Vtech 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2010 07

Profi t Attributable to Shareholders and Dividends

The profi t attributable to shareholders of the Company for the year ended

31 March 2010 was US$206.5 million, an increase of US$63.3 million as compared to

the previous fi nancial year.

Basic earnings per share for the year ended 31 March 2010 were US83.7 cents

as compared to US58.5 cents in the previous fi nancial year. During the year, the

Group declared and paid an interim dividend of US16.0 cents per share, which

aggregated to US$39.5 million. The directors have proposed a fi nal dividend of

US62.0 cents per share, which will aggregate to US$153.1 million.

Liquidity and Financial Resources

Shareholders’ funds as at 31 March 2010 were US$515.7 million, a 17.2%

increase from US$440.2 million reported for the fi nancial year 2009. The

shareholders’ funds per share increased by 16.8% from US$1.79 to US$2.09.

The Group had no bank borrowings as at 31 March 2009 and 31 March 2010.

As at 31 March 2010 and 2009 2010 2009

US$ million US$ million

Deposits and cash 382.6 287.2

Currency-linked deposits – 4.9

382.6 292.1

As at 31 March 2010, deposits and cash plus currency-linked deposits with

principal protected had increased to US$382.6 million, rose 31.0% from

US$292.1 million at the previous year-end.

Treasury Policies

The Group’s treasury policies are designed to mitigate the impact of

fl uctuations in foreign currency exchange rates arising from the Group’s global

operations and to minimise the Group’s fi nancial risks. The Group cautiously

uses derivatives, principally forward foreign exchange contracts, as appropriate

for risk management purposes only, for hedging foreign exchange transactions

and for managing the Group’s assets and liabilities. It is the Group’s policy not

to enter into derivative transactions for speculative purposes.

Working Capital

As at 31 March 2010 and 2009

All fi gures are in US$ million unless stated otherwise 2010 2009

Stocks 159.3 128.0

Average stocks as a percentage of Group revenue 9.4% 9.0%

Turnover days 75 days 67 days

Trade debtors 185.7 154.0

Average trade debtors as a percentage of

Group revenue 11.1% 11.6%

Turnover days 61 days 73 days

Stocks as at 31 March 2010 increased by 24.5% over the balance at 31 March

2009 to US$159.3 million. The turnover days increased from 67 days to 75 days.

The increase in stock level was primarily due to advance purchase of raw

materials to cater for the increased demand for the Group’s products in the

fi rst quarter of the fi nancial year 2011.

Trade debtors as at 31 March 2010

was US$185.7 million as compared

to US$154.0 million in the previous

fi nancial year. The turnover days

decreased from 73 days to 61 days.

The increase in trade debtor balance

as at 31 March 2010 was mainly due

to an increase in revenue in the fourth

quarter of fi nancial year 2010 when

compared with the corresponding

period of the previous fi nancial year.

Capital Expenditure

For the year ended 31 March 2010,

the Group invested US$26.3 million in

the purchase of plant and machinery,

equipment, computer systems and

other tangible assets. All of these

capital expenditures were fi nanced

from internal resources.

Capital Commitments and

Contingencies

In the fi nancial year 2011, the Group

will incur capital expenditure of

US$45.2 million for ongoing business

operations. This includes our planning

to further invest US$19.1 million

of capital in Qingyuan, northern

Guangdong province, in the fi nancial

year 2011.

All of these capital expenditures will

be fi nanced from internal resources.

As of the fi nancial year end date, the

Group had no material contingencies.

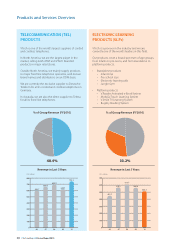

Earnings per Share in Last 5 Years

0

20

40

60

100

80

1009080706

54.9

76.6

89.4

58.5

83.7

US cents