Vonage 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

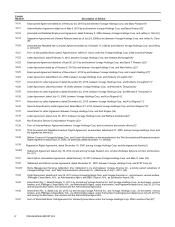

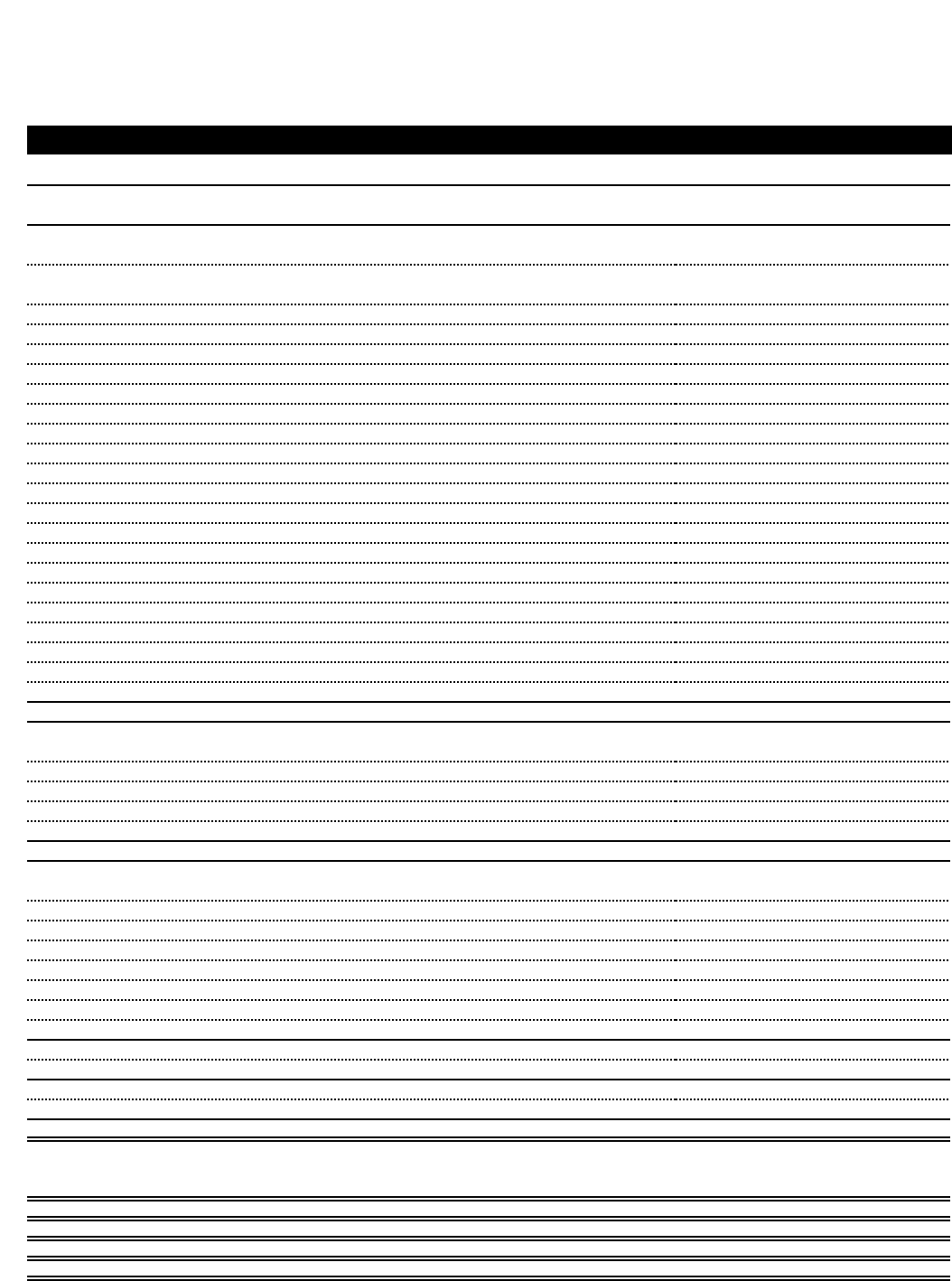

F-7 VONAGE ANNUAL REPORT 2013

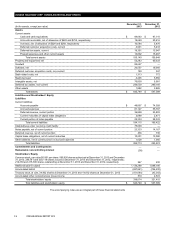

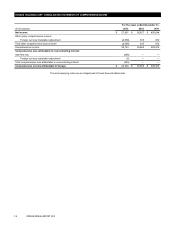

VONAGE HOLDINGS CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS

For the years ended December 31,

(In thousands) 2013 2012 2011

Cash flows from operating activities:

Net income $ 27,801 $36,627 $409,044

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization and impairment charges 31,208 30,949 35,776

Amortization of intangibles 4,858 2,375 1,275

Loss from abandonment of software assets — 25,262 —

Deferred tax expense (benefit) 16,795 19,488 (325,601)

Change in fair value of embedded features in notes payable and stock warrant — — 950

Loss on extinguishment of notes ——

11,806

Amortization of discount on notes ——

914

Allowance for doubtful accounts (256)926 (4)

Allowance for obsolete inventory 663 527 773

Amortization of debt related costs 1,515 1,235 1,391

Share-based expense 17,843 11,975 14,279

Changes in operating assets and liabilities:

Accounts receivable 1,236 (3,461)(2,663)

Inventory (5,835) 748 (1,362)

Prepaid expenses and other current assets (662)1,345 412

Deferred customer acquisition costs 621 (66)1,891

Other assets 1,970 (788)163

Accounts payable (26,335) 7,801 29,090

Accrued expenses 17,869 (10,719) (21,216)

Deferred revenue (1,111) (3,517)(5,167)

Other liabilities 63 (864)(4,965)

Net cash provided by operating activities 88,243 119,843 146,786

Cash flows from investing activities:

Capital expenditures (9,889) (13,763) (12,636)

Purchase of intangible assets ——

(3,725)

Acquisition and development of software assets (12,291) (12,987) (22,292)

Acquisition of business, net of cash acquired (100,057)— —

Decrease in restricted cash 1,252 1,278 1,049

Net cash used in investing activities (120,985) (25,472) (37,604)

Cash flows from financing activities:

Principal payments on capital lease obligations and other liability (3,471) (2,104)(1,783)

Principal payments on notes (23,334) (28,333) (229,166)

Proceeds from issuance of notes payable and revolving credit facility 102,500 — 100,000

Extinguishment of notes ——

(1,054)

Debt related costs (2,056) — (2,697)

Common stock repurchases (56,294) (27,545) —

Acquisition of redeemable noncontrolling interest 455 ——

Proceeds from exercise of stock options and stock warrant 4,091 1,725 4,562

Net cash provided by (used in) financing activities 21,891 (56,257) (130,138)

Effect of exchange rate changes on cash (1,596) 133 885

Net change in cash and cash equivalents (12,447) 38,247 (20,071)

Cash and cash equivalents, beginning of period 97,110 58,863 78,934

Cash and cash equivalents, end of period $ 84,663 $97,110 $58,863

Supplemental disclosures of cash flow information:

Cash paid during the periods for:

Interest $ 4,722 $4,653 $15,563

Income taxes $ 2,323 $2,329 $2,289

Non-cash financing transactions during the periods for:

Common stock repurchases $ 736 $644 $—

Issuance of Common Stock in connection with acquisition of business $ 26,186 $—$—

The accompanying notes are an integral part of these financial statements

Table of Contents