Vonage 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 VONAGE ANNUAL REPORT 2013

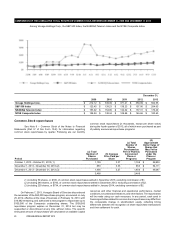

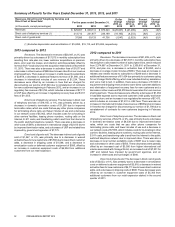

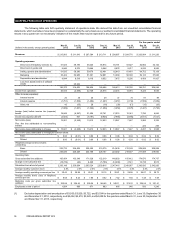

Summary of Results for the Years Ended December 31, 2013, 2012, and 2011

Revenues, Direct Cost of Telephony Services and

Direct Cost of Good Sold For the years ended December 31,

Dollar

Change

2013 vs.

2012

Dollar

Change

2012 vs.

2011

Percent

Change

2013 vs.

2012

Percent

Change

2012 vs.

2011

(in thousands, except percentages) 2013 2012 2011

Revenues $ 829,067 $ 849,114 $ 870,323 $ (20,047) $ (21,209) (2)% (2)%

Direct cost of telephony services (1) 213,712 231,877 236,149 (18,165) (4,272) (8)% (2)%

Direct cost of goods sold 37,586 39,133 41,756 (1,547) (2,623) (4)% (6)%

(1) Excludes depreciation and amortization of $14,892, $15,115, and $15,824, respectively.

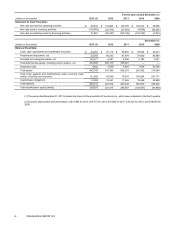

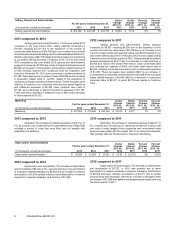

2013 compared to 2012

Revenues. The decrease in revenues of $20,047, or 2%, was

primarily driven by a decrease of $17,573 in monthly subscription fees

resulting from rate plan mix, lower customer acquisitions on premium

plans, prior year line losses, and retention activities partially offset by

revenue from Vocalocity since the acquisition that closed on November

15, 2013. There was also a decrease in activation fees of $1,077 and

a decrease in other revenue of $996 due to lower rates from our revenue

sharing partners. There was an increase in credits issued to subscribers

of $2,449, a decrease in additional features revenue of $1,090, and a

decrease in international minutes of use revenue of $1,234. These

decreases were offset by an increase in fees that we charged for

disconnecting our service of $1,024 due to reinstatement of contracts

for new customers beginning in February 2012, and an increase in our

regulatory fee revenue of $3,784, which includes a decrease of $7,771

in USF fees offset by an increase in regulatory recovery fees and E-911

fees of $11,555.

Direct cost of telephony services. The decrease in direct cost

of telephony services of $18,165, or 8%, was primarily driven by a

decrease in domestic termination costs of $1,290 due to improved

termination rates, which are costs that we pay other phone companies

for terminating phone calls, and fewer minutes of use and a decrease

in our network costs of $5,962, which includes costs for co-locating in

other carriers’ facilities, leasing phone numbers, routing calls on the

Internet, E-911 costs, and transferring calls to and from the Internet to

the public switched telephone network. There was also a decrease in

other costs of $678, a decrease in international usage of $2,413 driven

by improved termination rates, and a decrease of USF and related fees

imposed by government agencies of $7,775.

Direct cost of goods sold. The decrease in direct cost of goods

sold of $1,547, or 4%, was primarily due to a decrease in waived

activation fees for new customers of $5,566 due to lower direct customer

adds, a decrease in shipping costs of $1,598, and a decrease in

amortization costs on deferred customer equipment of $585, offset by

an increase in customer equipment costs of $6,204 from additional

customers from our retail expansion.

2012 compared to 2011

Revenues. The decrease in revenues of $21,209, or 2%, was

primarily driven by a decrease of $21,307 in monthly subscription fees

resulting from a decreased number of subscription lines, which reduced

from 2,374,887 at December 31, 2011 to 2,359,816 at December 31,

2012, and plan mix, a decrease in activation fees of $3,850, and a

decrease in overage in plan minutes of $864. There was an increase in

rebates and credits issued to subscribers of $249 and a decrease in

additional features revenue of $1,424 due primarily to customers opting

for our Vonage World offering, which now includes directory assistance

and voice mail to text. In addition, there was a decrease of $1,663 in

equipment and shipping revenue due to lower direct customer additions

and elimination of equipment recovery fees for new customers and a

decrease in other revenue of $2,578 due to lower rates from our revenue

sharing partners. These decreases were offset by a decrease of $1,064

in bad debt expense due to improved customer credit quality and lower

non-pay churn, and an increase in our regulatory fee revenue of $7,473,

which includes an increase of $7,231 in USF fees. There was also an

increase in international minutes of use revenue of $390 and an increase

in fees that we charged for disconnecting our service of $1,798 due to

reinstatement of contracts for new customers beginning in February

2012.

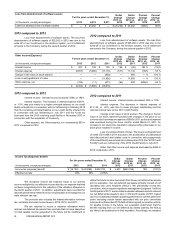

Direct cost of telephony services. The decrease in direct cost

of telephony services of $4,272, or 2%, was primarily due to a decrease

in domestic termination costs of $8,538 due to improved termination

rates, which are costs that we pay other phone companies for

terminating phone calls, and fewer minutes of use and a decrease in

our network costs of $7,550, which includes costs for co-locating in other

carriers’ facilities, leasing phone numbers, routing calls on the Internet,

E-911 costs, and transferring calls to and from the Internet to the public

switched telephone network due to improved rates. There was also a

decrease in local number portability costs of $837 due to lower rates

and a decrease in other costs of $503. These decreases were partially

offset by an increased cost of $5,386 from higher international call

volume associated with Vonage World, an increased cost of $7,231 for

USF and related fees imposed by government agencies, and an

increase in other taxes and surcharges of $540.

Direct cost of goods sold. The decrease in direct cost of goods

sold of $2,623, or 6%, was primarily due to a decrease in amortization

costs on deferred customer equipment of $2,918, a decrease in waived

activation fees for new customers of $4,711 due to lower direct customer

adds, and a decrease in shipping costs of $300. These decreases were

offset by an increase in customer equipment costs of $5,303 from

additional customers from our retail expansion started in the second

quarter of 2011.

Table of Contents