Vonage 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 VONAGE ANNUAL REPORT 2013

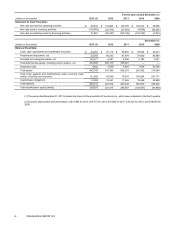

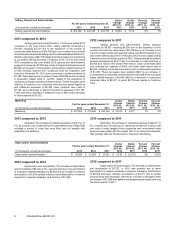

Loss from abandonment of software assets

For the years ended December 31, Dollar

Change

2013 vs.

2012

Dollar

Change

2012 vs.

2011

Percent

Change

2013 vs.

2012

Percent

Change

2012 vs.

2011

(in thousands, except percentages) 2,013 2,012 2,011

Loss from abandonment of software assets $—$

25,262 $ — $ (25.262) $ 25.262 (100)% 100%

2013 compared to 2012

Loss from abandonment of software assets. The loss from

abandonment of software assets of $25,262 in 2012 was due to the

write-off of our investment in the Amdocs system, net of settlement

amounts to the Company, during the second quarter of 2012.

2012 compared to 2011

Loss from abandonment of software assets. The loss from

abandonment of software assets of $25,262 in 2012 was due to the

write-off of our investment in the Amdocs system, net of settlement

amounts to the Company, during the second quarter of 2012.

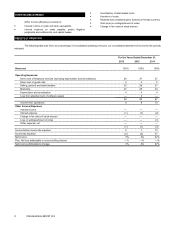

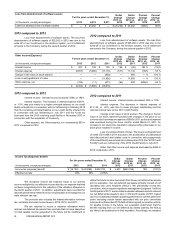

Other Income (Expense)

For the years ended December 31, Dollar

Change

2013 vs.

2012

Dollar

Change

2012 vs.

2011

Percent

Change

2013 vs.

2012

Percent

Change

2012 vs.

2011

(in thousands, except percentages) 2013 2012 2011

Interest income $ 307 $ 109 $135 $198 $(26)182 %(19)%

Interest expense (6,557) (5,986) (17,118) (571)11,132 (10)% 65 %

Change in fair value of stock warrant ——

(950)—

950 —% 100 %

Loss on extinguishment of notes — — (11,806) — 11,806 —% 100 %

Other expense, net (104)(11)(271)(93)260 (845)% 96 %

$ (6,354) $ (5,888) $ (30,010)

2013 compared to 2012

Interest income. Interest income increased $198, or 182%.

Interest expense. The increase in interest expense of $571,

or 10%, was due mainly to a higher principal balance on our credit

facility entered into in connection with our refinancing in February 2013

than the remaining principal balance on our credit facility entered into

in connection with our refinancing in July 2011 and the funds we

borrowed from the 2013 revolving credit facility in November 2013 in

connection with the acquisition of Vocalocity.

Other expense, net. Other expense, net increased by $93 in

2013 compared to 2012.

2012 compared to 2011

Interest income. Interest income decreased $26, or 19%.

Interest expense. The decrease in interest expense of

$11,132, or 65%, was due to lower principal outstanding and the

reduced interest rate on the 2011 Credit Facility.

Change in fair value of stock warrant. The change in the fair

value of our stock warrant fluctuated with changes in the price of our

common stock and was an expense of $950 in 2011, as the stock warrant

was exercised during the three months ended March 31, 2011. An

increase in our stock price resulted in expense while a decrease in our

stock price resulted in income.

Loss on extinguishment of notes. The loss on extinguishment

of notes of $11,806 in 2011 was due to the acceleration of unamortized

debt discount and debt related costs in connection with prepayments

of the credit facility we entered into in December 2010 (the "2010 Credit

Facility") and our refinancing of the 2010 Credit Facility in July 2011.

Other. Net other income and expense decreased by $260 in

2012 compared to 2011.

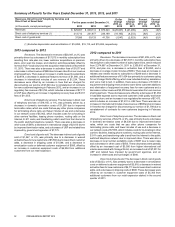

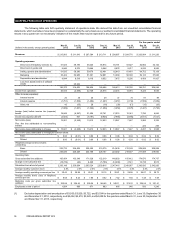

Income Tax (Expense) Benefit

For the years ended December 31, Dollar

Change

2013 vs.

2012

Dollar

Change

2012 vs.

2011

Percent

Change

2013 vs.

2012

Percent

Change

2012 vs.

2011

(in thousands, except percentages) 2013 2012 2011

Income tax (expense) benefit $ (18,194) $ (22,095) $322,704 $ 3,901 $

(344,799) 18% (107)%

Effective tax rate 39% 38% (375)%

We recognize income tax expense equal to our pre-tax

income multiplied by our effective income tax rate, an expense that had

not been recognized prior to the reduction of the valuation allowance in

the fourth quarter of 2011. In addition, adjustments were recorded for

discrete period items related to stock compensation and changes to our

state effective tax rate.

The provision also includes the federal alternative minimum

tax and state and local income taxes in 2013, 2012, and 2011.

We are required to record a valuation allowance which

reduces net deferred tax assets if we conclude that it is more likely than

not that taxable income generated in the future will be insufficient to

utilize the future income tax benefit from these net deferred tax assets

prior to expiration. Our net deferred tax assets primarily consist of net

operating loss carry forwards (“NOLs”). We periodically review this

conclusion, which requires significant management judgment. Until the

fourth quarter of 2011, we recorded a valuation allowance which reduced

our net deferred tax assets to zero. In the fourth quarter of 2011, based

upon our sustained profitable operating performance over the past three

years excluding certain losses associated with our prior convertible

notes and our December 2010 debt refinancing and our positive outlook

for taxable income in the future, our evaluation determined that the

benefit resulting from our net deferred tax assets (namely, the NOLs)

are likely to be usable prior to their expiration. Accordingly, we released

Table of Contents