilities: Accounts payable and accrued liabilities Income taxes payable Advance ticket sales Non-refundable passenger credits Current portion of long-term debt (note 4) Current portion of obligations under capital lease (note 5) $ 43... -

Page 25

Years ended December 31, 2000 and 1999 (Stated in Thousands of Dollars, Except Per Share Data) 2000 Revenues: Passenger revenues Charter and other Expenses: Passenger services Aircraft fuel Maintenance Sales and marketing Amortization Employee profit share provision Flight operations Reservations ... -

Page 26

... TAT E M E N T S OF CASH FLOWS Years ended December 31, 2000 and 1999 (Stated in Thousands of Dollars) 2000 Cash provided by (used in): Operations: Net earnings Items not involving cash: Amortization Gain on disposal of capital assets Future income tax Cash flow from operations Increase in non-cash... -

Page 27

... advance ticket sales under current liabilities. (c) Non-refundable passenger credits: The Corporation, under certain circumstances, may issue future travel credits which are nonrefundable and which expire one year from the date of issue. The utilization of passenger credits are recorded as revenue... -

Page 28

... gains and losses are accrued as exchange rates change to offset gains and losses resulting from the underlying hedged transactions. Premiums and discounts are amortized over the term of the contracts. The Corporation manages its exposure to jet fuel price volatility through the use of fixed... -

Page 29

... capitalized to buildings under construction. Regina 3. Other long-term assets: Included in other long-term assets are pre-payments of premiums for long-term contracts with fuel suppliers of $2,000,000, deposits on long-term operating lease agreements of $3,435,000 and prepayments of insurance of... -

Page 30

...T S 4. Long-term debt: 2000 $12,000,000 term loan of which the remaining $1,703,000 will be drawn subsequent to year end and will be repayable in monthly instalments of $108,000 commencing May 2001 including interest at 9.03%, maturing April 2011, secured by the hangar facility $8,756,000 term loan... -

Page 31

...$ The Corporation has available a facility with a chartered bank of $2,000,000 for letters of guarantee and $7,000,000 U.S. for forward foreign exchange contracts. At December 31, 2000, letters of guarantee totaling $925,000 have been issued under these facilities. The credit facilities are secured... -

Page 32

... Amount Winnipeg Performance shares: Balance, beginning of year Conversion of performance shares Balance, end of year 333,644 (333,644) - 10 (10) - $ 125,390 437,146 (103,502) 333,644 13 (3) 10 $ 69,039 Daniel is part of our airport team in Hamilton. P a g e 3 0 (c) Stock split: On May 12, 2000... -

Page 33

... the Plan which may be issued within a one year period shall not exceed 10% of the issued and outstanding common shares at any time. Stock options are granted at a price that equals the market value and have a term of four years. Changes in the number of options, with their weighted average exercise... -

Page 34

... of their gross pay and acquire common shares of the Corporation at the current fair market value of such shares. The Corporation matches the employee contributions and shares may be withdrawn from the Plan after being held in trust for one year. Employees may offer to sell common shares, which have... -

Page 35

...207 The components of the net future income tax liability at December 31, 2000 is as follows: Future income tax assets: Share issue costs Future income tax liabilities: Capital assets Net future income tax liability $ 1,334 $ 17,162 $ 15,828 Thunder Bay Ally works with our Ottawa airport team. -

Page 36

... Import Bank of the United States on the twenty-six Boeing new generation aircraft. This $744,000,000 U.S. commitment may be used for the aircraft purchases beginning in 2003. (b) Employee profit share: The Corporation has an employee profit sharing plan whereby eligible employees will participate... -

Page 37

... to U.S. dollar denominated prices. The Corporation periodically uses financial instruments, including forward exchange contracts and options, to manage its exposure. At December 31, 2000 the Corporation did not have any forward contracts outstanding. (c) Interest rate risk: The Corporation has... -

Page 38

...Ontario Teachers'Pension Plan Board Tim Morgan Senior Vice President, Operations WestJet Airlines Ltd. D onald A. MacD onald President Sanjel Corporation Larry Pollock President and Chief Executive Officer Canadian Western Bank and Canadian Western Trust Corporate Officers Clive J. Beddoe Executive... -

Page 39

...Email - [email protected] Website - www.cibcmellon.com Legal Counsel Burnet, D uckworth and Palmer Calgary, AB Stock Exchange Listing WestJet is publicly traded on the Toronto Stock Exchange under the symbol W JA. Auditors KPMG LLPP Calgary, AB Investor Relations Contact Information Phone... -

Page 40

5055 - 11th Street NE • Calgary, Alberta T2E 8N4 • Telephone: 403.444.2600 • Facsimile: 403.444.2301 • Website: www.westjet.com