Vonage 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-23 VONAGE ANNUAL REPORT 2013

We used the net proceeds of the 2010 Credit Facility of

$194,000 ($200,000 principal amount less original discount of $6,000),

plus $102,090 of cash on hand, to (i) exercise our existing right to retire

debt under our prior senior secured first lien credit facility, for 100% of

the contractual make-whole price, (ii) retire debt under our prior senior

secured second lien credit facility at a more than 25% discount to the

contractual make-whole price, and (iii) cause the conversion of all then

outstanding third lien convertible notes into 8,276 shares of our common

stock We also incurred $11,444 of fees in connection with the 2010

Credit Facility and repayment of our prior 2008 financing. We agreed to

make an additional cash payment to the holders of our prior senior

secured second lien credit facility in an aggregate amount of $9,000 if

we engaged in Qualifying Discussions (as defined in the Master

Agreement) prior to June 30, 2011 that result in a merger or acquisition

transaction (as defined in the Master Agreement) that is consummated

prior to June 30, 2012. No such discussions occurred prior to June 30,

2012.

In accordance with FASB ASC 470 “Debt Modification and

Extinguishment”, substantially all of the repayment of the Prior Financing

was treated as an extinguishment of notes resulting in a loss on early

extinguishment of notes of $26,531. For the portion of the repayment

of the Prior Financing treated as a debt modification, we carried forward

$1,072 of unamortized discount, which will be amortized to interest

expense over the life of the debt using the effective interest method in

addition to the $6,000 of original issue discount in connection with the

2010 Credit Facility. The accumulated amortization as of December 31,

2012 was $7,072, including acceleration of $6,081. The amortization

for 2011 was $915.

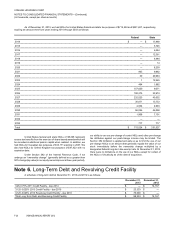

Repayments

In 2011, we made repayments of the entire $200,000 under

the 2010 Credit Facility, with $20,000 designated to cover our 2011

mandatory amortization, $50,000 designated to cover our 2011 annual

excess cash flow mandatory repayment, if any, and $130,000

designated to cover the outstanding principal balance under the 2010

Credit Facility at the time of the 2011 Credit Facility financing. A loss on

extinguishment of $11,806, representing a $1,000 prepayment fee to

holders of the 2010 Credit Facility, professional fees of $54, and

acceleration of unamortized debt discount and debt related costs of

$6,081 and $4,671, respectively, was recorded in 2011 as a result of

the repayments.

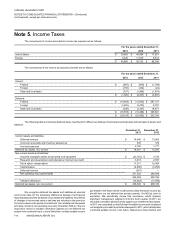

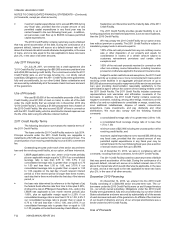

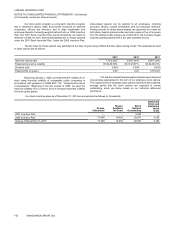

NOTE 7. Fair Value of Financial Instruments

Effective January 1, 2008, we adopted FASB ASC 820-10-25,

“Fair Value Measurements and Disclosures”. This standard establishes

a framework for measuring fair value and expands disclosure about fair

value measurements. We did not elect fair value accounting for any

assets and liabilities allowed by FASB ASC 825, “Financial Instruments”.

FASB ASC 820-10 defines fair value as the amount that would

be received for an asset or paid to transfer a liability (i.e., an exit price)

in the principal or most advantageous market for the asset or liability in

an orderly transaction between market participants on the measurement

date. FASB ASC 820-10 also establishes a fair value hierarchy that

requires an entity to maximize the use of observable inputs and minimize

the use of unobservable inputs when measuring fair value. FASB ASC

820-10 describes the following three levels of inputs that may be used:

> Level 1: Quoted prices (unadjusted) in active markets that are

accessible at the measurement date for identical assets and

liabilities. The fair value hierarchy gives the highest priority to

Level 1 inputs.

> Level 2: Observable prices that are based on inputs not quoted on

active markets but corroborated by market data.

> Level 3: Unobservable inputs when there is little or no market data

available, thereby requiring an entity to develop its own

assumptions. The fair value hierarchy gives the lowest priority to

Level 3 inputs.

Although management believed its valuation methods were

appropriate and consistent with other market participants, the use of

different methodologies or assumptions to determine the fair value of

certain financial instruments could have resulted in a different fair value

measurement at the reporting date.

Fair Value of Other Financial Instruments

The carrying amounts of our financial instruments, including

cash and cash equivalents, accounts receivable, and accounts payable,

approximate fair value because of their short maturities. The carrying

amounts of our capital leases approximate fair value of these obligations

based upon management’s best estimates of interest rates that would

be available for similar debt obligations at December 31, 2013 and 2012.

We believe the fair value of our debt at December 31, 2013 was

approximately the same as its carrying amount as market conditions,

including available interest rates, credit spread relative to our credit

rating, and illiquidity, remain relatively unchanged from the issuance

date of our debt on February 11, 2013 for a similar debt instrument.

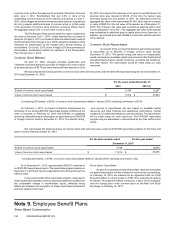

Note 8. Common Stock

Net Operating Loss Rights Agreement

On June 7, 2012, we entered into a Tax Benefits Preservation

Plan ("Preservation Plan") designed to preserve stockholder value and

tax assets. Our ability to use our tax attributes to offset tax on U.S.

taxable income would be substantially limited if there were an

"ownership change" as defined under Section 382 of the U.S. Internal

Revenue Code. In general, an ownership change would occur if one or

more "5-percent shareholders," as defined under Section 382,

collectively increase their ownership in us by more than 50 percent over

a rolling three-year period.

In connection with the adoption of the Preservation Plan, our

board of directors declared a dividend of one preferred share purchase

right for each outstanding share of the Company’s common stock. The

preferred share purchase rights were distributed to stockholders of

record as of June 18, 2012, as well as to holders of the Company's

common stock issued after that date, but will only be activated if certain

triggering events under the Preservation Plan occur.

Under the Preservation Plan, preferred share purchase rights

will work to impose significant dilution upon any person or group which

acquires beneficial ownership of 4.9% or more of the outstanding

Table of Contents

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)