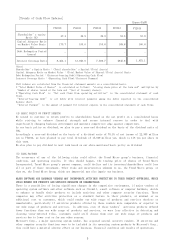

Trend Micro 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Trend Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

costs caused by the above could cause our group’s business, results of operations and financial condition

could suffer. Also the talent war with competitors could adversely affect to our group's labor cost.

Moreover, unexpected high turnover and recruitment which does not work out as planned, may hurt our group's

business performance.

If any of cost increase caused by those above, our group’s business, results of operations and financial

condition could suffer.

THE LOSS OF HUMAN RESOURCES INCLUDING MAJOR TECHNICAL SPECIALIST PERSONNEL COULD ADVERSELY AFFECT OUR

BUSINESS.

The computer security industry which our group belongs to, has grown increasingly competitive. In this

competitive atmosphere, there is a possibility of human resources flow including major technical specialist

personnel. Our group has made contracts with all employees for the purpose of preservation of

confidentiality and obligation not to compete. Despite taking such legislative actions, we could suffer

substantial disruptions in our business to our reputation due to outflow of technical and strategic vital

information, and other companies developing similar technology with ours. In addition, our group’s

business, operations and financial condition could suffer as a result of the above.

FLUCTUATIONS IN OUR QUARTERLY FINANCIAL RESULTS COULD CAUSE THE MARKET PRICE OF TREND MICRO INCORPORATED,

TREND MICRO GROUP’S PARENT COMPANY, FOR ITS SHARES TO BE VOLATILE.

We believe that our quarterly financial results may fluctuate in ways that do not reflect the long-term

trend of our future financial performance. It is likely that in some future quarterly periods, our

operating results may be below the expectations of public market analysts and investors. In this event,

the share price of Trend Micro Incorporated, Trend Micro group’s parent company, could fall.

Factors which could cause our quarterly financial results to fluctuate include:

•timing of sales of our products and services to customers’ budgetary constraints, seasonal buying

patterns and our promotional activities;

•new product introductions by our competitors;

•significant marketing campaigns, research and development efforts, employee hiring, and other capital

expenditures by us to drive the growth of our business;

•changes in customer needs for antivirus and other computer securities; and

•changes in economic conditions in our major markets.

FOREIGN EXCHANGE FLUCTUATIONS COULD LOWER OUR RESULTS OF OPERATIONS BECAUSE WE EARN REVENUES DENOMINATED IN

SEVERAL DIFFERENT CURRENCIES.

Our reporting currency is the Japanese yen and the functional currency of each of our subsidiaries is the

currency of the country in which the subsidiary is domiciled. However, a significant portion of our

revenues and operating expenses is denominated in currencies other than the Japanese yen, primarily the US

dollar, Euro, and Asian currencies. As a result, appreciation or depreciation in the value of other

currencies as compared to the Japanese yen could result in material transaction or translation gains or

losses which could reduce our operating results. These negative effects from currency fluctuations could

become more significant if we are successful in increasing our sales in markets outside of Japan.

Also, we have a portion of marketable securities for fund management. Those values will be affected by the

ups and downs of exchange rate denominated in foreign currencies and significant currency fluctuations

could hurt our corporate earnings significantly.

We do not currently engage in currency hedging activities.

FINANCIAL MARKET FLUCTUATIONS COULD LOWER OUR RESULTS OF OPERATIONS.

We have marketable securities and security investments for efficient fund management. Those values of the

capital holdings will be affected by fluctuations in the financial market and exchange rates. In the

future, if financial market fluctuates widely, this could have a material adverse effect on our financial

condition and results of operations proportionate devaluation loss on investment in securities.

INFRINGEMENT OF OUR INTELLECTUAL PROPERTY COULD HURT OUR BUSINESS.

Our success depends on the development of proprietary software technology. We rely on a combination of

contractual rights and patent, copyright, trademark and trade secret laws to establish and protect

proprietary rights in our software. If we are unable to establish and protect these rights, our competitors

may be able to use our intellectual property to compete against us. This could limit our growth and hurt

our business. It is possible that no additional patents will be issued to us or any of our subsidiaries. In

addition, our issued patents may not prevent other companies from competing with us. On the other hand,

there is the possibility of the suspension of our products and services sales, compensation, and royalty

payment of licensee because of our patent infringement upon another company. Additionally, there is also a

9