Vtech 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

02 VTech Holdings Ltd Annual Report 2010

Letter to Shareholders

Dear Shareholders,

I am pleased to report that VTech has

successfully managed our businesses

through the adverse economic

conditions prevailing in the fi nancial

year 2010. In addition to achieving an

increase in revenue, we delivered a

proportionally higher growth in profi t.

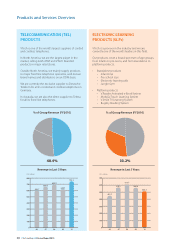

In the US, the market share of our

telecommunication (TEL) products

grew further. Sales of contract

manufacturing services (CMS)

increased despite the decline in the

global electronic manufacturing

services (EMS) market. We also

achieved good growth across the

board in Asia Pacifi c.

Our track record for product

innovation continues. We launched a

new telephony system for small and

medium sized business (SMB), which

has been well received. For electronic

learning products (ELPs), we have

recently delivered two new platform

products to the market and they have

received strong support from our

retail customers.

Results and Dividend

Group revenue for the year ended

31 March 2010 rose by 5.8% over

the previous fi nancial year, to

US$1,532.3 million. Profi t attributable

to shareholders of the Company

grew strongly, by 44.2%, to US$206.5

million. The proportionally higher

profi t is mainly attributable to

eff ective spending on advertising and

promotions for ELPs, as well as better

foreign exchange risk management.

Basic earnings per share increased

by 43.1% to US83.7 cents, compared

to US58.5 cents in the fi nancial year

2009. The Board of Directors (the

Board) has proposed a fi nal dividend

of US62.0 cents per ordinary share.

Together with the interim dividend of

US16.0 cents per ordinary share, this

gives a total dividend for the year of

US78.0 cents per ordinary share, an

increase of 47.2% over the previous

fi nancial year.

Segment Results

North America, our largest market,

was an important contributor to our

strong results. Despite the severe

downturn in the US, we managed to

increase revenue in the region. TEL

products and CMS performed well,

countering a decline in sales of ELPs.

Our TEL products continued to

lead the market in product design,

innovative features and competitive

pricing. Capitalising on the exit of

a major competitor towards the

end of the calendar year 2008, we

boosted our estimated share of

the US corded and cordless phone

market to almost 50%. With the

launch of our AT&T branded SMB

telephony systems, we have also

opened a major new area of growth

in North America. These systems are

ideal for small and medium sized

offi ces, as well as for facilities such as

warehouses and distribution centres.

A sharp improvement in the second

half saw CMS revenue in North

America increase for the full fi nancial

year, buoyed by increased sales of

professional audio equipment to both

existing and new customers. Sales

of ELPs were impacted by unstable

economic conditions in the region,

where we had strategically delayed

the launch of a major new platform

product.

Revenue from Europe was aff ected

by the weak economy. Despite a

sales rebound in the second half

as customers began to restock, TEL

products experienced a sales decline

for the full fi nancial year. Sales of

ELPs in the region also decreased,

mainly due to the decrease in sales

of platform products. CMS saw lower

demand for switching mode power

supplies and wireless products, which

off set gains in professional audio

equipment.

I am pleased to report that VTech has

successfully managed our businesses through

the adverse economic conditions prevailing

in the fi nancial year 2010. In addition to

achieving an increase in revenue, we delivered

a proportionally higher growth in profi t.