Trend Micro 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Trend Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

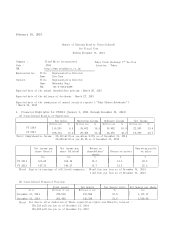

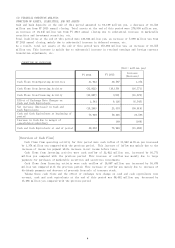

(Japan GAAP)

(Note)

Shareholder’s Equity Ratio : (Total shareholder’s Equity)/(Total Assets)

Capital Adequacy Ratio on Market Value : (Total Market Value of Shares)/(Total Assets) Basis

Debt Redemption Period : (Interest-bearing Debt)/(Operating Cash Flow)

Interest Coverage Ratio : (Operating Cash Flow)/(Interest Payment)

*All indexes are calculated from the financial statement amounts on a consolidated basis.

*Total Market Value of Shares is calculated as follows; closing share price at the term end multiplies by

number of shares issued at the term end (net of treasury shares).

*Operating Cash Flow is Net cash flows from operating activities in the consolidated statement of cash

flows.

Interest-bearing Debt is all debts with interest payments among the debts reported in the consolidated

balance sheet.

Interest Payment is the amount of payment for interest expense in the consolidated statement of cash flows.

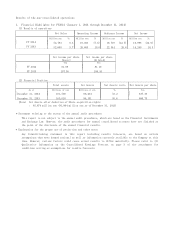

(4) BASIC POLICY OF PROFIT SHARING

We intend to continue to return profits to shareholders based on the net profit on a consolidated basis

while striving to enhance financial strength and secure internal reserve in order to deal with

significantly changing business environment and maintain competitive edge against competitors.

As our basic policy on dividend, we plan to pay a year-end dividend on the basis of the dividend ratio of

70%.

Accordingly a year-end dividend on the basis of a dividend ratio of 70.1% of net income of 22,303 million

yen in FY2014, we have planned to pay total dividends of 15,629 million yen, which is 116 yen per share in

this term.

We also plan to pay dividend in next term based on our above mentioned basic policy on dividend.

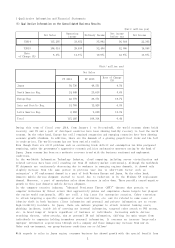

(5) RISK FACTORS

The occurrence of any of the following risks could affect the Trend Micro group's business, financial

condition, and operating results. If this should happen, the trading price of shares of Trend Micro

Incorporated, Trend Micro group's parent company, could decline and its investors/shareholders could lose

all or part of their investment. Other risks and uncertainties unknown to us, the Trend Micro group, or

that we, the Trend Micro Group, think are immaterial may also impair our business.

MAJOR SOFTWARE AND HARDWARE VENDORS MAY INCORPORATE ANTIVIRUS PROTECTION IN THEIR PRODUCT OFFERINGS, WHICH

COULD RENDER OUR PRODUCTS AND SERVICES OBSOLETE OR UNMARKETABLE.

There is a possibility of facing significant changes in the competitive environment, if major vendors of

operating system software and other software such as firewall, e-mail software or computer hardware, decide

to enhance or bundle their products to include antivirus and other computer security functions. These

companies may offer antivirus protection as a standard feature in their products, at minimal or no

additional cost to customers, which could render our wide range of products and services obsolete or

unmarketable, particularly if antivirus products offered by these vendors were comparable or superior to

our wide range of products and services. In addition, even if these vendors’ antivirus products offered

fewer functions than our wide range of products and services, or were less effective in detecting and

cleaning virus-infected files, customers could still choose them over our wide range of products and

services due to lower cost or for any other reasons.

Microsoft Corp., a major operating system vendor, has acquired several security vendors. If antivirus and

other computer security functions were to be included in its operating system products by Microsoft Corp.,

this could have a material adverse effect on our business, financial condition and results of operations.

[Trends of Cash Flow Indexes]

FY2010 FY2011 FY2012 FY2013 FY2014

Shareholder’s equity

Ratio (%) 47.4 49.9 49.9 53.6 53.8

Capital Adequacy Ratio

on Market Value Basis

(%)

173.7 150.0 155.8 189.8 160.8

Debt Redemption Period

(years) - - - - -

Interest Coverage Ratio 8,424.1 13,846.0 7,300.7 4845.8 1,872.1

5