Trend Micro 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Trend Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

syndrome, etc., terrorist attacks and other geopolitical risks prolonged continuation of these adverse

factors may hurt our results of operations and financial condition.

THE STOCK PRICE OF TREND MICRO INCORPORATED, TREND MICRO GROUP’S PARENT COMPANY, IS VOLATILE, AND

INVESTORS BUYING THE SHARES MAY NOT BE ABLE TO RESELL THEM AT OR ABOVE THEIR PURCHASE PRICE.

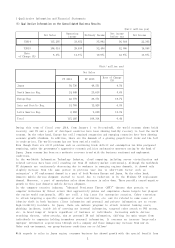

Shares of the common stock of Trend Micro Incorporated, Trend Micro group’s parent company, are traded on

the Tokyo Stock Exchange. Recently, the Japanese securities markets have experienced significant price and

volume fluctuations. The market prices of securities of high-tech companies, and internet companies in

particular, have been especially volatile. Since trading in shares of Trend Micro Incorporated commenced

on the Tokyo Stock Exchange on August 17, 2000, stock price of Trend Micro Incorporated has fluctuated

between a low of (Yen) 1,440 and a high of (Yen) 9,005. The closing price on the Tokyo Stock Exchange for

our stock on December 30, 2014 was (Yen) 3,340. The market price of our shares is likely to fluctuate in

the future.

BECAUSE OF DAILY PRICE RANGE LIMITATIONS UNDER JAPANESE STOCK EXCHANGE RULES, YOU MAY NOT BE ABLE TO SELL

YOUR SHARES OF THE COMMON STOCK OF TREND MICRO INCORPORATED, TREND MICRO GROUP’S PARENT COMPANY, AT A

PARTICULAR PRICE ON ANY PARTICULAR TRADING DAY, OR AT ALL.

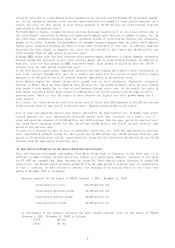

Stock prices on Japanese stock exchanges are determined on a real-time basis by the equilibrium between

bids and offers. These exchanges are order-driven markets without specialists or market makers to guide

price formation. To prevent excessive volatility, these exchange set daily upward and downward price

fluctuation limits for each stock, based on the previous day’s closing price. Although transactions may

continue at the upward or downward limit price if the limit price is reached on a particular trading day,

no transactions may take place outside these limits. Consequently, an investor wishing to sell at a price

above or below the relevant daily limit may not be able to sell his or her shares at such price on a

particular trading day, or at all.

11