Vonage 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-27 VONAGE ANNUAL REPORT 2013

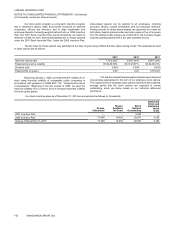

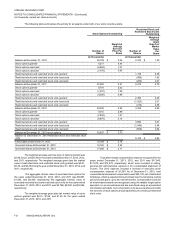

The following table summarizes the activity for all awards under both of our stock incentive plans:

Stock Options Outstanding

Restricted Stock and

Restricted Stock Units

Outstanding

Number of

Shares

Weighted

Average

Exercise

Price Per

Share

Number of

Shares

Weighted

Average

Grant

Date Fair

Market

Value

Per

Share

(in thousands) (in thousands)

Balance at December 31, 2010 35,729 $2.26 2,332 $1.50

Stock options granted 6,217 4.44

Stock options exercised (2,894) 1.47

Stock options canceled (1,770) 5.85

Restricted stocks and restricted stock units granted 1,198 4.38

Restricted stocks and restricted stock units exercised (995)1.83

Restricted stocks and restricted stock units canceled (260)2.27

Balance at December 31, 2011 37,282 2.51 2,275 2.79

Stock options granted 8,701 2.22

Stock options exercised (1,237) 1.39

Stock options canceled (4,506) 3.99

Restricted stocks and restricted stock units granted 2,400 2.29

Restricted stocks and restricted stock units exercised (1,022)2.31

Restricted stocks and restricted stock units canceled (310)2.58

Balance at December 31, 2012 40,240 2.32 3,343 2.59

Stock options granted 9,315 2.89

Stock options exercised (7,842) 1.47

Stock options canceled (8,876) 2.14

Restricted stocks and restricted stock units granted 3,896 3.01

Restricted stocks and restricted stock units exercised (1,549)2.48

Restricted stocks and restricted stock units canceled (508)2.84

Balance at December 31, 2013-stock options 32,837 $2.73

Balance at December 31, 2013-Restricted stock and restricted stock

units 5,182 $2.92

Exercisable at December 31, 2013 15,789 $2.74

Unvested shares at December 31, 2012 16,762 $2.34

Unvested shares at December 31, 2013 17,048 $2.71

The weighted average exercise price of options granted was

$2.89, $2.22, and $4.44 for the years ended December 31, 2013, 2012,

and 2011, respectively. The weighted average grant date fair market

value of restricted stock and restricted stock units granted was $3.01,

$2.29, and $4.38 during the year ended December 31, 2013, 2012, and

2011, respectively.

The aggregate intrinsic value of exercised stock options for

the years ended December 31, 2013, 2012, and 2011 was $9,891,

$1,042, and $8,450, respectively. The aggregate intrinsic value of

exercised restricted stock and restricted stock units for the years ended

December 31, 2013, 2012, and 2011 was $3,788, $2,250, and $3,954,

respectively.

The weighted average grant date fair market value of stock

options granted was $2.16, $1.58, and $1.65 for the years ended

December 31, 2013, 2012, and 2011.

Total share-based compensation expense recognized for the

years ended December 31, 2013, 2012, and 2011 was $17,843,

$11,975, and $14,279, respectively, which were recorded to selling,

general and administrative expense in the consolidated statement of

income. The 2012 expense included a reversal of executive stock

compensation expense of $1,200. As of December 31, 2013, total

unamortized share-based compensation was $22,102, net of estimated

forfeitures, which is expected to be amortized over the remaining vesting

period of each grant, up to the next 48 months. Compensation costs for

all share-based awards are recognized using the ratable single-option

approach on an accrual basis and are amortized using an accelerated

amortization schedule. Our current policy is to issue new shares to settle

the exercise of stock options and prospectively, the vesting of restricted

stock units.

Table of Contents

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)