Vtech 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

06 VTech Holdings Ltd Annual Report 2010

Management Discussion and Analysis

Operating Profi t/Margin

The operating profi t for the year

ended 31 March 2010 was US$224.1

million, an increase of US$69.8 million

or 45.2% over the previous fi nancial

year. The operating profi t margin also

increased from 10.7% in the previous

fi nancial year to 14.6% in the current

fi nancial year. The ratio of EBITDA to

revenue in the fi nancial year 2010 was

17.0% against 12.9% recorded in the

previous fi nancial year. The increase

was partly refl ected by the increase

in gross profi t and lower selling and

distribution costs.

Selling and distribution costs

decreased by 10.7% from US$232.1

million in the previous fi nancial

year to US$207.3 million in the

fi nancial year 2010. The decrease

was mainly attributable to more

eff ective spending on advertising

and promotional dollars for ELPs by

the Group. As a percentage of Group

revenue, selling and distribution costs

decreased from 16.0% in the previous

fi nancial year to 13.5% in the fi nancial

year 2010.

Administrative and other operating

expenses decreased from US$84.2

million in the previous fi nancial year

to US$71.2 million in the fi nancial year

2010. With better foreign exchange

risk management, exchange loss

arising from the Group’s global

operations in the ordinary course of

business was minimal in the fi nancial

year 2010. This contrasted with an

exchange loss of US$27.6 million

recorded in the previous fi nancial year

owing to the depreciation of the Euro

and Sterling against the US dollar.

Excluding the eff ect of exchange

diff erences, the administrative and

other operating expenses increased

by US$14.6 million compared to

the previous fi nancial year. These

expenses included the settlement

and license fees together with the

legal and professional costs of a

lawsuit with Motorola Inc. related to

infringement of six patents asserted

against the Group. Administrative

and other operating expenses as

a percentage of Group revenue,

excluding the eff ect of exchange

diff erences, increased from 3.9% in

the previous fi nancial year to 4.6% in

the current fi nancial year.

During the fi nancial year 2010, the

research and development expense

was US$56.8 million, a slight decrease

of 0.2% over the previous fi nancial

year. Research and development

expense as a percentage of Group

revenue decreased from 3.9% in the

previous fi nancial year to 3.7% in the

fi nancial year 2010.

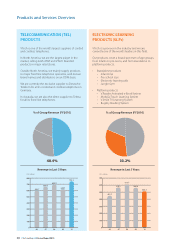

Group R&D Expenditure

in Last 5 Years

40.3

45.2

51.3

56.9 56.8

0

10

20

30

40

50

60

70

US$ million

06 07 08 09 10

Gross Profi t Margin in Last 5 Years

06 07 08 09 10

0

10

20

30

40 37.1

50

%

36.9 37.6

36.4 36.5

Net Profi t Margin in Last 5 Years

06 07 08 09 10

0

5

10

15

10.7

20

%

12.5

13.9

9.9

13.5

Group EBITDA/Revenue and

EBIT/Revenue in Last 5 Years

12.9

11.3

14.9

13.3

16.6

14.7 12.9

10.7

17.0

14.6

%

EBITDA/Revenue

EBIT/Revenue

06 07 08 09 10

0

4

8

12

16

20