Trend Micro 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Trend Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

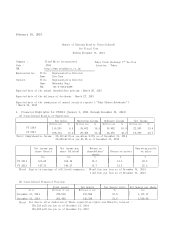

(3) FINANCIAL CONDITION ANALYSIS

CONDITION OF ASSETS, LIABILITIES, AND NET ASSETS

Cash and bank deposits at the end of this period amounted to 63,109 million yen, a decrease of 16,523

million yen from FY 2013 annual closing. Total assets at the end of this period were 279,938 million yen,

an increase of 18,445 million yen from FY 2013 annual closing due to substantial increase in marketable

securities and investment securities, etc.

Total liabilities at the end of this period were 126,844 million yen, an increase of 7,890 million yen from

FY 2013 annual closing, mainly due to substantial increase in deferred revenue, etc.

As a result, total net assets at the end of this period were 153,094 million yen, an increase of 10,555

million yen. This increase is mainly due to substantial increase in retained earnings and foreign currency

translation adjustments, etc.

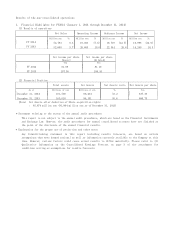

CONDITION OF CASH FLOW

(Unit: million yen)

Cash flows from operating activity for this period were cash inflow of 31,942 million yen increased

by 1,374 million yen compared with the previous period. This increase of inflow was mainly due to the

increase of income tax payment while increase in net income before taxes.

Cash flows from investing activity were cash outflow of 32,922 million yen, increased by 16,771

million yen compared with the previous period. This increase of outflow was mainly due to large

payments for purchases of marketable securities and securities investments.

Cash flows from financing activity were cash outflow of 16,887 million yen increased by 16,676

million yen compared with the previous period. This increase of outflow was mainly due to increase of

dividends payments and decrease of proceeds from sale of treasury stock.

Taking these cash flows and the effect of exchange rate change on cash and cash equivalents into

account, cash and cash equivalents at the end of this period was 58,662 million yen, decreased by

15,286 million yen compared with the previous period.

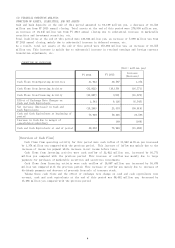

FY 2014 FY 2013 Increase

(Decrease)

Cash Flows from Operating Activities 31,942 30,567 1,374

Cash Flows from Investing Activity (32,922) (16,150) (16,771)

Cash Flows from Financing Activity (16,887) (210) (16,676)

Effect of Exchange Rate Changes on

Cash and Cash Equivalents 2,581 9,126 (6,545)

Net increase (Decrease) in Cash and

Cash Equivalents (15,286) 23,333 (38,619)

Cash and Cash Equivalents at beginning of

period 73,949 50,446 23,503

Increase in Cash due to merger of

consolidated subsidiary - 169 (169)

Cash and Cash Equivalents at end of period 58,662 73,949 (15,286)

[Overview of Cash Flow]

4