Texas Instruments 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

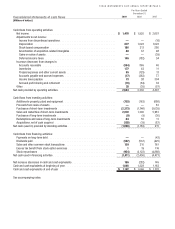

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 5

Consolidated statements of cash flows

[Millions of dollars]

For Years Ended

December 31,

2009 2008 2007

Cash flows from operating activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,470 $1,920 $2,657

Adjustments to net income:

Income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——(16)

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 877 1,022 1,022

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186 213 280

Amortization of acquisition-related intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 37 48

Gains on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——(39)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 146 (182)34

Increase (decrease) from changes in:

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (364)865 40

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 177 43 11

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 (125)13

Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17)(382)77

Income taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73 38 304

Accrued profit sharing and retirement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16)(84)33

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 (35)(57)

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,643 3,330 4,407

Cash flows from investing activities:

Additions to property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (753)(763)(686)

Proceeds from sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——61

Purchases of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,273)(1,746)(5,035)

Sales and maturities of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,030 1,300 5,981

Purchases of long-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9)(9)(30)

Redemptions and sales of long-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . 64 55 11

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (155)(19)(87)

Net cash (used in) provided by investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,096)(1,182)215

Cash flows from financing activities:

Payments on long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——(43)

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (567)(537)(425)

Sales and other common stock transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109 210 761

Excess tax benefit from stock option exercises . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119 116

Stock repurchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (954)(2,122 )(4,886)

Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,411)(2,430)(4,477)

Net increase (decrease) in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . 136 (282)145

Cash and cash equivalents at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,046 1,328 1,183

Cash and cash equivalents at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,182 $1,046 $1,328

See accompanying notes.