Vonage 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17 VONAGE ANNUAL REPORT 2013

Under our 2013 Credit Facility, a “change of control” would

result from the occurrence of, among other things, the acquisition by

any person or group (other than Mr. Citron and his majority-controlled

affiliates) of 35% or more of the voting and/or economic interest of our

outstanding common stock on a fully-diluted basis. The definition of

“change of control” in the 2013 Credit Facility remains the same as under

the credit facility that we entered into in July 2011, a copy of which has

been previously filed with the Securities and Exchange Commission as

Exhibit 10.1 to a Form 8-K filed by us on July 29, 2011.

Further, we were named as a defendant in several suits that

related to patent infringement and entered into agreements to settle

certain of the suits in 2007. Certain terms of those agreements, including

licenses and covenants not to sue, will be restricted upon a change of

control, which may discourage certain potential purchasers from

acquiring us.

Such provisions could have the effect of depriving

stockholders of an opportunity to sell their shares at a premium over

prevailing market prices. Any delay or prevention of, or significant

payments required to be made upon, a change of control transaction or

changes in our board of directors or management could deter potential

acquirors or prevent the completion of a transaction in which our

stockholders could receive a substantial premium over the then-current

market price for their shares.

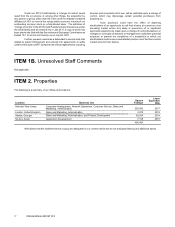

ITEM 1B. Unresolved Staff Comments

Not applicable.

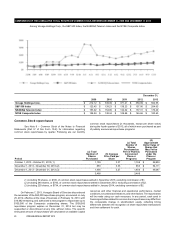

ITEM 2. Properties

The following is a summary of our offices and locations:

Location Business Use

Square

Footage

Lease

Expiration

Date

Holmdel, New Jersey Corporate Headquarters, Network Operations, Customer Service, Sales and

Marketing, Administration 350,000 2017

London, United Kingdom Sales and Marketing, Administration 3,472 2015

Atlanta, Georgia Sales and Marketing, Administration, and Product Development 65,824 2014

Tel Aviv, Israel Application Development 7,158 2015

426,454

We believe that the facilities that we occupy are adequate for our current needs and do not anticipate leasing any additional space.

Table of Contents